by Penny Angeles-Tan | Oct 2, 2024 | Business

Ethereum (ETH) price today has decreased. However, the prediction of Ethereum price increase to $ 10,000 is still strong with the existing technical data. Here is the full explanation.

Amid today’s declining crypto market conditions, ETH is predicted to achieve a price increase of $10,000. However, today Ethereum price also fell like the majority of other crypto tokens.

So, how can ETH get a predicted price increase? Even though ETH’s recent performance has also underperformed compared to BTC.

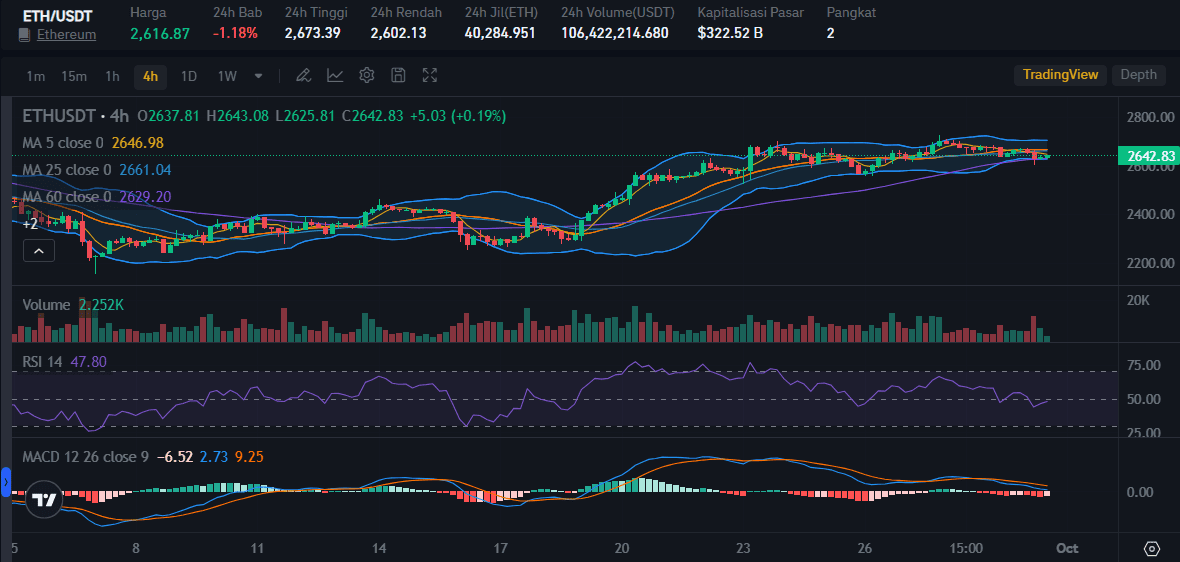

Current Ethereum (ETH) Price Chart

Above is the ETH to USDT price chart taken from the Bitrue website. When this article was written on September 30, Ethereum was trading at $2,616 with a decline of 1.18% in the last 24 hours. Previously, during the same period, ETH was at $2,673 as its highest price.

The number on the ETH RSI indicator is 47.80, which means that ETH is safe, not in an over-selling condition even though there is a decrease in purchasing numbers.

Ethereum’s MACD condition is also quite safe with the graph declining but not yet touching the boundary line. Thus, ETH bearishness is technically not coming any time soon.

Are There Signals of an Ethereum Price Bullish?

Recently, Ethereum has experienced poor performance. Several times the price of ETH was in the red even though the majority of crypto tokens were rising.

However, it is predicted that global macroeconomic trends will provide benefits for Ethereum. M2 money supply growth will support Ethereum price increases.

Later, when the central bank eases monetary restrictions it will create a new surge in liquidity in Ethereum which is also in line with Bitcoin.

Beyond global macroeconomic trends, Julien Bittel, head of macro research of Global Macro Investor, stated that ETH could reach its $10,000 price target shortly by conducting a technical analysis of Ethereum.

This is because there are similarities between the current Ethereum price chart and 2023-2024 when ETH experienced a sharp increase.

