by | Mar 6, 2025 | Business

PAWS is set for its highly anticipated exchange listing on March 18, 2025! Learn about its origins, Solana migration, tokenomics, airdrop details, and price predictions. Will PAWS be the next big Web3 success story? Read now!

The cryptocurrency market is excited as PAWS, a promising new token born from a Telegram mini-app, officially announces its Token Generation Event (TGE) and exchange listing.

Scheduled for March 18, 2025, the event is expected to mark a major milestone for the project and its rapidly growing community.

The Rise of PAWS: From Telegram Mini-App to Web3 Powerhouse

Initially developed as a mini-app within Telegram, PAWS quickly gained traction among users, amassing over 85 million onboarded users and 50 million monthly active users (MAU). However, regulatory shifts within Telegram, specifically the centralization of its ecosystem under The Open Network (TON), prompted PAWS to take a new direction.

To maintain its decentralized ethos, PAWS transitioned to Solana, leveraging its robust blockchain infrastructure to expand accessibility, scalability, and security.

This strategic migration has already yielded impressive results. Within just 48 hours of integrating with Phantom Wallet, PAWS witnessed over nine million downloads, showcasing its immense popularity and potential in the decentralized finance (DeFi) landscape.

PAWS Tokenomics and Airdrop Strategy

In preparation for its TGE, PAWS has released crucial details regarding its tokenomics and distribution strategy:

– Total Supply: 100 billion PAWS tokens

– Airdrop Allocation:

- 62.5% distributed to PAWS app users for current and future incentives

- 7.5% reserved for Solana OG communities

– Exchange Listings: The token will be available on both decentralized exchanges (DEX) and centralized exchanges (CEX) from day one

– Token Claim: Eligible users can claim their PAWS tokens via the official website

The emphasis on community-driven tokenomics underscores PAWS’ commitment to fostering organic growth, a stark contrast to projects that rely heavily on venture capital funding and traditional marketing strategies.

Speculation on Exchange Listings and Price Predictions

With the official listing date confirmed, speculation is mounting over which major exchanges will support PAWS trading.

While the PAWS team has yet to release an official statement regarding its listing venues, cryptic hints—including recurring mentions of “BBB”—have led many to believe that Binance, Bybit, and Bitget could be among the first to list the token.

Other prominent exchanges such as KuCoin, MEXC, Gate.io, and OKX are also being closely monitored.

Price predictions for PAWS are equally intriguing. Analysts estimate an initial trading range between $0.009 and $0.010, drawing comparisons to similar meme-based tokens such as Hamster Kombat ($HMSTR), which debuted with a comparable total supply.

If PAWS sustains its current momentum and successfully executes its roadmap, its valuation could rise to $0.030–$0.050 in the mid-term. A potential Binance listing could catalyze further price appreciation, with some experts speculating that PAWS could eventually reach the $1 mark.

The PAWS Airdrop: How to Participate

The PAWS airdrop program is one of the most anticipated in the crypto space. Eligible users who actively engaged with the PAWS mini-app before December 30, 2024, will receive PAWS tokens. To qualify, participants must have:

- Frequently used the PAWS mini-app on Telegram

-

Complete in-app tasks to earn PAWS points

-

Linked their TON wallet before the snapshot date

While the exact distribution timeline has yet to be finalized, the PAWS team continues to provide regular updates to ensure a seamless token claim process.

Conclusion: Is PAWS Truly a New Web3 Success Story?

With its bold move to Solana and its commitment to community-driven growth, PAWS is positioning itself as a formidable force in the cryptocurrency landscape.

Drawing inspiration from successful Web3 projects such as Pudgy Penguins, Berachain, and Doodles, PAWS aims to transcend its origins as a meme coin and become a major player in the decentralized ecosystem.

As the March 18, 2025, listing date approaches, all eyes are on PAWS and its potential to disrupt the market. Whether it can live up to its high expectations remains to be seen, but one thing is certain—PAWS is a project that cannot be ignored.

by | Mar 6, 2025 | Business

Metro Finance, one of Australia’s leading independent non-bank lenders for asset finance, has followed on from its recent consumer survey findings, sharing responses from Australian businesses and revealing a range of impacts as cost of living pressures continue to bite consumer spending.

