by Penny Angeles-Tan | Oct 10, 2024 | Business

Today, Ethereum price is increasing while the crypto market is in the red zone. Is this condition proof that Ethereum can reach the level of $ 2,600?

Since Iran’s attack on Israel, Ethereum price has been affected and experienced a decline as the crypto market has been very volatile this week. However, surprisingly today the price of Ethereum has increased, even leaving Bitcoin which has fallen in price.

Will Ethereum break through $2,600 as holders of this token hope? Read the complete analysis in this article until the end.

Will Ethereum (ETH) Price Break $2,600

Long-term holders (LTHs) of Ethereum often determine how the ETH token will be priced in the future. There are indicators of LTH behavior. Currently, Ethereum LTH is showing an accumulation mode which is providing a positive signal to the Ethereum price.

The more long-term holders who HODL will also make the price of ETH increase because it means there is long-term trust in this token.

However, investor sentiment towards Ethereum also varies. Although many investors HODL, there is a negative sentiment from investors regarding Ethereum’s ability to reach $2,600. This is because the price of Ethereum decreased by 7.3% from October 1 to 8.

The Impact of an HBO Documentary and the Price of Ethereum

This article was written on October 9, 2024, just when HBO scheduled its newest documentary entitled “Money Electric: The Bitcoin Mystery” to be broadcast.

The film is said to reveal who Satoshi Nakamoto is. The figures believed to be Satoshi Nakamoto are Len Sassaman, Hal Finney, and Adam Back.

This HBO film created a riot among crypto fans. It was stated that the documentary could influence Bitcoin price to Ethereum. Will the prices of BTC, ETH, and other crypto tokens drop when the film is finally shown by HBO?

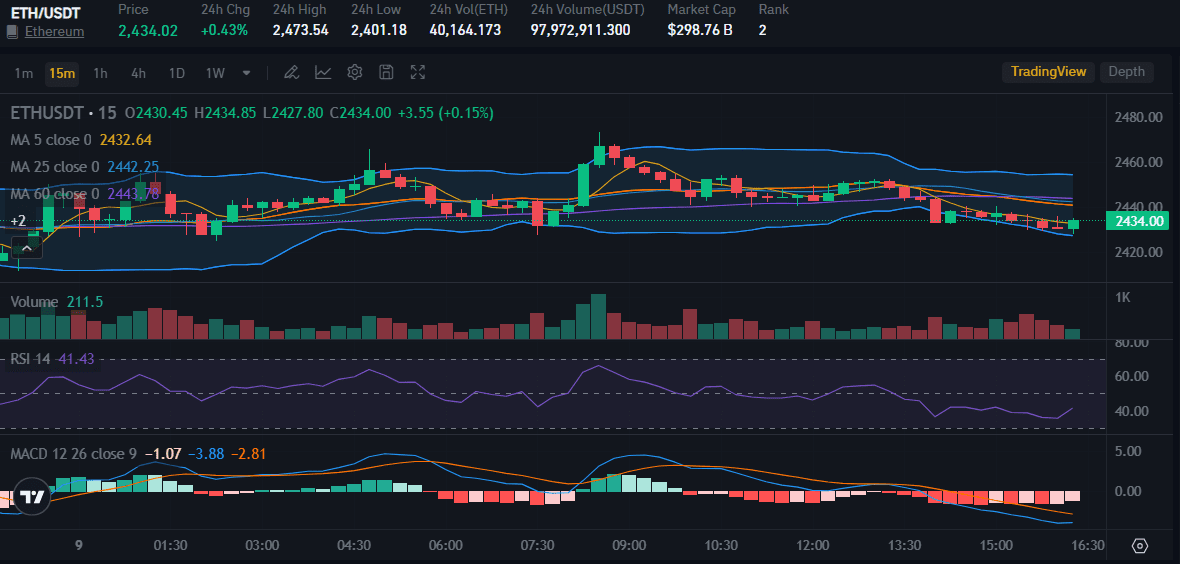

Ethereum Price Chart Today

When this article was written, Ethereum experienced a price increase of +0.42% so that it was trading at $2,434. Even though the increase did not reach 1%, this can be said to be good news because the majority of crypto tokens today experienced a price decline, including BTC, SOL, and USDT.