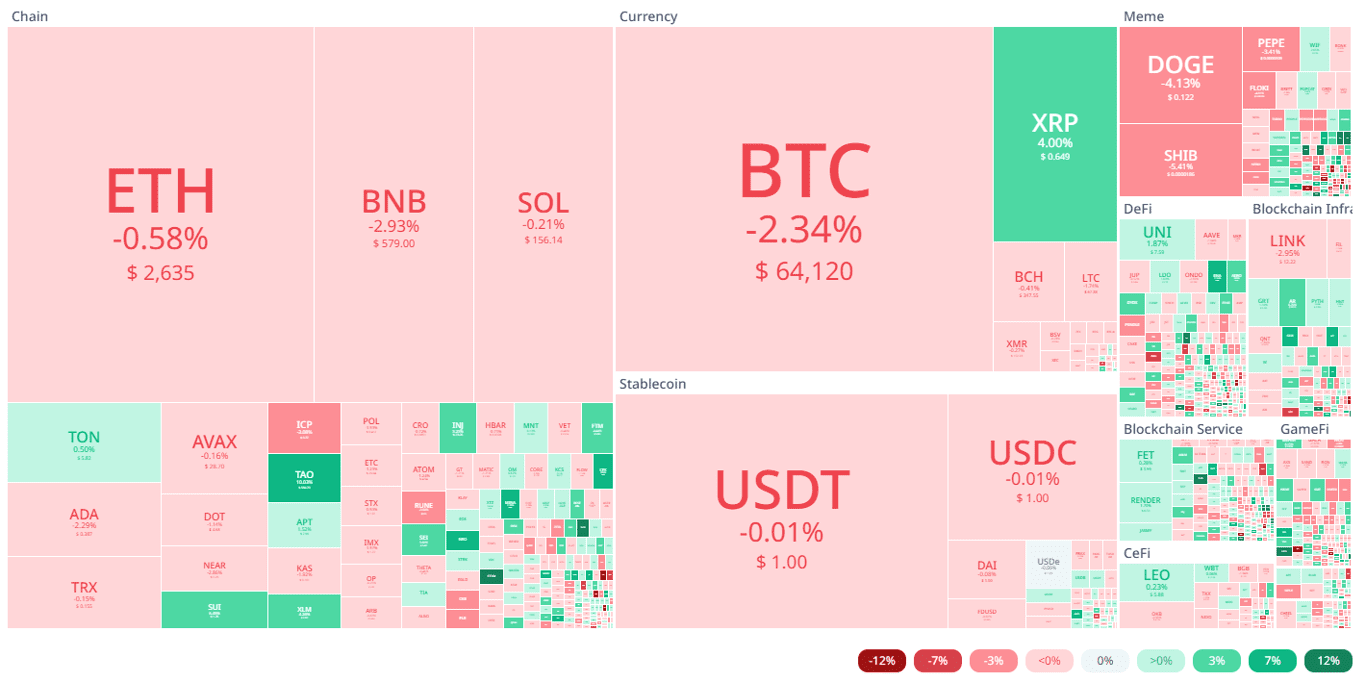

However, today’s Ethereum price drop is nothing to worry about. This is because the crypto market condition is not currently good. The majority of crypto tokens experienced price declines of varying amounts.

Not only the prices of large tokens, such as BTC, ETH, SOL, USDT, and BNB but also various meme-coins also experienced price declines. GameFi tokens that have been hotly discussed recently, such as HMSTR, NOT, and DOGS, are also following this downward price trend.

Conclusion

This is information about the downward trend in the price of Ethereum (ETH), complete with a discussion of how to predict the price increase in the future.

For those of you who want to learn how to buy ETH, Bitrue has a solution for you. Many features can be used, starting from checking ETH prices in real-time, reading the latest information about Ethereum, to checking conversion prices from ETH to USD easily.

By conducting in-depth research before buying crypto tokens, you will be more secure so you can easily determine an investment budget according to your financial condition.

by Penny Angeles-Tan | Oct 1, 2024 | Business

Today, Bitcoin price is down. Is it true that Bitcoin no longer dominates the crypto ecosystem? Understand how BTC is doing to other crypto tokens by reading this article until the end.

Bitcoin Price today it’s down. Even though the decline is not too big, this decline is a sign that the crypto ecosystem is not in good condition. The reason is, not only Bitcoin, but the majority of crypto tokens are also experiencing prices plummeting today.

What is the real state of the crypto market now? Is it true that there will be a major price correction in the future and the price drop in the majority of crypto tokens today is the start of that price correction? Check out the explanation below.

