by | Jun 16, 2025 | Business

In

today’s fast-evolving digital lending landscape, transparency and

accountability are more critical than ever. At Happycash, we believe that

sustainable financial inclusion must be built on a foundation of trust and

regulatory compliance. That’s why we are proud to highlight our ongoing and

active collaboration with the Credit Information Corporation (CIC)—the

Philippines’ central credit registry. As both a submitting entity and an

accessing entity with the CIC, Happycash play a dual role in strengthening the

credit information ecosystem.

Since

our inception, Happycash has consistently reported loan data to CIC in

accordance with established guidelines. This partnership reflects our

commitment to building a responsible lending ecosystem that protects both

borrowers and lenders. By sharing accurate and timely credit data, we help

create a more robust financial infrastructure that empowers users while

reducing systemic risks. As an accessing entity, we also leverage the CIC

database to gain deeper insights into borrower creditworthiness, promoting

responsible lending decisions and risk mitigation.

Why

CIC Reporting Matters

As a

government-mandated credit registry, CIC plays a vital role in enabling fair

access to credit. When lenders like Happycash report to CIC:

Borrowers benefit from

having a verifiable credit history, helping them unlock better financial

opportunities in the future.Lenders gain deeper

insights into borrowers’ creditworthiness, promoting responsible

decision-making and risk mitigation.The entire ecosystem

benefits from reduced fraud, lower default rates, and enhanced financial

stability.

Our

Compliance Journey

Happycash

has taken proactive steps to integrate CIC reporting into our operations:

Regular and timely

submission of borrower credit data.Internal policies and staff

training aligned with CIC standards.Continuous engagement with

CIC for updates, clarifications, and audits to ensure full compliance.

We

view credit reporting not just as a regulatory requirement, but as a

responsibility to the people we serve. Our commitment extends beyond

compliance—we aim to be a model for ethical, data-driven lending in the fintech

sector.

Looking

Ahead

As

the Philippines continues to strengthen its credit information ecosystem,

Happycash remains committed to supporting CIC’s mission and aligning our

practices with the highest regulatory standards. We believe that transparency

is key to building long-term relationships with our users and earning the trust

of regulators, partners, and stakeholders.

by | Jun 16, 2025 | Business

In recognition of Father’s Day 2025, Karaoke Manekineko has introduced a limited-time promotion aimed at celebrating dads through accessible and fun family karaoke sessions. The special offer runs from 15 to 22 June across participating outlets.

In celebration of Father’s Day, Karaoke

Manekineko is offering

discounted happy hour rates exclusively for fathers from 15 to 22

June 2025. The initiative is part of the brand’s effort to encourage more

family bonding through music in a casual, welcoming environment.

The special promotion features heavily reduced prices during happy hours

for all fathers. Rates start as low as RM6++ for a 1-hour session on

weekdays, with extended sessions available at RM12++ for 2 hours and

RM15++ for 3 hours. Weekend prices begin at RM9++ per hour,

increasing to RM18++ for two hours and RM20++ for three hours.

This limited-time offer is valid during Happy Hour across the

promotional period and applies exclusively to fathers. All prices exclude

SST and service charges.

With this campaign, Karaoke Manekineko not only acknowledges the contributions of fathers but also reinforces

its ongoing mission to be a venue for family-friendly entertainment. The move

comes at a time when more consumers are seeking value-driven, inclusive

experiences that cater to multigenerational households.

For more information, guests are encouraged to contact their nearest

Manekineko outlet.

by | Jun 13, 2025 | Business

Despite employment reaching a record high in 2024, half of Australian workers (50%) are living paycheck to paycheck, according to ADP Research’s People at Work 2025 report. The study, which surveyed nearly 38,000 workers across 34 markets, uncovers stark regional disparities and generational divides in the global workforce’s financial resilience.

The findings reveal a complex financial picture, both locally and internationally: taking on extra work doesn’t necessarily close the pay gap, as nearly six in 10 (57%) workers surveyed globally are still struggling to make ends meet, even working multiple jobs.