However, the increase in Ethereum prices has not been calm. Because, if you look at the ETH price chart above, the RSI and MACD indicators actually show unpleasant signs.

Ethereum’s RSI is 41.9 points lower than 50, which means there is a large selling trend, more dominant than the buying trend. The MACD line is also declining. If this continues to happen, Ethereum will face a bearish trend.

Ethereum Versus Bitcoin

Ethereum has become the leading altcoin and is predicted to be an alternative coin that can beat Bitcoin. And as expected, the two tokens are always compared regarding their price ups and downs.

In terms of average price increases, the price of Bitcoin has increased by 128% from year to year, while Ethereum is only 53%.

Since it was first launched in July 2015, Ethereum has been able to reach the $1,300 level in 2.5 years since it was first launched. Ethereum reached the level of $4,891 in November 2021 but had to be willing to drop drastically to $900 in 2022 due to unstable world economic conditions.

Conclusion

That is an explanation of the price of Ethereum which has increased today and predictions of reaching the $2,600 level. You can do more in-depth research about Ethereum, from checking prices in real time to finding out about the latest ETH projects only on the Bitrue website.

Bitrue also provides a price conversion feature ETH to USD so you don’t need to change websites to check it. Understand more details about how to buy Ethereum before investing in this token.

by Penny Angeles-Tan | Oct 9, 2024 | Business

The crypto market is currently not doing well. However, the price of SUI has been steadily increasing in the past month. What is the reason for this increase in the price of the token?

Amid the crypto market, which is currently red, a piece of good news came from SUI. SUI Price experienced a significant increase of up to 20% in the last 24 hours when BTC, ETH, BNB, SOL, and USDT experienced a price decline.

What is the reason behind this spike in token prices? Read the explanation in this article until the end.

Why are SUI prices increasing?

In terms of market capitalization, SUI is ranked 18th. Even though it has not yet entered the top ten, in the last month, SUI’s performance is considered very good. This is because SUI experienced an increase of up to 124% during that time.

There are several reasons why SUI prices have increased, one of which is the news that the USDC Circle stablecoin will be launched on the Sui Network. The announcement of this launch was made on September 17 and since then, the price of SUI tokens has experienced a steady increase until now.

The launch of USDC is considered important because it is classified as the second largest token in the world as a currency that is used significantly in on-chain transactions besides USDT. SUI, which has experienced a smart contract network, makes investors optimistic about the innovations that will occur in the future.

Apart from the news of the launch of USDC on the SUI network, support from one of the global crypto exchanges also makes SUI even more prominent among investors.

