by Penny Angeles-Tan | Sep 19, 2024 | Business

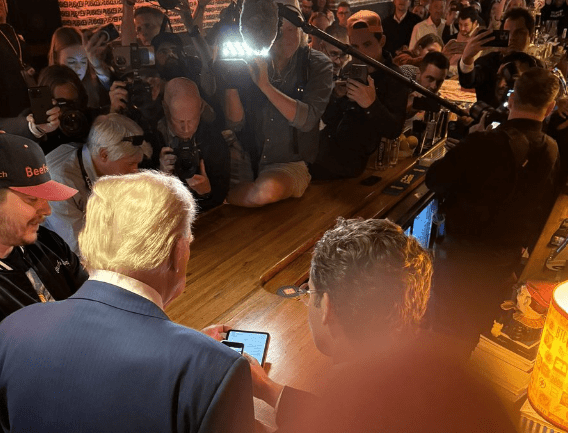

First in history, Bitcoin was used as payment for transactions by Donald Trump, former President of the United States. This transaction took place at a bar in New York City.

With an end that is considered no longer young, 78 years, this action has received praise. The reason is, that Trump showed adaptation to modern technology by using cryptocurrency to pay for burger and beer orders at PubKey, a famous restaurant and bar in Manhattan that accepts Bitcoin.

PubKey: A Historic Place for Bitcoin Transactions

PubKey is not just an ordinary bar, this place is known as one of the pioneers in accepting Bitcoin as a means of payment. Before Trump attended a rally on Long Island, he stopped at PubKey and made a Bitcoin transaction.

With the help of a PubKey employee, Trump used the bar’s cell phone and tablet to complete the payment.

This moment was greeted enthusiastically by the customers at the bar, especially those who are Bitcoin fans.

One customer even shouted, “Make Bitcoin great again,” as a form of support for Trump’s move. In a post on social media, PubKey called this transaction one of the most historic moments in the world of Bitcoin.

The Rise of Bitcoin and Trump’s Support of Cryptocurrencies

Bitcoin, whose price has soared more than 500% in the past five years, is now priced at around $61,248.50 per Bitcoin.

In fact, when this article was written on September 19, Bitcoin price had increased by +2.95% and was at $61,919. Increased quite significantly compared to the previous day which was below $59K.

The significant increase in Bitcoin’s value has attracted the attention of investors, including public figures such as Donald Trump.

Trump’s use of Bitcoin in PubKey is not just a symbolic stunt, but also part of a larger push to support cryptocurrencies.

A few days earlier, Trump talked about cryptocurrencies when launching World Liberty Financial, a new venture in the crypto space founded by entrepreneur Steve Witkoff with two of Trump’s sons, Donald Trump Jr. and Eric Trump.

During an event at X Spaces promoting World Liberty Financial, Trump explained that his sons, including 18-year-old Barron Trump, encouraged him to understand and accept cryptocurrency.

Trump even revealed that Barron has several digital “wallets,” which refers to places where Bitcoin and other crypto assets are stored.

“He was talking about his wallet, he had four wallets or something,” Trump said, reflecting his admiration for his son’s understanding of the technology.

Trump’s Ambition to Make America the “Crypto Capital of the Planet”

Trump’s move to use Bitcoin in PubKey is not just a moment in time, but reflects a larger vision for the future of the US in the world of cryptocurrency.

In July, Trump promised to make the United States the “crypto capital of the planet” and “Bitcoin superpower of the world” if he is re-elected president.

Trump also said that if Bitcoin were to go “to the moon,” a term often used in the crypto community to describe its extraordinary price rise, he would want America to lead this revolution.

At the Bitcoin 2024 Conference in Nashville, Trump expressed his commitment to supporting Bitcoin and other cryptocurrencies. He also criticized the policies of President Joe Biden and Vice President Kamala Harris, which he called a “war on crypto.”