The business survey, responded to by 1,000 Australian employed and self-employed workers, indicates a spread of both economic optimism and belt-tightening.

When it came to business spending, respondents earmarked two primary costs for their own business or their employer’s in 2025: 39.9 per cent cited human resources, which includes training and benefits programs, as a key cost for the year ahead, while 42.3 identified supplier costs of producing goods and services being the main consideration.

Despite the expectation that goods and services will cost more in 2025 (a sentiment shared with recent respondents of Metro’s consumer survey), 66.4 per cent of respondents did not think their business would seek financing in 2025. This figure, however, contrasts with the overwhelming majority of those surveyed who remain confident of securing business finance if needed, at 72.1 per cent.

42.3 per cent of respondents also suspected the need to improve business cashflow would be the main motivator to seek financing in 2025.

Metro Finance CEO, David Albest, commented on the latest trends in the business survey.

“As we saw recently with the results of Metro’s 2025 consumer survey, there is a general sense of the market cautiousness, as businesses and their customers both take a hard look at their budgets, and make prudent decisions based on some uncertain market conditions,” David said.

From an operational point-of-view, increasing revenue (32.1 per cent), improving cashflow (29.7 per cent) and reducing debt (27 per cent) were the primary business goals for FY25, with respondents’ businesses reacting to inflation, higher interest rates and slower consumer spending. 38.7 per cent of all respondents also acknowledged that their business was cutting costs in a bid to improve net profit.

Interestingly, while saving costs and conserving budgets were recurrent themes with those surveyed, sustainability and initiatives to tackle waste and energy consumption are appearing to be adopted by businesses around the country.

39.6 per cent identified recycling as a way businesses were including sustainability in their operations, while 27.6 per cent flagged solar energy technology.

19.6 per cent of survey respondents also acknowledged low or zero emission vehicles as a feature of businesses’ sustainability efforts.

David Hall, National Novated Manager at Metro, commented on the proliferation of low and zero emission vehicles being provided to employees through salary packaging.

“Metro’s novated leasing offering is contuinuing to experience growth, with over 18,000 cars, of which 11,000 were low or zero-emission vehicles, being leased by employees through their employers in 2024,” David explained.

“What we’re seeing from a market perspective is novated leasing is an increasingly popular way for businesses to retain staff and incentivise high-performers, while at the same time helping employees’ household budgets save money by reducing their tax liability and providing consistency and predictability in their repayments. At a time of market volatility, this can been extremely beneficial for both sides of the fence,” David continued.

Investing in sustainability, either by adopting new processes and initiatives, or updating business assets, is also generating positive residual benefits for businesses in 2025: 35.7 per cent of respondents believed their business was well-respected in the community because of its sustainability efforts.

26.4 per cent cited customers seeing sustainable business as industry leaders, with 19.9 per cent also attributing greater B2B engagement because of their respective company’s sustainability initiatives. 16.4 per cent, however, believed that customers saw sustainable businesses as being more expensive than competitors.

Recently, Metro’s MetroEco green lending program received an additional $50 million funding commitment from the Clean Energy Finance Corporation (CEFC) – this new investment doubles the CEFC’s total commitment to $100 million, highlighting the strong demand from businesses ready to embrace sustainability in a number of different ways.

Since launching MetroEco in July 2024, Metro has supported over 4,000 electric vehicles hit the road across 26 different brands, along with funding energy-efficient equipment and battery technology — all made possible with competitive interest discounts for eligible green assets.

As a partner of Greenfleet, the Metro business offset 2,134 tonnes of carbon in 2024, and contributed $49,968 to sustainability efforts such as revegetating 547 hectares of land which included 460 hectares of protected koala habitat. Since joining Greenfleet in 2023, Metro has offset 4,015 tonnes of carbon, and contributed $80,815.

Following the trends: consumers watch their pennies

As businesses take a conservative approach to FY25, consumers are no-doubt influencing the current trend of belt-tightening; also identified in Metro’s Australia-wide consumer survey, which also saw 1,000 respondents take part.