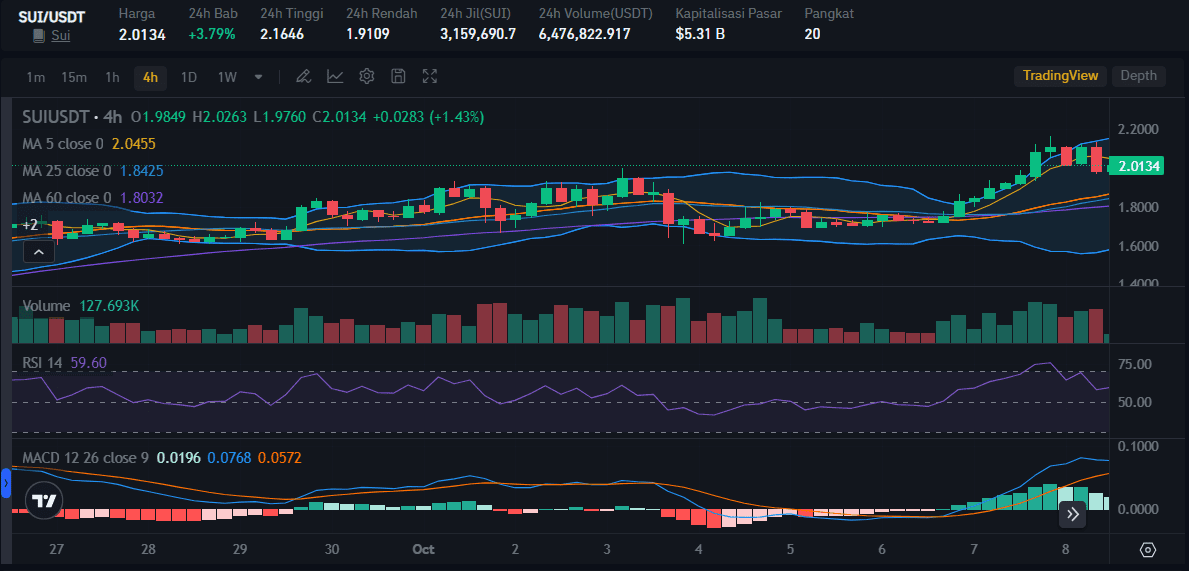

Current SUI Price Chart

At the time of writing, SUI was trading at $2.0134 with an increase of +3.79%. The highest price was $2.1646 in the last 24 hours.

It can be seen from the capture above taken from Market Bitrue, SUI currently has a positive outlook price chart. The RSI indicator is at 59, which means the buying trend dominates positively compared to the selling trend.

The MACD SUI indicator also appears to be climbing upwards. SUI token holders must get ready because a bullish SUI trend will occur.