Additionally, Trump promised to fire Securities and Exchange Commission (SEC) Chairman Gary Gensler, who is currently leading a regulatory crackdown on digital currencies. For Trump, regulations that are too strict will only hinder the growth of a dynamic and innovative crypto industry.

Trump Campaign and Acceptance of Donations in Crypto

Trump’s commitment to cryptocurrencies is also visible in his campaign moves. In May, the Trump campaign began accepting donations in crypto.

In the announcement, Trump proudly called himself a “crypto candidate,” or a candidate who fully supports digital currency.

Conclusion

Donald Trump’s move using Bitcoins in transactions on PubKey marks a new era in which cryptocurrencies are increasingly accepted in everyday life, even among major political figures such as former US Presidents. This proof us that Bitcoin to USD can be convert in transaction in the public area like PubKey.

With his ambition to make America the world’s crypto hub, Trump clearly sees huge potential in this technology.

With the support of his family, including his younger son Barron, Trump appears ready to lead the US towards a future more connected to the digital world and cryptocurrencies.

If re-elected, Trump promises to fight for Bitcoin and end policies he sees as barriers to crypto innovation.

Meanwhile, the historic moment in PubKey remains one of the most important milestones in Bitcoin’s development, signaling the growing role of cryptocurrency in global life and politics.

by Penny Angeles-Tan | Sep 17, 2024 | Business

ETH price continues to decline. It is predicted that Ethereum’s decline is due to Trump’s assassination last week and the Fed’s interest rate announcement. Here is a more detailed analysis.

The current condition of Ethereum is considered worrying. The reason is, the ETH price continues to decline even though the prices of other crypto assets are “green”. The price of ETH is currently considered the lowest since 2021.

Let’s review together what the current condition of the Ethereum price chart is. Analysis of factors that influence the price of Ethereum will also be explained in this article.

Ethereum Decline Factors

Allegedly, the decline in ETH prices was due to the assassination attempt on former US president, Donald Trump, at the Trump International Golf Club in Florida.

This second assassination plot was recorded at the end of last week and affected the prices of BTC and ETH. Quoted from Decrypt, the price of ETH at that time immediately fell by around 4.2% to reach $2,315 on Monday in the European trading session.

Not only was it influenced by the second murder of Trump by the Secret Service, the fall in ETH prices was also due to anticipation of a monetary policy decision by the Fed this weekend. The Fed’s decision has made the crypto market a little anxious, especially towards the end of the third quarter of 2024.

The Fed is likely to cut interest rates so that DeFi returns are attractive enough to pay attention to. However, the focus is also on rebuilding the DeFi lending market on the Ethereum mainnet. This could be used as a pump against Ethereum’s poor performance price.

ETH Price Keeps Going Down

Currently, the ratio of ETH to BTC pairs is at 0.039. This ratio is considered the lowest since April 2021. This decline in performance was analyzed starting on July 24 because the ETH/BTC pair fell below the ETH price range line between May 21 and July 24.

Please note, the ETH/BTC pair is the price ratio of ETh and BTC. The pair shows how much BTC is needed to buy 1 ETH.