In Australia, over half (52%) of workers with two jobs and nearly six in 10 (58%) of those with three or more jobs report holding multiple roles to cover necessary expenses.

Key Findings:

Global strain: Globally, more than half (54%) of single-job holders, 59% of workers with two jobs, and 61% of workers with three or more jobs are struggling to make ends meet.

Working multiple jobs to make ends meet: A significant portion of Australians are turning to multiple jobs to cope with financial demands.

Two jobs: 58% say they do it to afford extra costs, and 35% to build life savings and prepare for retirement.

Three or more jobs: 58% do it to build savings and prepare for retirement, and 46% to cover extra costs.

Regional Comparison: The country with the highest percentage of workers living paycheck to paycheck is Egypt (84%), followed by Saudi Arabia (79%) and the Philippines (78%). In contrast, South Korea reports the lowest proportion globally, at just 18%. Within the Asia-Pacific region, Australia ranks as the fourth lowest in terms of the share of employees living paycheck to paycheck, with 50% of workers facing this financial pressure. Only Japan (29%), Taiwan (30%), and China (31%) report lower proportions.

Why workers take multiple jobs

The survey reveals that most workers holding multiple jobs are doing it to cover their necessary expenses, to save for future spending, and to build savings for retirement. The number of workers working more than one job is the highest in the Middle East Africa (34%), Latin America (24%), and Asia Pacific (24%).

While people have different reasons for taking on extra work, holding two or more jobs can be a necessity in parts of the world where average wages are low relative to a country’s cost of living. Informal economies in Africa, Latin America and parts of Asia exacerbate challenges, with workers who piece together gig or part-time roles lacking stability or protection.

Navigating the high cost of living

“Pay is the foundation of financial wellbeing for most workers, yet our data shows that even record employment isn’t translating into financial security. Nearly two-thirds of people who hold three jobs still struggle to make ends meet. This presents an opportunity for employers to take a more holistic approach to compensation to help workers navigate the higher living costs of today’s global economy,” ADP chief economist Nela Richardson said.

“With the rising cost of living putting pressure on Australian households, many workers are finding it increasingly difficult to stretch their paychecks, even when holding down multiple jobs. For small and medium-sized businesses, offering across-the-board pay rises may not be realistic — but there are other meaningful ways to support employees,” Judy Barnett, Operations Director at ADP Australia said.

“Flexible work arrangements, subsidised transport, wellness programs, or financial planning support can go a long way in easing day-to-day pressures. These practical benefits help build trust, reduce turnover, and create more resilient workplaces at a time when employee wellbeing has never been more critical,” added Barnett.

by | Jun 13, 2025 | Business

XRP ETF approval is closer than ever as Ripple nears a $50M SEC settlement. With June 17 looming and markets on edge, is XRP about to skyrocket—or crash? Here’s what you need to know.

As the SEC’s decision deadline for Franklin Templeton’s spot XRP ETF on June 17 rapidly approaches, speculation is escalating over the potential approval of XRP spot ETFs from major firms, including Grayscale, Franklin Templeton, and Bitwise.

Market participants are taking note of Ripple’s ongoing push to settle its long-running lawsuit with the SEC, a development that could remove a major obstacle to ETF approval, pending final judicial sign-off.

XRP ETF Odds: From Euphoria to Slight Pullback

On prediction platform Polymarket, the probability of an XRP ETF being greenlit by end-2025 soared to 98% in early June, before easing to around 88% in recent days. These numbers underscore both strong confidence and market sensitivity to regulatory cues.

SEC vs. Ripple: The Settlement Stalemate

Ripple’s legal battle with the SEC hinged on whether XRP constituted an unregistered security. Although the two parties reached a tentative $50 million settlement in March, Judge Torres rejected their joint motion in May due to procedural issues under Rule 60.