Key findings of the Metro consumer survey (Jan 2025):

-

44 per cent of all respondents shop around for the best price on fuel, and will only buy on days where it is historically lower at the bowser

-

48.9 per cent of households surveyed said that saving money on energy utilities would be their main interest in upgrading their home’s technology

-

41.3 per cent said they would not currently purchase an electric vehicle (EV), with 41.5 per cent claiming that they do not consider EVs mobility to be durable, regardless of brand

-

29 per cent, however, indicated they would opt for an EV made by an established mainstream brand already selling internal combustion engine (ICE) vehicles in the market

-

66.2 per cent said they would consider either a plug-in or mild hybrid for their next vehicle

-

33.4 per cent, would like to save as much as possible and would consider a loan on an electric vehicle if the rate was cheaper

-

52.9 per cent cited concerns over petrol prices as being a key motivator for a hybrid vehicle purchase

-

33.7 per cent have recently established a new household budget

-

43.7 per cent said they would, or have already switched brands to more affordable options

by | Mar 6, 2025 | Business

On March 14, 2025, the PROTECT International Conference Series on “Doing Business Amidst New Threats” will take place at the New World Makati Hotel.

The international community is facing an evolving different threat to global peace and security. While the global security risk and threat in 2024 may be described as “unprecedented”, 2025 may be described as “unconventional”. We see this in geopolitical tensions, gray zone warfare actions, AI arms race, rising insider threats, fragmented extremism and other developments. PROTECT 2025 conference on Doing Business Amidst New Threats will deep dive into these security challenges.

On March 14, 2025, the PROTECT International Conference Series on “Doing Business Amidst New Threats” will take place at the New World Makati Hotel.

The event will feature prominent speakers, distinguished panelists, and thought leaders from various sectors as they discuss key issues affecting businesses today. From cyber threats and health security to climate change and cross-border crimes, the conference will address how these complex issues intersect and how businesses can navigate these volatile landscapes.

For more information on the forum, contact the Secretariat: le******@*******************al.com

The Opening Address will be delivered by Secretary Eduardo Año, National Security Adviser to the National Security Council. Gen. Romeo S. Brawner, Jr. PA, Chief of Staff of the Armed Forces of the Philippines will deliver the Keynote Address.

Digitalization And Cyber Threats will be featured in three panel discussions on Digital Identity, Cyber Threats, and The Legal Aspects of Cybercrime.

Digital technology has been changing the ways businesses are done and will continue to do so each year. Meantime, cyber threat actors are applying more advanced and sophisticated technologies to challenge cybersecurity. Understanding what is happening in the world now is therefore no longer an option but is an absolute necessity. The future is rapidly developing whether we like it or not. Adapting to change, if not done strategically can be disastrous.

A Session on Human and Health Issues aims to provide an awareness of human health security and the interactions of key issues and events. Moderated by Dr. Kenneth Hartigan-Go, discussions will cross cut through health, education, and security.

Environmental/Climate Issues will be the subject of one session. The changing environment affects the business world. They impact on business practices from resources, to supply chain, to logistics, to energy sources, to customer behavior and demographics.

Cross-border phenomena concern both international and domestic security. Heightened concerns about transnational crimes are a consequence of advances in transportation and telecommunication. Many times, businesses become instruments or victims of such crimes.

A session on Transnational Issues will start with a presentation on Crime- Terror Nexus by Global Security Expert Prof. Rohan Gunaratna of the S. Rajaratnam School of International Studies, Nanyang Technological University, Singapore. This will be followed by a Panel Discussion on cross-border phenomena.

The National Issues session will discuss two major security challenges confronting the Philippines today: state-sponsored cyber challenges and the country’s relations with the US and China.

by | Mar 6, 2025 | Business

Interior Diary, a top Singaporean interior design firm, has rebranded to focus on premium renovations, elevating its offerings to create sophisticated, bespoke spaces. With an emphasis on artisanal craftsmanship, high-quality materials, and timeless design aesthetics, the firm caters to homeowners seeking refined living environments. The rebranding aligns with evolving homeowner preferences for thoughtful, luxurious interiors that balance function and beauty. Directors highlight this transformation as a natural evolution, reflecting their passion for pushing design boundaries and delivering curated spaces that tell each client’s unique story. By combining innovation with heritage, Interior Diary is setting new standards in the Singaporean design scene, solidifying its position as a leader in creating personalized, high-end homes.