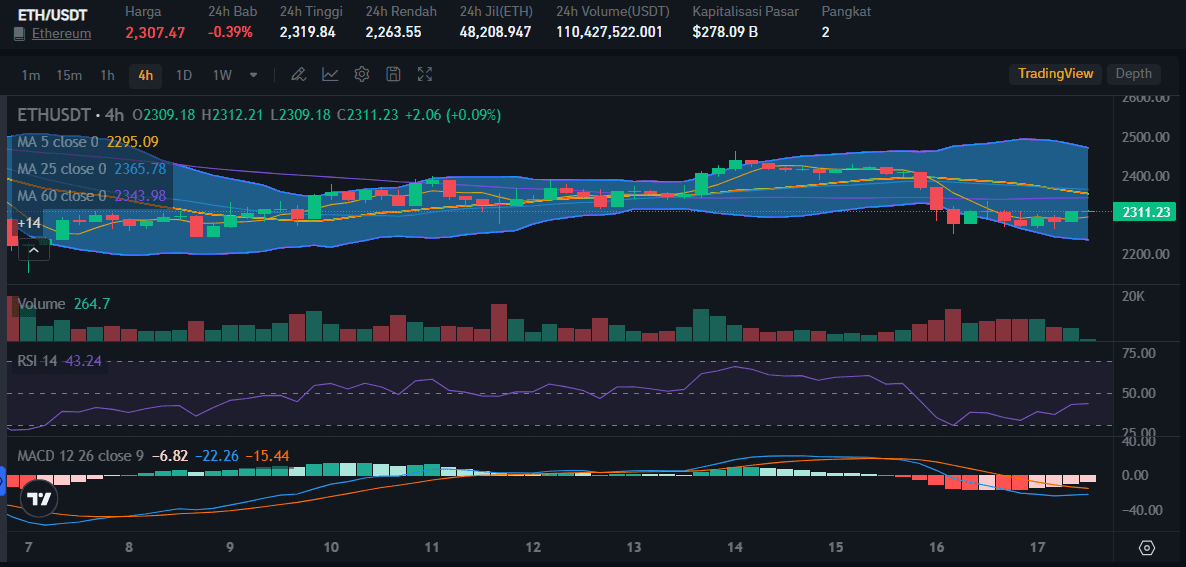

The price of ETH to USDT also experienced a decline. When this article was written on September 17, ETH had decreased by -0.39%. Currently, the price of ETH is $2,307.

It can be seen from the Ethereum price chart above that the ETH RSI indicator is also falling below 50. Ethereum’s RSI is at 43.24. This means that the selling pressure on ETH is much greater than the buying trend.

The MACD indicator also reflects something similar. It can be seen how the Ethereum MACD line drops from the boundary line. This makes ETH’s bearish trend inevitable.

Conclusion

The ETH price chart is indeed in a sad decline at the moment. However, this does not rule out the possibility that Ethereum could rise because price fluctuations in the crypto ecosystem are commonplace.

You can buy ETH when the price is decreasing like now. However, you must conduct a thorough analysis before investing. You can also learn how to buy ETH.

Bitrue can help you to carry out a detailed analysis of ETH. Bitrue also has an ETH to USD price converter feature to find out exactly how much this crypto asset is worth compared to the current dollar.

by Penny Angeles-Tan | Sep 17, 2024 | Business

Grayscale Investments introduces Grayscale XRP Trust. How does it affect the price of XRP? How does it benefit users? Check out the explanation below.

Grayscale Investments, a company known for its cryptocurrency-based products, has introduced the Grayscale XRP Trust. This product allows accredited investors to invest directly in XRP.

The XRP community, including Ripple CEO Brad Garlinghouse, has welcomed this move.

So, how does the Grayscale XRP Trust benefit users and impact the future of XRP in the crypto ecosystem? Understand in detail by reading this article to the end.

What is the Grayscale XRP Trust?

The Grayscale XRP Trust is an investment vehicle that allows investors, primarily institutional and accredited investors, to participate in the growth of XRP.

Think of it like a special container containing XRP. By purchasing shares in this trust, investors indirectly own a share of the XRP that is in the trust.

The launch of the XRP Trust by Grayscale is considered a significant step for the development of XRP. This shows increased investor confidence in this token and its future growth potential.

Garlinghouse also emphasized that XRP has the potential to attract interest from institutional and retail investors.

Why is the Grayscale XRP Trust Important?

There are several reasons why this project is very important, especially for users, one of which is because it makes it easier to access XRP. See the explanation below for more details.

1. Easy Access to XRP

Not all investors have the technical knowledge or infrastructure required to purchase and store XRP directly.

The Grayscale XRP Trust simplifies this process. Investors only need to purchase trust shares, and Grayscale will manage their XRP holdings.