They have refiled and paused appeals, aiming for limited remand through the Second Circuit. A procedural status report is due to be submitted by the SEC by June 16, yet the settlement is still awaiting final judicial approval, meaning the case remains formally open.

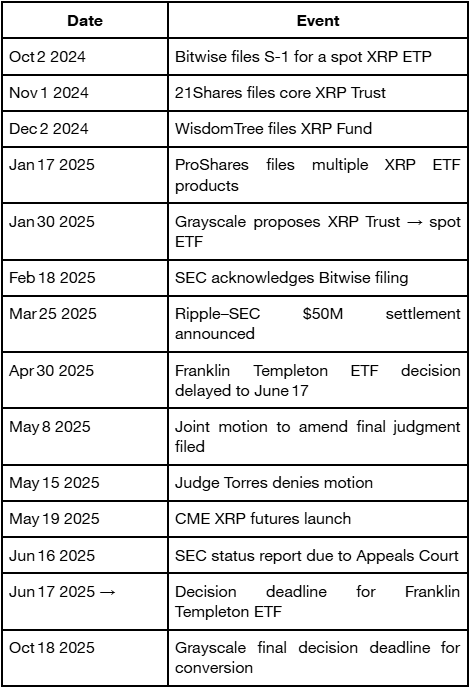

Looking ahead, the June 17 deadline looms large for the Franklin Templeton ETF decision, and Grayscale’s chance of converting its XRP Trust to a spot ETF finalizes by October 18, 2025.

Price Dynamics & “Buy the Rumor” Effects

XRP has been highly reactive to both XRP ETF speculation and legal headlines:

- On June 12, XRP price declined roughly 5,21%, closing near $2.13, as the broader crypto market weakened.

- Technical indicators: a break above the 50-day EMA may lead to retesting $2.50 and eventually $3.55, while sliding below the 200-day EMA risks a drop to $1.93 .

Traders are treating the ETF buildup like the classic “buy the rumor, sell the news” scenario long seen with Bitcoin and Ethereum.

Projections range from bullish (up to $27) to cautious, with expectations of swift 20–40% corrections post-approval.

Market Volatility & Liquidation Shock

In the past 24 hours, XRP faced $7.95 million in liquidations, predominantly on long positions, triggered by a 182% futures imbalance and price dipping to around $2.11.

Though sharp, analysts view this as a short-duration turbulence within a broader upward trend, especially given ongoing institutional tailwinds.

Institutional Momentum: Futures, Stablecoins & Corporate Treasury Adoption

1. CME XRP Futures

On May 19, CME Group launched cash-settled XRP futures, standard (50,000 XRP) and micro (2,500 XRP) contracts, linked to the CME CF XRP‑Dollar Reference Rate.

These futures add institutional legitimacy, fulfilling a key SEC requirement for mature market structure.

2. Corporate & Real-World Adoption

Ripple’s network is seeing growing real-world use:

- Corporate allocations: Webus, VivoPower, and Wellgistics are committing over $450 million in XRP for treasury and payment purposes.

-

Tokenized assets: Guggenheim Treasury Services issued digital commercial paper on the XRP Ledger.

-

Stablecoin integration: On June 12, USDC came to XRPL, enabling auto-bridging through XRP, a move to bolster liquidity and stablecoin utility on Ripple’s network.

XRP Key Timeline at a Glance

What Comes Next?

1. June 16–17

2. Market and Technical Signals

Traders are watching the 50- and 200-day EMAs; momentum may surge or falter based on price action and ETF headlines.

3. Ongoing Institutional Growth

Futures activity, stablecoin integrations, and institutional treasury adoption all support XRP’s positioning—independent of a spot ETF outcome.

Conclusion

XRP stands at a pivotal juncture. With the SEC’s legal battle nearing resolution and regulated futures trading already in motion, the environment is primed for an ETF decision by late 2025. While odds on Polymarket exceed 80–90%, the outcome hinges on:

- Court confirmation of the $50 million settlement,

- SEC’s interpretation of ETF applications in this new legal context,

- And whether XRP’s market infrastructure satisfies regulatory demands for transparency and investor protection.