Current Crypto Market Conditions

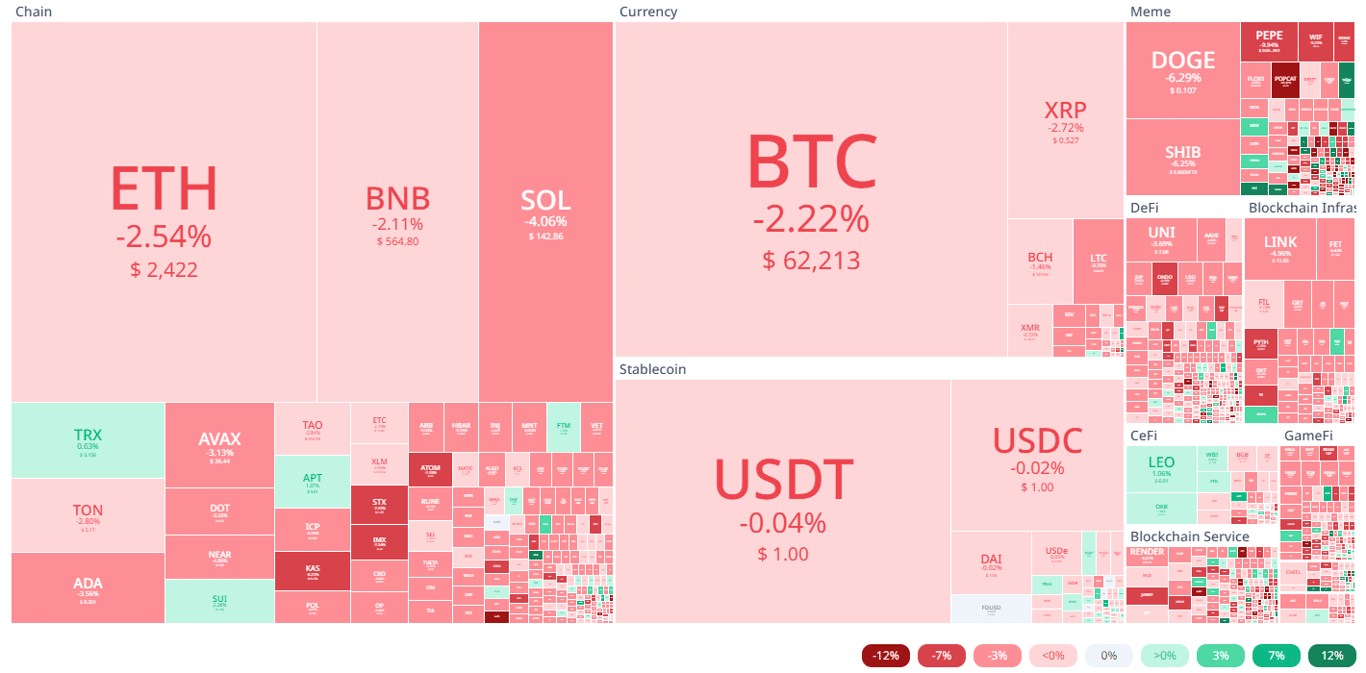

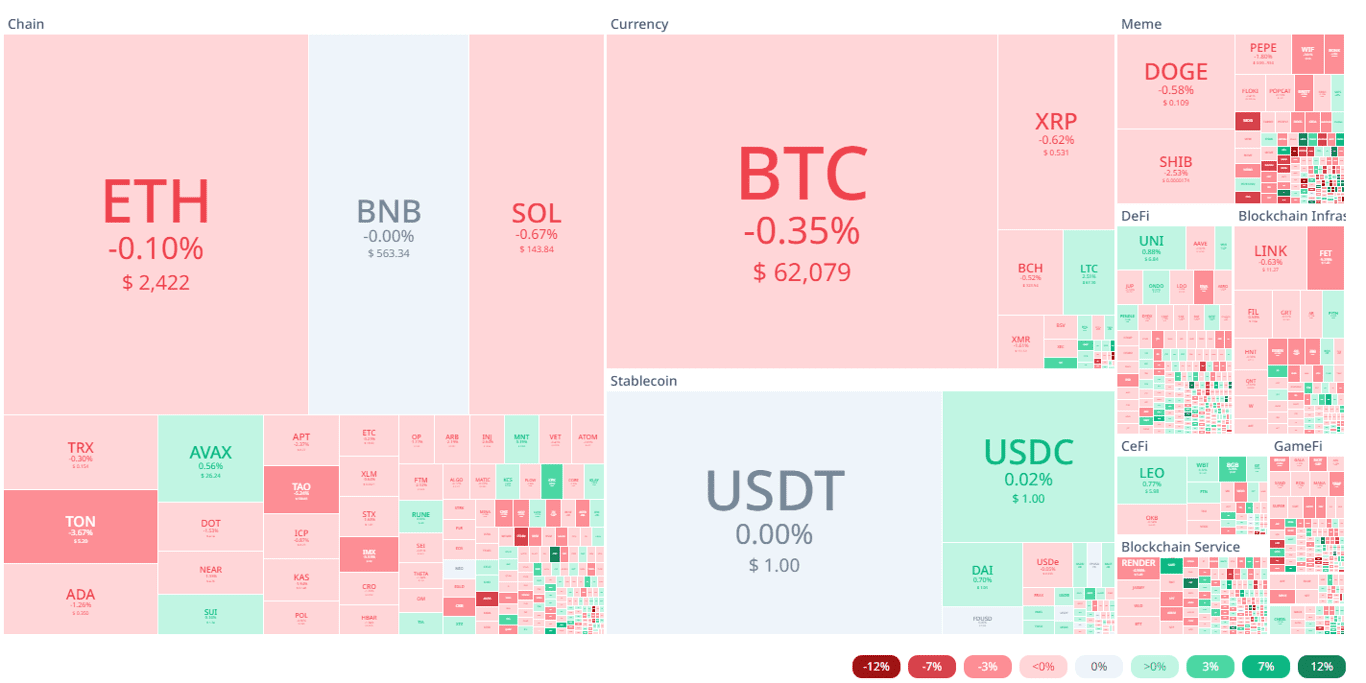

As mentioned at the beginning, currently the crypto market is red. Large tokens, such as BTC, ETH, and SOL experienced significant price declines.

Bitcoin Price currently is $62,213 with a decline of -2.22%, Ethereum price was $2,422 with a decline of -2.54%. The decline in SOL is higher, namely -4.06%, and currently Solana is trading at $142.86.