Singapore, March 6, 2025 — Interior Diary, a distinguished interior design firm in Singapore, is proud to announce its strategic rebranding initiative, reinforcing its commitment to delivering premium renovation services. This transformation reflects the company’s dedication to excellence, innovation, and personalized design solutions that cater to the discerning tastes of homeowners and businesses alike.

A Legacy of Excellence

Established in 2016, Interior Diary has consistently positioned itself as more than just an interior design firm—it has become a trusted partner in helping clients achieve their dream spaces. With a portfolio boasting over 2,000 completed home renovation projects, the firm has garnered a reputation for crafting personalized interior design solutions that resonate with the unique personalities and lifestyles of its clients.

Embracing a Premium Vision

The decision to rebrand stems from Interior Diary’s aspiration to align its services with the evolving needs of Singapore’s sophisticated clientele. By focusing on premium renovations, the firm aims to elevate living and working environments through designs that seamlessly blend functionality with artistry.

” We decided to rebrand ourselves to focus more on higher end renovations in response to an demand for personalised thematic styles like Japandi, Scandinavian and Wabi Sabi after the Covid period, ” said Director Gary Ng.

This renewed focus ensures that every project not only meets but exceeds client expectations, setting new benchmarks in the interior design industry.

Design Philosophy: Where Functionality Meets Artistry

At the heart of Interior Diary’s success lies its dedication to creating spaces that are both visually stunning and highly practical. The firm’s design philosophy is rooted in the belief that every space should tell a story—one that reflects the owner’s personality, lifestyle, and needs. This philosophy is further brought to life by their deep expertise in Japandi and Wabi-Sabi design principles, two styles that have gained immense popularity in Singapore for their minimalist and harmonious aesthetics.

Comprehensive Interior Design Solutions

Interior Diary offers end-to-end interior design solutions, encompassing conceptualization, space planning, material sourcing, renovation, and project management. The firm’s team of experienced designers and project managers work closely with clients to ensure a smooth, hassle-free process from start to finish.

Mr Steven Loh, the one of the company’s chief designers, said “The difference between interior designers and contractors is that we focus on balancing aesthetics, functionality and space planning to meet the home owner’s needs, while contractors mainly do the execution of the renovation. Therefore, we make the renovation process smoother and worry free for the client.”

Whether it’s a cozy HDB apartment, a sophisticated condominium, or a dynamic commercial establishment, Interior Diary’s designs reflect the personalities and lifestyles of their clients.

Commitment to Sustainability

In line with global trends and environmental responsibility, Interior Diary integrates sustainable practices into its design and renovation processes. By sourcing eco-friendly materials and implementing energy-efficient solutions such as Air Conditioning and Lighting integrated into a Smart Home System, the firm ensures that its projects contribute positively to the environment while providing clients with healthier living spaces.

Client-Centric Approach

Understanding that each client has unique needs and aspirations, Interior Diary adopts a personalized approach to every project. The firm strives to fulfill client requirements and beyond with quality services and sustainable materials.

A former client, Ms YH Kwang, on her Facebook, said that one of the designers “was incredibly professional and easy to work with. He took the time to understand what I needed and provided very good advice that helped me make decisions every step of the way”.

By bridging the knowledge gap, Interior Diary helps homeowners and business owners navigate their renovation, incorporating their lifestyles and work into their internal home or commercial setting.

Industry Recognition and Accreditations

Interior Diary’s unwavering commitment to excellence has been recognized through various industry accolades and accreditations. It has achieved awards like Asia Excellence Award in 2021/2022, Star Merchant award and Three Best merchant award.

The firm is a CaseTrust-Accredited Interior Design Firm, reflecting its adherence to fair consumer policies, transparent communication, proper staff training, and quality assurance. Additionally, Interior Diary is listed on the HDB Directory of Renovation Contractors (DRC), signifying its licensing to carry out renovation works on HDB projects.