2. Legitimacy and Trust

Grayscale is a well-known asset management company with a good reputation. By launching the XRP Trust, Grayscale provides additional legitimacy to XRP and attracts greater interest from institutional investors.

3. Growth Potential

XRP has great potential as an efficient cross-border payment tool. If XRP manages to reach this potential, the value of the XRP Trust could also potentially increase.

4. Portfolio Diversification

Investors can use the XRP Trust to diversify their investment portfolio. XRP offers a unique asset class with different profit potential than traditional assets.

Grayscale Plans to Turn XRP Trust Into an ETF

Grayscale has ambitions to turn the XRP Trust into a spot exchange-traded fund (ETF) in the future.

This is in line with steps that have been taken previously with their Bitcoin and Ethereum Trust products.

Impact of XRP Trust Launch on XRP Price

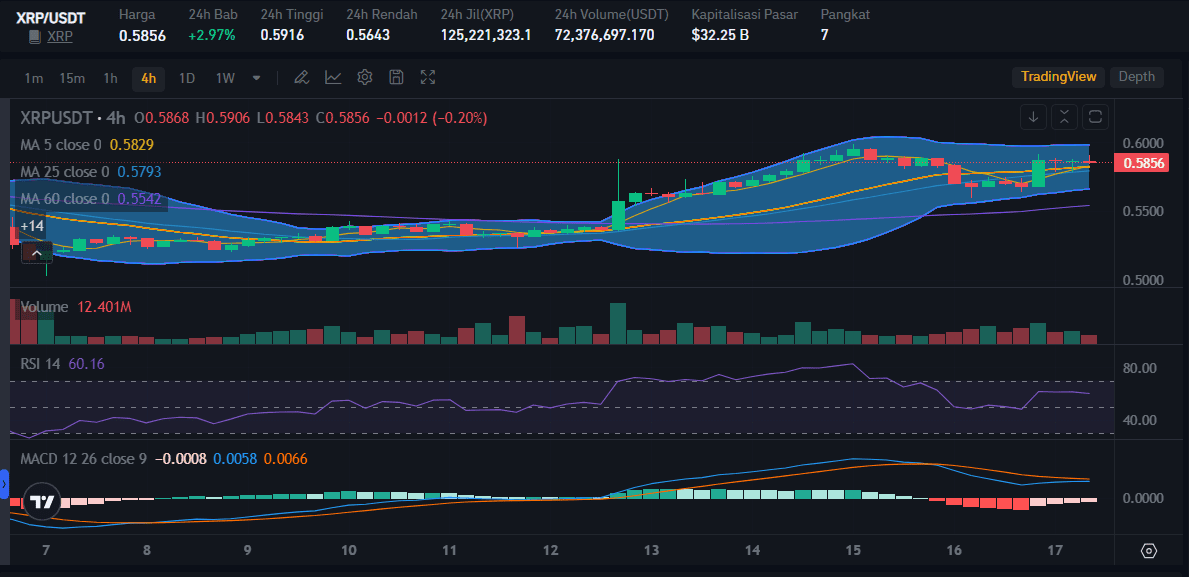

The launch of the Grayscale XRP Trust had little impact on XRP price. When this article was written, XRP had increased by +2.97% bringing the price to $0.5856. This increase is not a rare phenomenon due to the launch of a new project.

However, the existence of this project from Grayscale proves that XRP is indeed a strong digital asset that has received investment from large companies. So, don’t be surprised if buy XRP is something that should be taken into account for long-term investment.

Ripple CEO Optimistic about XRP’s Future

Brad Garlinghouse, CEO of Ripple, expressed optimism about the future of XRP. According to him, the approval of XRP in the United States will be a key factor in its global expansion.

Garlinghouse believes that with a clear roadmap, XRP will be able to attract the interest of investors from all over the world.