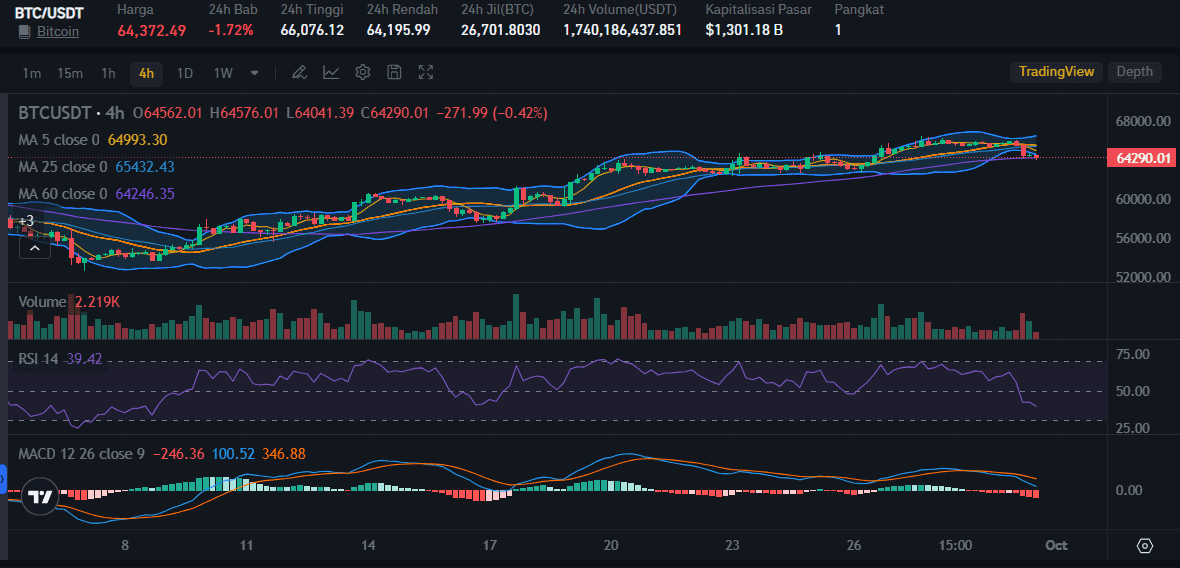

Current Bitcoin Price Chart

As of today, the price of Bitcoin to USDT has decreased by 1.72%. Perhaps, this decline does seem small because the current BTC price is still above $64K. However, previously Bitcoin was for $66,076, which means the price of BTC has fallen quite a lot at this time.

Looking at the Bitcoin price graph taken from the Bitrue market above, the RSI value is quite worrying because it is at 39. This means that if the BTC RSI value falls again, then BTC will be recorded as experiencing over selling and this will make the BTC price fall further.

The BTC MACD indicator also decreased with a fairly wide distance between the two lines. This condition makes predictions of bearish BTC stronger.

Bitcoin Predicted to Rise in Q4

There is a unique curse that is widely believed among analysts and crypto observers, namely Bitcoin which always gets worse in September. This is not even just a curse that can be taken lightly because there is underlying data.

Above is data on the decline and rise in Bitcoin prices since 2013. You can see that every September, BTC experiences a price decline. If this data continues, it means that BTC token holders will be happy because it means that in October BTC will experience another price increase.

Crypto Ecosystem Will Experience Price Correction?