Strategic Partnerships and Collaborations

To serve clients better, Interior Diary maintains regular collaborations with reputable suppliers like Blum, kompacPlus, providing more value and maintaining high industry standards. Partnerships also result in cost savings, which the company

Coordination and organization are integral parts of their work, requiring teamwork and communication with clients and suppliers to take an initial idea into fruition in a timely fashion.

Future Endeavors

Looking ahead, Interior Diary is committed to continuous learning and discovering new innovations, technology, and materials. The firm acknowledges that trends evolve and is dedicated to upgrading itself to stay ahead in the industry. With a vision to convey the passion they feel about their craft, Interior Diary aspires to change the bad reputation of interior designers in Singapore by creating works of integrity.

Website: https://www.interiordiary.com.sg/

by | Mar 5, 2025 | Business

President Trump is set to announce a Bitcoin Strategic Reserve, marking a historic shift in U.S. cryptocurrency policy. Discover how this move, along with new crypto regulations and market trends, could position the U.S. as a global leader in digital assets.

In a move set to redefine the U.S. stance on digital assets, President Donald Trump is expected to announce a significant shift in cryptocurrency policy, including the establishment of a Bitcoin Strategic Reserve.

This landmark decision, revealed by Commerce Secretary Howard Lutnick, signals a new era for crypto regulation and adoption in the United States.

The Bitcoin Strategic Reserve: A Game Changer

Speaking ahead of the first-ever White House Crypto Summit, Secretary Lutnick emphasized Trump’s commitment to positioning the U.S. as a global leader in digital assets.

“The President definitely thinks that there’s a Bitcoin strategic reserve,” Lutnick stated. “There will be the question of how we handle other cryptocurrencies, and I think the model is going to be announced on Friday.”

This reserve is expected to grant Bitcoin (BTC) unique status within the financial ecosystem. While other cryptocurrencies, including Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), may be included in the broader framework, Bitcoin appears to be at the heart of Trump’s crypto vision.

Trump’s Vision for Crypto Regulation

President Trump has been vocal about his support for digital assets, contrasting sharply with the stricter regulatory stance of the previous administration. In a Truth Social post, he outlined his plans:

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration. My Executive Order on Digital Assets directs the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

Trump also highlighted Bitcoin and Ethereum’s importance, stating, “I also love Bitcoin and Ethereum!”

White House Crypto Summit: Defining the Future of Digital Assets

The upcoming White House Crypto Summit, chaired by David Sacks and Bo Hines, represents a crucial step in the administration’s efforts to clarify regulatory guidelines, encourage financial innovation, and expand economic opportunities in the digital asset landscape.

The summit follows Trump’s Executive Order 14178, signed in his first week in office, which laid out a framework for the responsible growth and adoption of digital assets.

This move starkly contrasts with the previous administration’s regulatory actions, which led to increased scrutiny and legal battles within the crypto sector.

Market Impact: Bitcoin Volatility and Future Predictions

Bitcoin has experienced significant price swings recently. After dropping from nearly $100,000 to $78,200, BTC briefly surged to $95,000 before settling at $87,829 on March 5, 2025. Analysts predict that Bitcoin will continue fluctuating between $70,000 and $90,000 due to prevailing market uncertainty.

A crypto analyst forecasted, “Bitcoin’s price will remain within this range for the foreseeable future, given the current market conditions.”

Bitcoin’s market capitalization has now reached $1.73 trillion, with trading volume decreasing by 13% to $61.83 billion in the last 24 hours.

Potential Catalysts for Bitcoin’s Growth

Several factors could drive Bitcoin’s price higher in the coming months:

1. Regulatory Clarity: The White House Crypto Summit is expected to provide clear guidelines, reducing uncertainty in the market.

2. U.S. Strategic Bitcoin Reserve (SBR): If the government begins accumulating Bitcoin, demand could surge, driving prices higher.

3. Federal Reserve’s Monetary Policy: Declining bond yields suggest a potential interest rate cut, increasing market liquidity and benefiting Bitcoin.