This condition occurs due to several factors, one of which is because the conflict between Iran and Israel has continued to heat up since October 1. October is much awaited as a happy month with its #Uptober.

However, given the nature of the crypto ecosystem’s reaction to conflict between countries, will #Uptober still happen? You can follow the latest conditions in the crypto ecosystem by reading Bitrue articles.

by Penny Angeles-Tan | Oct 8, 2024 | Business

Currently, Bitcoin price is decreasing. However, crypto analysts predict that Bitcoin will experience a short squeeze. How is the explanation? Read this article until the end.

There is a reason why Bitcoin is called the king of crypto. Not only because BTC was the first token created, but also because over time, Bitcoin price reliable.

Today, Bitcoin is indeed red, just like the majority of other crypto tokens. However, crypto observers predict that Bitcoin will experience a significant increase this October.

Is that true? Let’s look at the explanation in this article.

Current State of the Crypto Market

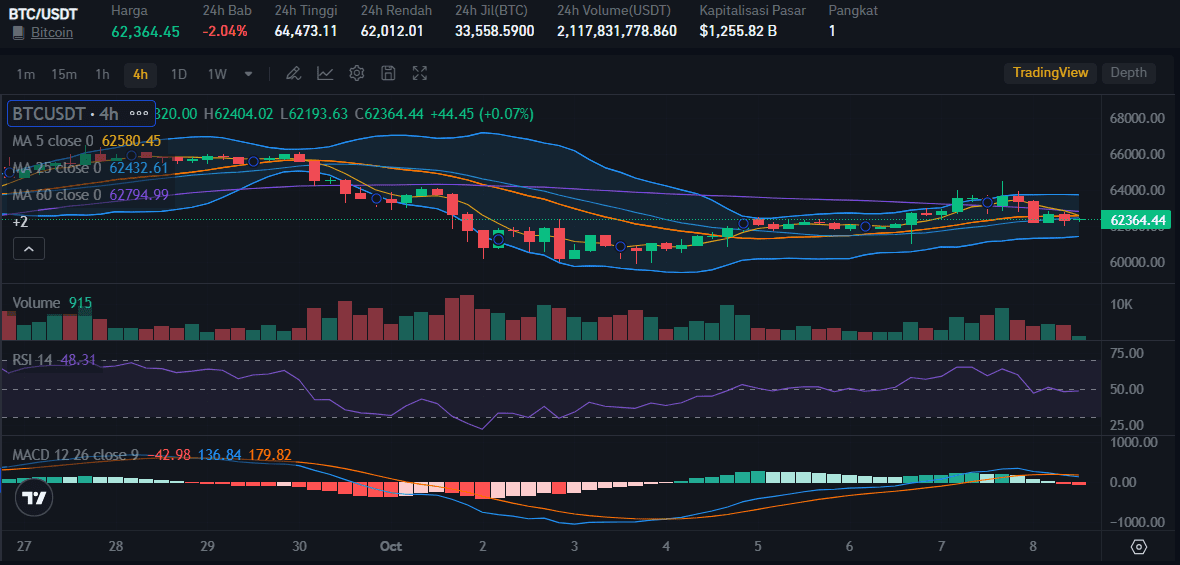

When this article was written on October 8 2024, the crypto market situation was not good. The majority of crypto tokens have experienced price declines, including Bitcoin.

This condition is quite worrying because October should be a month with good news for crypto token holders. However, #Uptober was eliminated when the conflict between Iran and Israel heated up on October 1. This is because the crypto ecosystem is very reactive to conflicts between countries.

At the moment, BTC price is also still experiencing a decline of -2.04%. Bitcoin’s price was %62,366, quite a drop compared to its 24-hour high of $64,473.

Trust in Bitcoin Still Very High

Among investors, whatever the investment instrument, there are investment strategies that are believed to provide maximum profits. This strategy is to provide the investment product when the price falls.