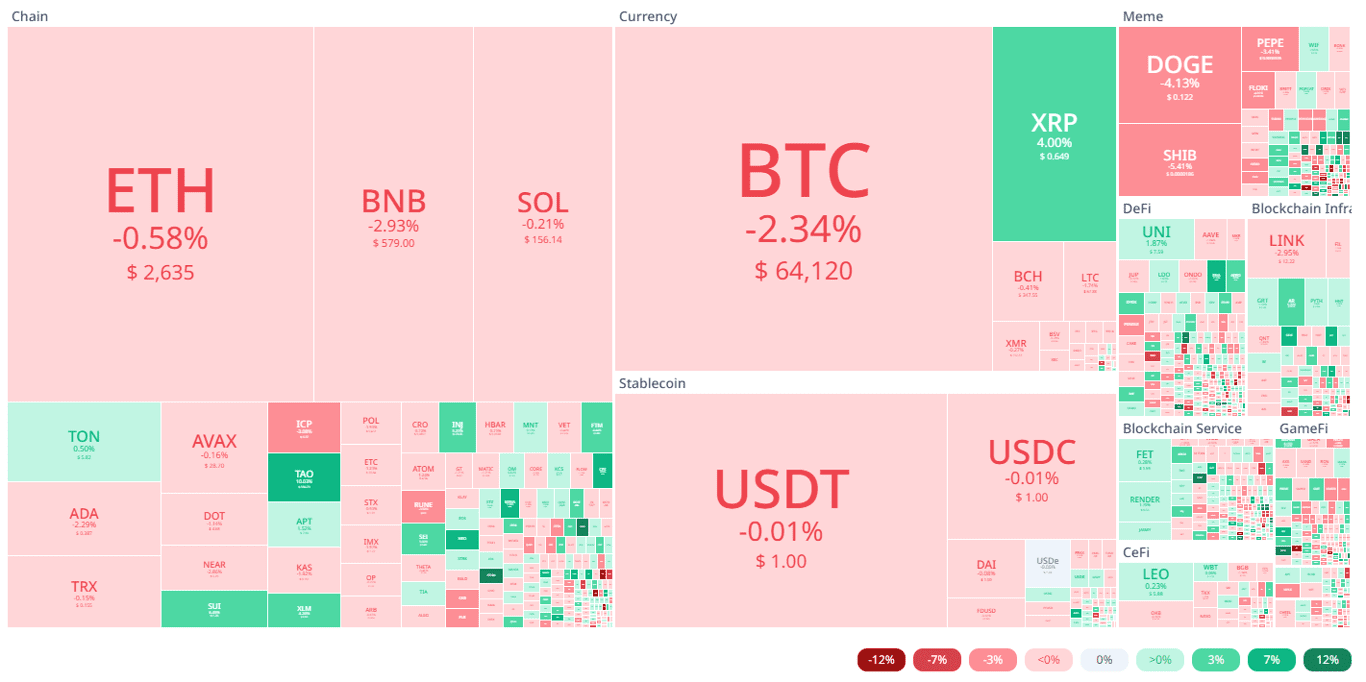

Currently, the majority of crypto tokens are red. Not only Bitcoin, but Ethereum, Solana, BNB, USDT, and various memecoins also experienced price declines.