Apart from that, the benefits of the Grayscale XRP Trust are:

- Increased Liquidity: As more investors become interested in XRP through these trusts, XRP market liquidity will increase.2. Wider Adoption: The XRP Trust can accelerate the adoption of XRP among institutions and large investors.3. XRP Position Strengthening: XRP will be increasingly recognized as a serious digital asset with huge growth potential.4. Innovation Driver: The interest of institutional investors will encourage further development of the XRP ecosystem.

Challenges and Hope

Although Grayscale has plans to convert its XRP Trust into an ETF, this is still subject to approval from the SEC.

However, the XRP community remains optimistic that with a favorable court ruling for Ripple, the chances of getting this approval are greater.

Conclusion

That’s the explanation about Grayscale XRP Trust. Grayscale’s latest project with XRP is an important step in the development of XRP. With this trust, investors can invest directly in XRP.

Additionally, Grayscale’s plans to convert the trust into an ETF indicate greater growth potential in the future. Even though there are still challenges that need to be faced, optimism towards XRP continues to increase along with positive developments that occur.

You can access XRP as a crypto asset on the Bitrue website and learn how to buy XRP. There are various XRP pairs that you can check, such as XRP to USDT, BTC, ETH, to USDC. You can also do a price converter XRP to USD easily on Bitrue. That way, you don’t need to bother switching websites just to check how digital assets are priced in USD.

by Penny Angeles-Tan | Sep 11, 2024 | Business

On-chain analyst Ali Martinez has recently issued an important warning regarding the current Bitcoin market conditions. Based on a two-month chart analysis, the TD Sequential indicator, commonly used to identify potential turning points in market trends, shows concerning sell signals. This signal suggests a possible reversal from the bullish trend that has recently strengthened. This warning comes amidst ongoing uncertainty in the crypto market, where sharp price fluctuations have become commonplace.

Martinez explains that the $51,000 support level is critical for investors to watch. If Bitcoin falls below this level, there is a significant risk that the price could continue to decline, potentially reaching $40,600. Such a decline could result in substantial losses for investors who have not taken preemptive measures. This prediction underscores the importance of the $51,000 support level in maintaining Bitcoin’s price stability and highlights that the crypto market remains highly volatile and susceptible to drastic changes. Martinez advises investors to remain vigilant and consider the risks associated with the current market uncertainty.

A drop below this support level could have a significant impact on Bitcoin (BTC) and potentially affect the broader crypto market. If BTC fails to maintain this critical support level, increased selling pressure could lead to further declines, not only impacting Bitcoin’s price but also potentially causing a domino effect on other crypto assets. This impact could create instability across the market, reduce investor confidence, and trigger panic selling.

Currently, Bitcoin is trading at $54,630, reflecting a 3.54% decrease over the last 24 hours, according to CoinMarketCap data. This price drop reflects market concerns about Bitcoin’s ability to hold its key support level. The high volatility and negative sentiment surrounding this price drop emphasize the need for caution among investors. Given the potential widespread impact of this decline, it is crucial for market participants to closely monitor price movements and market sentiment in the coming days.

CryptoPotato reports that over the last five trading days, the crypto market experienced a massive outflow of $277.2 million. This situation has further exacerbated the market’s existing pressures. The outflow reflects investor concerns and uncertainties, leading them to withdraw their funds from the crypto market. Despite various influencing factors, the sheer volume of this outflow indicates a significant lack of confidence in the current market stability.

Interestingly, this event occurred despite September 2 being a national holiday in the United States. National holidays are generally expected to provide some respite from market pressures, but this time, the situation was different. The large outflow still occurred, signaling that investor uncertainty and concerns are not limited by regular trading days. This highlights the fragility of current market sentiment and how global factors can influence investment decisions even during trading activity breaks.

Overall, this report underscores the importance of understanding market dynamics and factors that can influence short-term price movements. Market participants need to stay alert and be prepared for potential volatility resulting from these massive outflows. It also serves as a reminder for investors to continuously monitor the latest developments and make investment decisions based on thorough analysis.