XRP’s future could point toward institutional mainstreaming, or a roller-coaster bear trap. All eyes now are on the June 16–17 window.

by | Jun 13, 2025 | Business

The crypto market plunged over 7% amid escalating Israel-Iran conflict, renewed Trump tariff threats, and over $1.2B in liquidations. Bitcoin, Ethereum, and XRP led the selloff, while investors brace for further volatility driven by geopolitical risks, macro uncertainty, and massive options expiry.

The global cryptocurrency market suffered a severe blow on Friday, 13 June, with major digital assets plunging in response to a storm of negative catalysts, including geopolitical conflict, renewed U.S. trade tensions, macroeconomic concerns, and widespread liquidations.

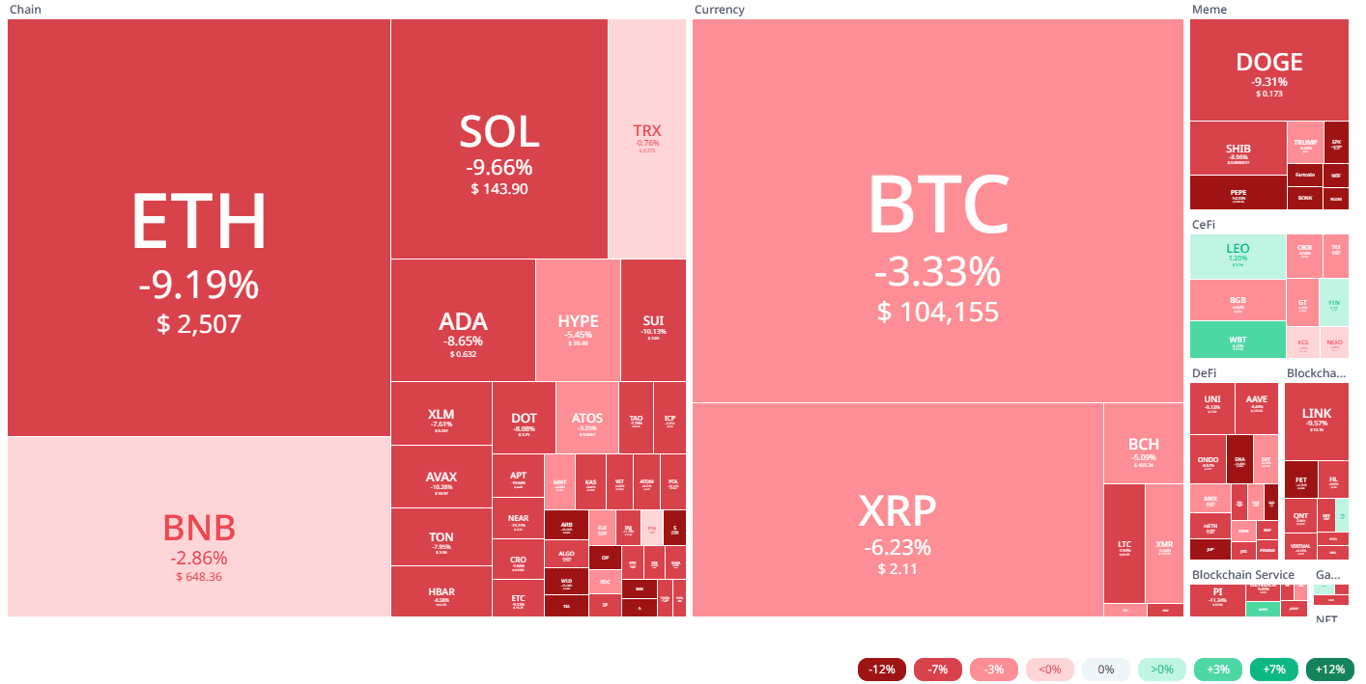

Bitcoin, Ethereum, and XRP Lead the Drop

The price of Bitcoin (BTC) tumbled to an intraday low of $102,000, marking a 7% drop over the past 48 hours. Ethereum (ETH) and XRP followed suit, plummeting 10% and 7% respectively within the last 24 hours.