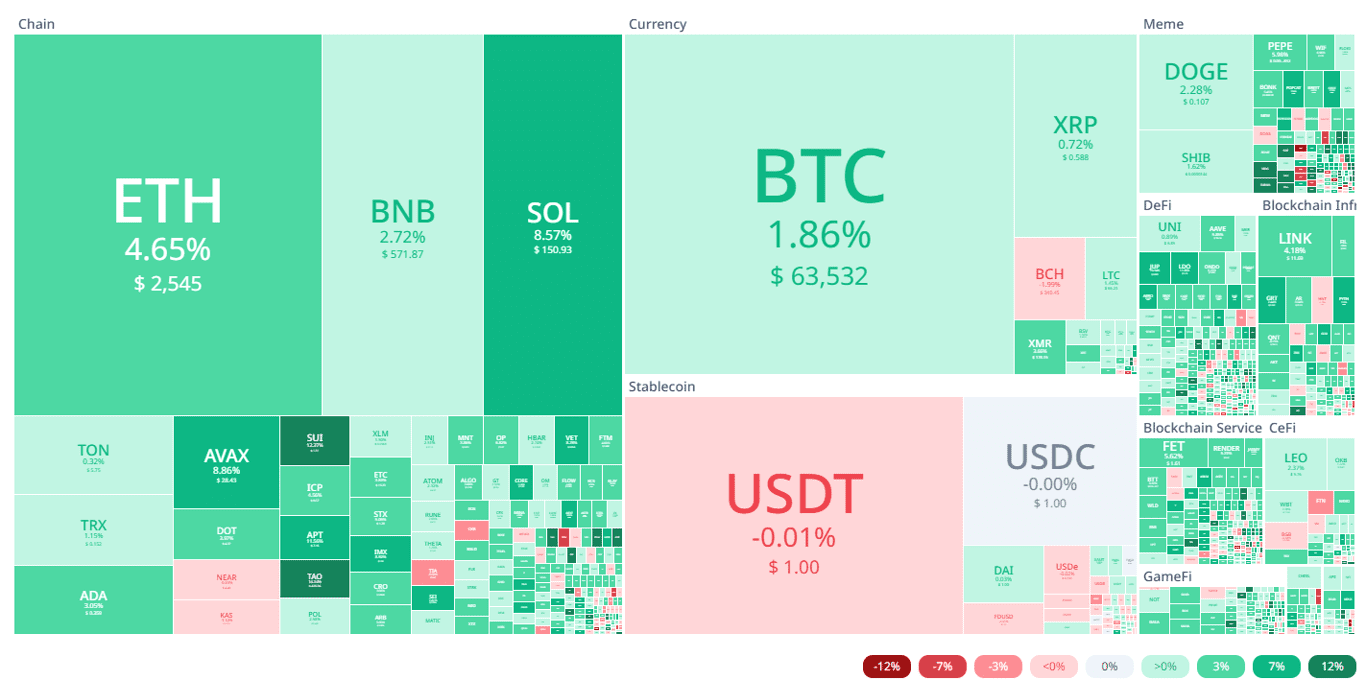

You can see from the screen capture the crypto ecosystem heatmaps taken from Cryptorank above. Many crypto tokens are experiencing price declines. The price decline is not that high, but this needs to be looked at more carefully because it is not just one or two tokens that have dropped in price.

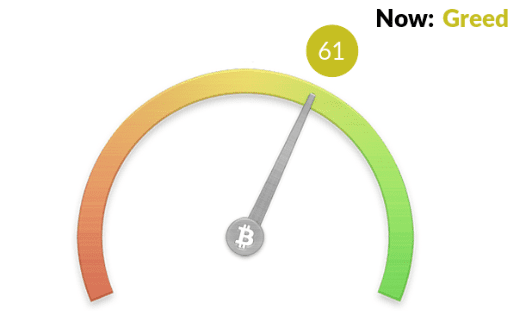

This correction prediction is supported by Fear & Greed data. Currently, the crypto ecosystem is in the greed phase, which means that there is a chance for correction in the future. This greed phase has been going on since yesterday even though in the previous week, the crypto ecosystem was in the Neutral phase.

Quoted from Trading View, Bitcoin’s role is currently quite dominant with a dominance figure of 57.17%. This Bitcoin dominance figure decreased by 0.63% in 24 hours.

Conclusion

That’s an analysis of the price of Bitcoin and how the crypto market conditions are as of today, September 30. If you are currently researching Bitcoin or other crypto tokens, you can directly visit the Bitrue website.

There are many interesting features on Bitrue that you can use to do research before investing in crypto. You can check the token price and convert it to the current USD price, for example, BTC to USD to find out the latest information on the crypto ecosystem by reading articles on the Bitrue blog.

If you are a new player in the crypto ecosystem, Bitrue is also a website that makes it easier for you to learn how to buy BTC and other crypto tokens.

by Penny Angeles-Tan | Sep 23, 2024 | Business

Bitcoin price rose quite sharply after the Fed announced a rate cut. At the same time, whales sold BTC in large amounts. How does this affect the BTC price?

Bitcoin price soaring up The Fed officially announced an interest rate cut. After struggling to reach $60,000 for a long time, BTC has now jumped to more than $63K.

Understand the current BTC price chart analysis. And is it true that there is a whale who sells BTC in large quantities? Check out the reasons and implications for the crypto industry.

Current Bitcoin Price Chart

When this article was written on September 20, 2024, the price of BTC to USDT is soaring at $63,749 with an increase of +2.93% in the last 24 hours. In the same period, BTC reached its highest point at $64,133.

The Bitcoin price chart above is taken from Market Bitrue. It can be seen that the graph gives a very positive signal for the current condition of BTC. In fact, the RSI number is far above 50. With the number 71.71, buying BTC tokens is becoming a popular trend compared to selling it.

The MACD indicator is also rising above the border line. The gap between the two lines indicating that BTC will soon experience an impressive bull run.

Current technical analysis is quite impressive. However, seeing that the flow of crypto coin prices is always fluctuating, you can always do research before making an investment. You must always do the DYOR technique.

To make it easier for you to do independent research, the Bitrue website can help you. Because, Bitrue provides easy access for you to check the price conditions of BTC and other crypto coins in real time.

Whales Selling BTC in Large Amounts

When the price of Bitcoin finally reached more than $63,000, a whale actually sold the BTC tokens he owned. No half-hearted, whate sold up to 1,030 BTC with a selling value of approximately $64.3 million on one of the global crypto exchanges.

This action certainly attracts attention. Moreover, BTC token holders are having fun celebrating the increase in BTC prices. However, selling tokens when their value rises is actually common in the crypto industry. This is a strategy to make a profit, especially when the token holder buys it when the price drops.