During this period, investors made substantial withdrawals in several days. On Tuesday, they withdrew $287.8 million, followed by $37.2 million on Wednesday. Withdrawals continued with $211.1 million on Thursday and reached $170 million on Friday. Among the entities affected, FBTC Fidelity recorded the largest losses, adding to the market’s existing burden.

The total outflow during this period reached a significant $706.1 million, extending the negative streak to eight consecutive days. This is the longest recorded period of decline, indicating deep concerns among investors and impacting the overall market stability. The continuous withdrawal trend reflects widespread uncertainty and the potential long-term impact on the dynamics of the crypto market.

For novice traders looking to start investing in Bitcoin, now might be an opportune time. You can track Bitcoin prices through the Nanovest app, which offers a comprehensive selection of crypto assets. Nanovest provides up to 600 crypto asset options and allows investors to start with a small capital of just 5,000 rupiah.

If you’re interested in crypto asset investment, Nanovest could be a suitable choice as it offers over 2,000 U.S. stocks and more than 600 crypto assets. Take advantage of the current market movement by investing through Nanovest! For those interested in using Nanovest, the app is available on both the Play Store and the App Store.

by Penny Angeles-Tan | Sep 11, 2024 | Business

DOGS’ reputation is growing day by day. Will DOGS become more successful in the crypto industry? Learn more about DOGS future predictions in this article.

As a new meme coin, DOGS’s reputation is increasingly strengthening in the crypto ecosystem. DOGS becomes the top 3 crypto with the most unique holders. This number is considered fantastic because the tokens with more holders than DOGS are only USDT and ETH.

So, will DOGS continue to be successful in the crypto ecosystem? Is DOGS’s performance worthy of long-term investment? This article will discuss it, especially for you. Watch until the end to learn about DOGS developments in the crypto ecosystem.

DOGS Latest Achievements

Recently, the TON community announced that as many as 17 million users claimed DOGS tokens. This achievement is quite impressive for a new meme coin like DOGS.

According to Tonviewer, more than 5 million wallets are holding DOGS tokens on the TON blockchain. With this amount, DOGS has become a meme coin with a fantastic number of unique holders.

With that many holders, DOGS can only be surpassed by USDT from Tether and Ethereum (ETH).

Throughout its existence, DOGS now has more than 53 million users on its mini app with more than 42 million users eligible for airdrop claims.

With this achievement, the TON Community has more hope in Catizen and Hamster Kombat which is predicted to be able to compete with the success of DOGS now.

DOGS, Meme Coin Leader?

DOGS has many fans. Its release on crypto exchanges is much anticipated. However, the release schedule which coincided with the incident of Pavel Durov’s arrest meant that the DOGS price performed beyond user expectations.

Crypto News Flash reports that DOGS is gaining tremendous traction among meme coins. It was recorded that as of September 10, DOGS had increased by 9%. Staking DOGS also attracts more and more users.

For additional information, you can get prize of 50,000 HMSTR tokens by staking DOGS on Bitrue. The requirements are very easy. You only need to verify KYC on your Bitrue account, make a deposit with a minimum nominal, then you can redeem at any time.