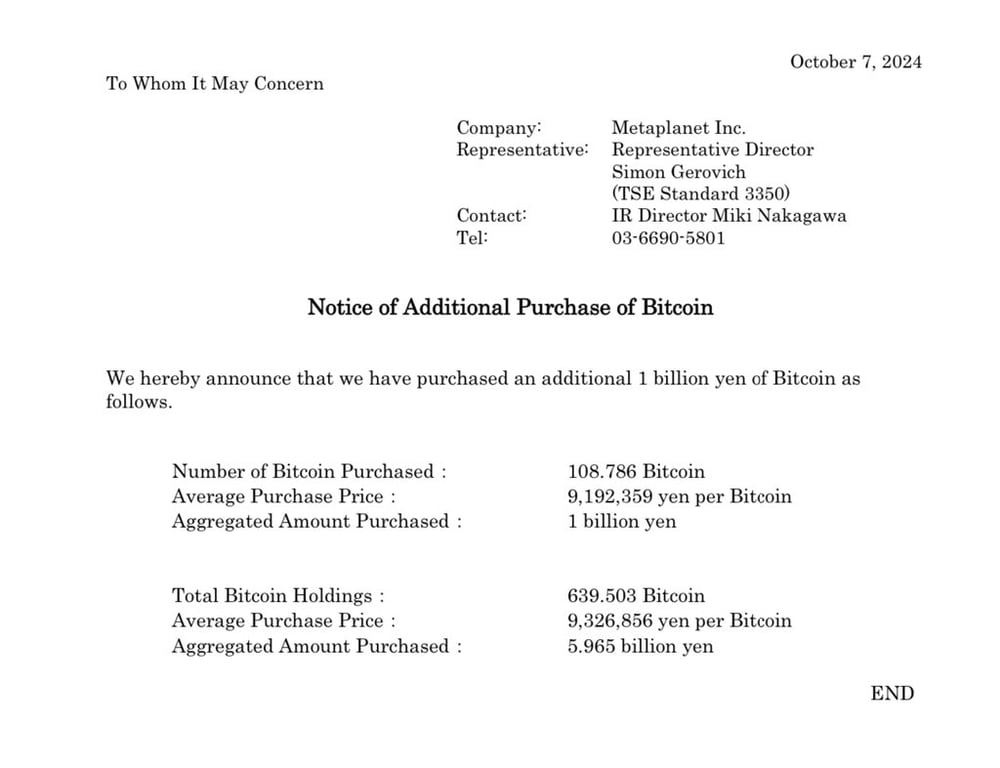

This strategy is widely used by crypto token holders. When Bitcoin prices fell recently, many large companies bought up BTC, such as MicroStrategy and Metaplanet from Japan.

On Monday, Metaplanet even bought 108,786 BTC so its ownership of this token is now 639.5 BTC with a value of more than $40 million. With similar enthusiasm from various parties for Bitcoin, this token still has high trust in the crypto ecosystem.

Quoted from TradingView, Bitcoin’s dominance in the crypto market was 58.10% on October 8, 2024. This figure shows an increase of 0.05%.

Bitcoin Will Experience a Short Squeeze?

Quoted from Coineagle, Bitcoin price is predicted to experience a short squeeze. This prediction is because Bitcoin is approaching a significant liquidation level where this number often triggers incorrect predictions that the token will fall, but the opposite happens.

This prediction will be even more positive if the Bictoin price manages to penetrate the $66,200 mark where the next price will rise significantly to $70,300 or even reach $72,578.

If we look again at the screen capture of the Bitcoin price graph above, we can see that even though BTC is currently experiencing a price decline, the indicators can provide a sense of security.

Because the RSI value of BTC is 48. Even though the selling trend is greater than the buying trend, there is no overselling phenomenon from holders of this coin. The MACD indicator is also still above the limit line, which means that a bullish trend could occur suddenly in the future.

Conclusion

Bitcoin prices are very volatile, just like other crypto tokens. Here’s why you should check how to buy BTC so you can better understand how to allocate investment funds according to your abilities.

You don’t need to be confused about checking Bitcoin prices in real-time. Bitrue provides features that you can use for free and can be used at any time. You can check the price conversion from BTC to USD without having to move websites.

by Penny Angeles-Tan | Oct 7, 2024 | Business

Iran’s attack on Israel dampened the #Uptober tradition in the crypto ecosystem. Most crypto prices have dropped, including Solana and XRP. How are the two crypto tokens doing now?