As of press time, Bitcoin had recovered slightly to trade around $104,155, while Ethereum was at $2,507 and XRP price at $2.11.

Overall, the global cryptocurrency market capitalization fell by over 7% in 24 hours to $3.3 trillion, according to CoinGlass data.

Israel-Iran Conflict Ignites Investor Fear

Markets were roiled early Friday by news that Israel launched a preemptive military strike on Iran, targeting strategic nuclear and military sites.

The attack reportedly resulted in significant casualties, including Iranian military leaders and civilians. Iranian officials have vowed a “harsh response,” raising fears of a broader regional war.

Israeli Prime Minister Benjamin Netanyahu declared the beginning of Operation Rising Lion, aiming to dismantle Iran’s nuclear capabilities. In response, Israel closed its main airport and raised national defenses to the highest level.

The White House swiftly issued a statement distancing the U.S. from the attack. Secretary of State Marco Rubio reiterated that the United States was not involved and that protecting American personnel in the region remains the top priority.

The geopolitical fallout immediately triggered a flight to safety: gold rose 0.75% to $3,428/oz, while crude oil spiked nearly 10% to $74 per barrel.

JPMorgan warned that oil could reach $120 if the conflict escalates, potentially pushing U.S. inflation back up to 5% from its recent 2.4% level.

Trump’s Tariff Threats Add to Market Volatility

Uncertainty deepened as former President Donald Trump signaled a return to protectionist trade policy. Trump announced plans to reintroduce sweeping tariffs aimed at pressuring U.S. trading partners, adding fuel to investor concerns.

While Treasury Secretary Scott Bessent hinted at a possible extension to the current 90-day tariff pause, markets reacted cautiously.

The fading optimism over a potential trade deal between the U.S. and China, combined with Trump’s demand for a 100 basis point Fed rate cut, compounded fears of macroeconomic instability, sending both traditional and digital markets into a tailspin.

$3.7 Billion in Options Expiry Sparks Liquidation Avalanche

One of the key technical drivers of Friday’s market crash was the expiry of over $3.7 billion in crypto options on Deribit. This includes 28,000 BTC options (worth over $3 billion) and 242,000 ETH options (worth $700 million).

The high volatility surrounding these expiries led to sharp position unwinding. BTC’s put-call ratio of 0.95 and Ethereum’s more bearish 1.20 reading reflected a shift in trader sentiment. The “max pain” points, $107,000 for BTC and $2,700 for ETH, indicated likely retracement levels.

CoinGlass data confirmed that crypto liquidations surged over 125% in one day, crossing $1.2 billion. An astonishing $930 million of long positions were wiped out in just 12 hours. The largest liquidation was a $201 million BTCUSDT order on Binance.

Over 247,000 traders were liquidated, with BTC and ETH accounting for the lion’s share of losses. Whales also contributed to the selloff, as seen with one notable wallet depositing 1,000 BTC (worth $106 million) to Binance after accumulating it at an average price of $18,665.

Support Levels Breached Across the Board

Bitcoin broke below its key support level at $106,000 and the June open, setting off a cascade of forced selling.

Ethereum mirrored this weakness, dropping below its $2,650 support. XRP also failed to hold above $2.20, despite positive sentiment stemming from Ripple’s ongoing legal resolution efforts with the U.S. SEC.

Solana (SOL) plunged 11% to $141, Dogecoin (DOGE) fell 2.5% to $0.19, and Binance Coin (BNB) slipped 4% to $597. Altcoins across the board suffered as the crypto market entered oversold territory, with the Relative Strength Index (RSI) dropping to 28.