However, the slightest movement from investors in the crypto industry certainly has an impact on the state of the token. So, what is the impact of selling this large amount of BTC? Pay attention to the following points.

- BTC prices can change along with selling large amounts of Bitcoin and affect the existing RSI indicator2. This BTC sale can trigger BTC price volatility

BTC and Its Popularity

After the Fed announced it would cut interest rates by 50 bps, Bitcoin prices tended to rise. This could trigger an increase in the prices of other tokens as well so that the crypto industry experiences a positive price shift.

Bitcoin is called the king of crypto for a reason. The reason is, when the price of BTC experiences an increase or decrease, the prices of other tokens will also be affected, both in positive and negative directions.

Even though when the price drops or during the Bitcoin halving the price of alternative coins will tend to rise because BTC dominance falls, Bitcoin’s popularity remains brilliant. This oldest token will still be suitable for investment purposes.

When you are interested in investing in BTC, you can learn how to buy Bitcoin. Check prices Bitcoin to USD It can also be used as primary research to check current prices so that you can determine the appropriate allocation of investment funds according to your abilities.

by Penny Angeles-Tan | Sep 20, 2024 | Business

The EIGEN Season 2 Stakedrop is only specifically for 3 categories of recipients. Are you among those eligible to receive this EIGEN airdrop?

Through its official account on X, the EigenLayer Foundation announced its airdrop event. The EIGEN Season 2 stakedrop was announced on September 4. However, there has been no additional announcement regarding exactly when this airdrop will take place.

Stakedrop EIGEN Season 2 is only specifically for 3 categories of recipients. Are you among those eligible to receive this EIGEN airdrop? Check out the explanation below.

Mengenal EigenLayer

Before discussing EIGEN Season 2 Stakedrop, let’s first discuss EigenLayer. That way, you will become more familiar with this protocol.

So, EigenLayer is a protocol on the Ethereum network. This protocol is very innovative because, with EigenLayer, users can restake ETH that has previously been staked on the Ethereum Beacon Chain.

In this way, the ETH owned by users can be used again to secure other projects built on the Ethereum network. The emergence of EigenLayer makes using ETFs much more efficient.

EigenLayer also helps improve the security of the Ethereum network and projects built on the Ethereum network. With more validators securing the network, the network will become more decentralized and resistant to attacks.

This protocol also opens the door to the development of new, innovative projects on top of Ethereum. That way, developers can easily access the security resources provided by EigenLayer without needing to build their security infrastructure.

EIGEN Season 2 Stakedrop

On September 4, EigenFoundation announced its airdrop event with the title Stakedrop EIGEN Season 2. This event will be held on September 17 2024. However, there is a possibility that it will be held before that date.

There are only 3 categories of recipients who are eligible to take part in this EIGEN airdrop event, namely Stakers & Operators, Ecosystem Partners, and Community. The following is a more detailed explanation.