Uptober, a joyful tradition in the crypto ecosystem every October, seems to be faltering due to conflicts between countries. The reason is, that since Iran attacked Israel the crypto market has turned red, and so have Solana price and XRP.

Let’s take a closer look at SOL and XRP. The discussion will also include Solana pricing and XRP price now so you can find out what the condition of both of them is in real-time.

Why is October Special in the Crypto Ecosystem?

The Uptober tradition in crypto is not a traditional tradition which reflects the increase in crypto token prices. Apart from the volatile nature of crypto, various other factors can also make October a sad month for crypto token holders.

However, here are some reasons why October has been special in recent years for the crypto ecosystem.

1. Market Strengthening After Summer

June to September were indeed slow months for the crypto ecosystem. Starting from the price of Bitcoin, Solana, XRP, Ethereum, and various other crypto tokens experiencing price declines.

After the summer, conditions improved. One reason is that institutional investors return to the office after their holidays and interest in trading and investment has strengthened again.

2. October Becomes Encouragement

The end of October becomes a bridge to Q4 where investors begin to tighten their belts to welcome strong final results. Market activity also increased with crypto holders starting to strategize fully so that purchasing power becomes greater.

3. Movement of Various New Projects

Often various projects are presented in the final quarter of each year, ranging from large industries to new regulations welcoming the new year. This is why crypto prices often strengthen in October because there is new hope for the future.

Uptober Contaminated by Iran and Israel Conflict

Iran’s attack on Israel in early October shook the investment world, including the crypto ecosystem. When news of the conflict between the two countries heated up, the majority of crypto prices immediately went red, including Solana and XRP.

Uptober is widely doubted by crypto players. Coinglass data shows that more than $351 million was withdrawn from the market in the last 24 hours at the time of the reported Iran attack.

Current Solana and XRP Price Chart

Let’s analyze the current prices of XRP and Solana. These two tokens are known to be strengthening, especially XRP which is currently raising its ETF project. However, it can be seen that the price of XRP to USDT is still red.

XRP still seems to respond negatively to existing conflicts. The current price of the token is $0.5300 with a decline of -0.6%. The RSI indicator is in free fall at 36, which means that if it falls again then there is overselling and XRP bearishness will certainly occur.

However, XRP’s MACD line is struggling to rise through the boundary line. If XRP can prove its strength, the line can rise and the bearish trend will be broken, replaced by a bullish trend.

SOL to USDT was also the same as XRP, decreasing by a similar percentage, namely -0.5%. Currently, Solana is trading at $143.63, having previously reached its highest price of $144.58 in the last 24 hours.

However, Solana still shows a stable situation. The RSI indicator is still at 46, which means that even though the selling trend is more dominant than the buying trend, there is no excessive selling.

The MACD indicator is below the limit line, but looks like it is trying to return above. Solana still has a possible bullish trend.

Conclusion

That is information about Solana and XRP regarding the Iran and Israel conflict. You have to be more careful in deciding to invest in the crypto ecosystem at times like now. Research must be further deepened.

Bitrue will help you to do detailed research. Real-time price checking is available to you for free and you can even convert prices from USD to XRP, SOL, BTC, ETH, and prices of every other crypto token. That way, you can understand better how to buy SOL, XRP, and other crypto tokens.

by Penny Angeles-Tan | Oct 5, 2024 | Business

On October 1, Iran launched an attack on Israel with 180 missiles. The attack caused the majority of crypto token prices to fall. So, what about the price of Bitcoin? Here’s the explanation.

Recently, the world has heated up again due to Iran’s attack on Israel. This conflict causes various investment instruments to experience price changes. Specifically, gold increased along with rising oil prices due to the conflict in the Middle East. So, what impact will Iran’s attack on Israel have on Bitcoin price?

You can see the development of Bitcoin prices after Iran attacks Israel and what the condition of the token price is now in this article. Read the detailed explanation until the end of the article.