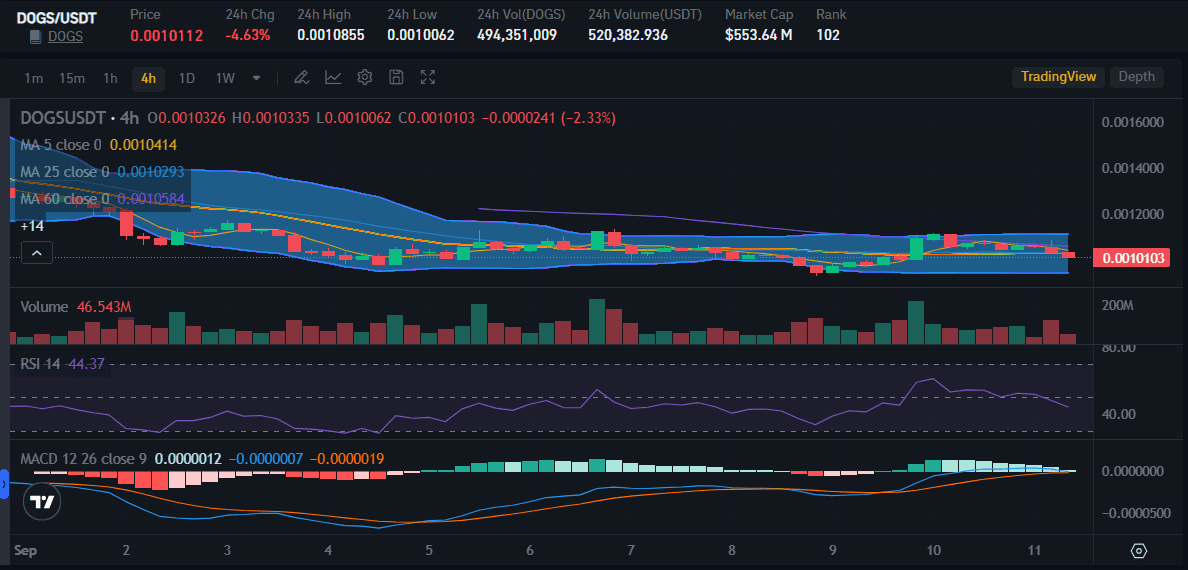

As of September 11, DOGS had declined by 4.63%. Now, DOGS is trading at $0.0010112. Previously, DOGS was at $0.0010855 as its highest price in the last 24 hours.

In the price chart above, the RSI line is at 46. A number below 50 indicates that the DOGS selling trend is higher than the buying trend.

However, DOGS holders can be a little optimistic about DOGS performance because the MACD line seems to be trying to rise upwards. It could be said that DOGS has the possibility of being bullish even though it is currently in the red.

Will DOGS Continue to Be Popular in the Crypto Ecosystem?

The important question now is, will DOGS continue to establish itself as a meme coin with strong value in the crypto ecosystem?

Since its inception, DOGS has become a favorite among Telegram fans and the TON Community. DOGS continues to be in demand even when Bitcoin and the majority of Altcoins experience price declines.

When Bitcoin fell to $54,000, DOGS rallied with an increase of up to 16.5%. However, will this positive DOGS trend continue in the future?

Yang pasti, like any other cryptocurrency, DOGS is subject to various factors that can influence its price. Here are some of the key factors, such as:

1. Market Sentiment and Speculation

Positive news, hype, and fear of missing out (FOMO) can drive up the price of DOGS. Negative sentiment or news can have the opposite effect. Discussions and trends on social media platforms like Twitter and Reddit can significantly impact the price of DOGS.

2. Supply and Demand Dynamics

The distribution of DOGS tokens among holders can affect price. A concentrated ownership can lead to higher price volatility, while a wider distribution can stabilize the price.

The availability of buyers and sellers in the market can impact price. Higher liquidity generally means more stable prices.

3. Technological Developments and Project Progress

Positive developments in the DOGS project, such as new features, partnerships, or milestones achieved, can boost investor confidence and drive up the price. Improvements in the DOGS blockchain’s scalability and performance can enhance its utility and attract more users, potentially increasing the price.

Conclusion

That is information related to DOGS becomes the top 3 crypto with the most holders. The number of holders can only be surpassed by USDT and ETH, making DOGS a meme coin that is quite worthy of consideration at the moment.

You can read other information related to DOGS and various other crypto ecosystem news updates only on Bitrue. Only on the blog Bitrue, you can get the latest news related to cryptocurrency which can be read anytime and anywhere for free!

You must be logged in to post a comment.