1. Stakers & Operators

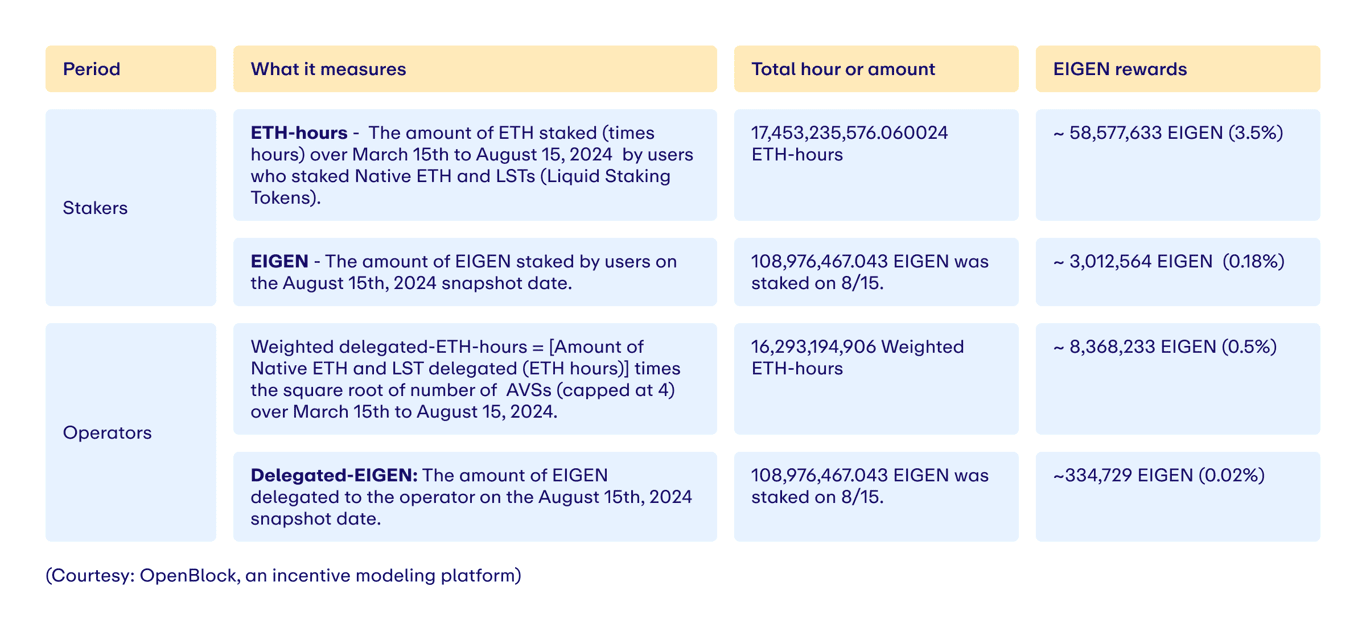

This recipient category is users who have staked ETH or EIGEN tokens. Later, stakers can immediately claim prizes when the airdrop officially opens. To calculate rewards, you can check the following table.

2. Ecosystem Partners

The EIGEN airdrop recipient category includes AVS, LRT, Rollup, RaaS, and other main contributors who meet the requirements of the EigenLayer ecosystem.

3. Community

The community in question is supporters, contributors, and early users of the EigenLayer project. Later, this category will be assessed by carrying out social identity verification as confirmation that the user is indeed in this category.

Conclusion

That is the information about the EIGEN Season 2 Stakedrop. You can follow the latest information about EigenLayer and the official date for holding the season 2 stakedrop by accessing the Bitrue blog.

Bitrue has a variety of the latest information about the crypto ecosystem. That way, you will always be up to date with the various crypto projects currently underway.

by Penny Angeles-Tan | Sep 20, 2024 | Business

The Fed’s rate cut announcement has impacted the crypto ecosystem. Will the USDT price paired with other crypto tokens also increase?

After the Fed announced interest rate cuts, the cryptocurrency industry heated up. Many tokens have experienced price increases. So, what about the USDT price? Has the USDT token pair also experienced positive price changes? The following is the explanation.

Impact of the Fed’s Interest Rate Cut Announcement

The Fed has announced a 50bps cut in interest rates. This condition has heated up various investment assets, including the crypto industry. The majority of crypto tokens have even gone “green”. This condition is of course encouraging for crypto token holders.

Bitcoin recorded its price at $63,532 with an increase of 1.8% in 24 hours. Then there is Ethereum which has recently experienced a decline and even received a bad reaction from its holders because the price continues to fall. But now, ETH is up 4.65% and has a price of $2,545.

However, it turns out that the condition of positive price changes after the announcement of the interest rate cut does not apply to USDT. USDT Price fell by 0.01%.

Tether USDT Dominates the Stablecoin Market

In the stablecoin market, Tether USDT continues to strengthen its teeth. TON’s USDT Tether dominates and records itself with an increase of up to 75%, from the previous 55%. Its market capitalization even exceeds $118 billion. This figure is proof of the significant increase in Tether USDT in the last 2 years.

There are several reasons why Tether USDT has had such a significant increase now, namely:

- Tether USDT has a strong network with better liquidity than other stablecoins so users have more trust2. Users shift away from USDC due to the collapse of Silicon Valley Bank 3. Tether also has an allocation of US government bonds, thus providing income of up to hundreds of millions for Tether itself.

Conclusion

That is information regarding the current condition of the crypto industry after the announcement of the Fed’s interest rate cut. Even though Tether’s USDT price tends to fall compared to other crypto tokens which rise, this can be a moment to buy USDT as an investment strategy.

However, investing in crypto assets must be accompanied by in-depth research. Carry out technical and fundamental analysis to find out what the condition of the token will be now and in the future.

You can learn how to buy USDT, check prices USDT to USD, to find out the price in real-time on Bitrue. Take advantage of Bitrue’s various features to conduct independent research so that you are more confident in investing in digital assets.

You must be logged in to post a comment.