Impact of Iran’s Attack on Israel on Bitcoin Prices

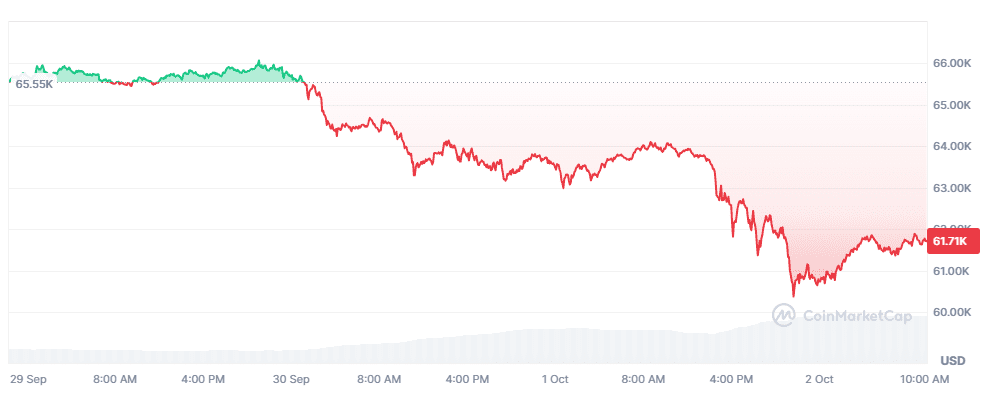

October has just begun and the world already seems chaotic. This was due to 180 Iranian ballistic and hypersonic missile attacks on Israel on Tuesday, October 1. Just after this attack, the crypto ecosystem immediately reacted. Almost all crypto tokens are colored “red” in response to tensions between the two countries.

This price decline was also experienced by BTC. Bitcoin prices fell quite drastically with a percentage decline in the range of 2-3%. In fact, on September 30 Bitcoin touched $65,000 after experiencing a long decline.

It is reported that BTC will also experience an increase in October after feeling it in September. However, due to the Iran-Israel conflict, these hopes were dashed.

Bitcoin and Its Response to World Conflict

Bitcoin does have an unfavorable trend in its response to world conflicts. Bitcoin tends to experience a decline when conflicts between countries arise.

As during the conflict between Russia and Ukraine in 2022, Bitcoin even experienced a decline of up to 7.9% and the price plunged below $35,000. Bitcoin even had a negative impact during the geopolitical conflict between the United States and China in 2018 and 2020.

However, Bitcoin once gave a positive response, namely when North Korea conducted a nuclear test in 2017. At that time, the price of Bitcoin soared with a continuous upward trend.

Current Bitcoin Price Chart

At the moment, harga BTC to USDT indeed experienced an increase of 1.16%. Although the price is still below $63,000, the increase is quite encouraging. The BTC token RSI indicator shows a number above 50, which means that currently, the buying trend is slightly dominating over the selling trend.

The positive Bitcoin RSI number is also reflected in the MACD line. It can be seen that the BTC MACD indicator is trying to rise above its limit line. This means that if the line continues to hold and is sustainable in its increase, a BTC bullish trend will occur and the price of Bitcoin will experience a sustainable increase.

Conclusion

The explanation of the impact of Iran’s attack on Israel on Bitcoin prices has reached its end. Even though it is enough to make the majority of investors worry and temporarily switch to traditional investment instruments, Bitcoin’s price is showing its strength again.

It is best to watch out for the high volatility of crypto tokens both positively and negatively. This is why we must conduct in-depth research when investing in the crypto ecosystem.

If you are currently doing independent research on Bitcoin to find out what its current condition is, Bitrue can help you. Bitrue has various features that you can use for independent research, starting from checking prices in real-time, finding out price conversions from BTC to USD, to articles that you can check to find out about current developments in crypto trends.

That way, you will understand about how to buy Bitcoin overall. Also, adjust your financial capabilities in determining how you invest in BTC and other crypto tokens.

You must be logged in to post a comment.