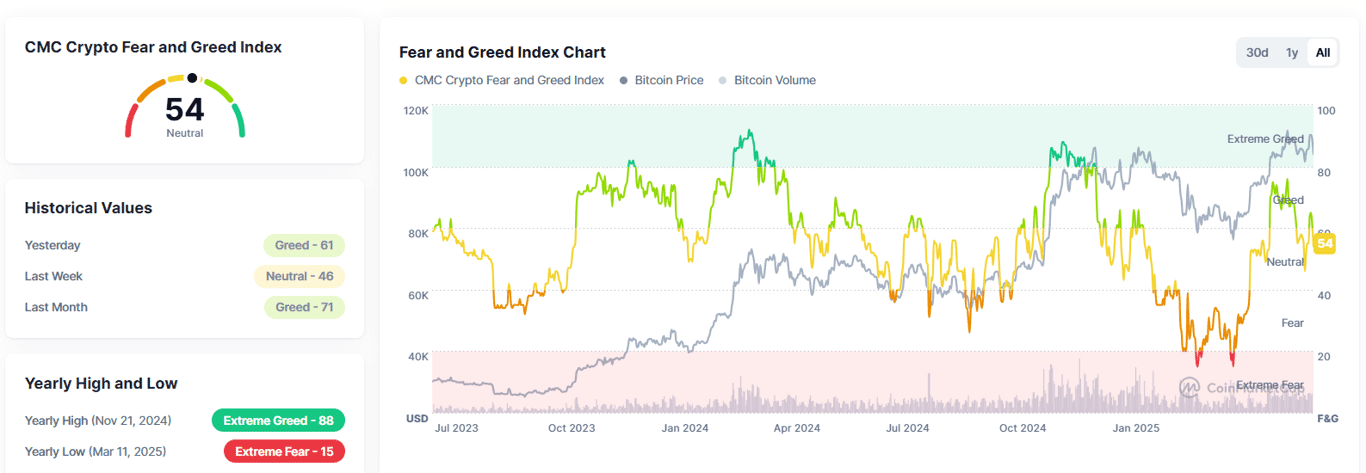

Interestingly, despite the carnage, the Crypto Fear & Greed Index remained in the “Greed” zone at 54.

A “Bull Trap” or Start of a Deeper Correction?

Thursday’s market behavior now looks like a classic “bull trap.” Initially, crypto assets rallied following a surprisingly low U.S. CPI reading of 2.4%, but this optimism was swiftly replaced by fear amid cascading liquidations, geopolitical risk, and technical breakdowns.

Analysts say the market had already shown signs of weakening demand, especially for Bitcoin. According to CoinPanel’s Dr. Kirill Kretov, “Macroeconomic uncertainty is still high, and with thin liquidity, even moderate players can move prices significantly.”

What Comes Next? Analyst Outlooks

Despite current volatility, many experts maintain a bullish long-term view:

1. Bitcoin (BTC): Analysts forecast consolidation between $100,000–$120,000. Bitfinex projects $115,000 by early July, while Fundstrat’s Tom Lee suggests a year-end target between $150,000 and $250,000.

2. Ethereum (ETH): A summer rally could see ETH revisit $2,800–$3,000 levels, supported by rising institutional interest.

3. XRP: The June 16 SEC lawsuit outcome remains a key catalyst. A favorable verdict could ignite a rally above $2.50, while a negative ruling may push it toward $1.80 or lower.

4. Dogecoin (DOGE): Technical resistance at $0.25 remains a barrier. Without fresh momentum, a dip toward $0.15 is possible.

Conclusion: A Cautionary Turning Point

Friday’s meltdown was a sobering reminder of the fragility of risk assets in a high-volatility, high-uncertainty environment. Whether this marks the start of a broader downtrend or a temporary correction remains unclear.

What is certain, however, is that traders and investors alike are in for a turbulent ride ahead, as global tensions, U.S. politics, and market mechanics continue to collide.

As the world watches developments in the Middle East and the financial markets react, one thing is clear: the age of crypto is no stranger to chaos, and opportunity.

You must be logged in to post a comment.