4. SEC Lawsuit Developments: The SEC’s recent decision to drop lawsuits against major firms like Uniswap and Coinbase has boosted investor confidence in the crypto sector.

Technical Analysis: Risks and Opportunities

While Bitcoin’s long-term outlook remains bullish, technical indicators highlight potential risks. BTC recently fell below the 50-day and 200-day Weighted Moving Averages (WMA), raising concerns of a possible “death cross”—a bearish technical signal.

Bitcoin also dipped below the 38.2% Fibonacci retracement level, suggesting that if BTC breaks the $78,200 support level, further declines toward $71,500 (61.8% Fibonacci retracement) are likely.

However, if BTC surpasses the $95,000 resistance level, it could regain bullish momentum and push towards a new all-time high.

The National Cryptocurrency Association: A New Resource for Crypto Users

In tandem with these regulatory shifts, the National Cryptocurrency Association (NCA) has officially launched. Led by Stuart Alderoty, Ripple’s Chief Legal Officer, the NCA aims to educate the public, provide resources, and simplify the complexities of digital assets.

With a $50 million grant from Ripple, the NCA will fund awareness campaigns and learning materials to highlight practical crypto applications.

The association’s neutral stance ensures that it remains a valuable resource for industry participants without favoring any specific company or blockchain.

Conclusion: A Defining Moment for U.S. Crypto Policy

The Trump administration’s efforts to establish a Bitcoin Strategic Reserve and revamp crypto regulations mark a defining moment for the industry.

As the White House Crypto Summit approaches, stakeholders eagerly anticipate clearer regulatory guidelines and a strengthened position for the U.S. in the global digital asset market.

With the potential for regulatory clarity, increased institutional investment, and macroeconomic catalysts, the crypto industry stands at the precipice of a new era—one that could solidify the United States as the global leader in digital finance.

by | Mar 5, 2025 | Business

From Practice Room to the Performance Stage

Applications are NOW OPEN for the 2025 Australian Festival of Chamber Music International Masterclasses Program

Applications are NOW OPEN for young and emerging musicians (individuals and in ensembles) from across the country to register for the Australian Festival of Chamber Music’s (AFCM) International Masterclasses Program, led by music maker, clarinettist, chamber musician, collaborator and educator Lloyd van’t Hoff, who is a past ABC Symphony Australia Young Performer of the Year.

Photos: The Andromeda Quartet which took part in the Masterclass Program in 2024, and the program leader Lloyd van’t Hoff in Townsville

Held in Townsville-Gurambilbarra in North Queensland from 18 July – 1 August, before and during the AFCM, the International Masterclasses program is an immersive experience for young chamber musicians, offering direct mentorship from world-class artists, chamber music training, and professional development opportunities through lessons, public and private masterclasses, and performances, while also providing industry insights from leading musicians and arts professionals.

Program highlights include individual lessons from artists including AFCM Artistic Director Jack Liebeck (violin), Ana-Maria Vera (piano) and Lloyd Van’t Hoff (clarinet), group instrumental classes and coaching sessions led by AFCM artists and faculty members, interactive group discussions and review sessions in the Chamber Music Forum, professional development seminars from industry experts, individual career guidance from mentors, public Masterclass participation and a final showcase performance – the International Masterclasses Concert at the Townsville Civic Theatre. Through support from the Ian Potter Foundation, limited funding is available to assist with participation costs, on application.

Interested musicians can apply at afcm.com.au, by calling 07 4771 4144 or by emailing ni*******@******om.au

Applications CLOSE ON MARCH 31, 2025.

by | Mar 5, 2025 | Business

baroma—an exclusive online shop specializing in niche and exceptional brands, is thrilled to announce its official launch in 2025. Aiming to transform everyday moments into extraordinary experiences, baroma invites adventurous individuals to embark on a unique sensory journey through a thoughtfully curated selection that begins with the olfactory sense. Committed to the belief that happiness should come naturally, baroma emphasizes that the pursuit of joy is not only a privilege but an essential part of life.

In a bold move to revolutionize the online shopping landscape, baroma announces its official launch, celebrating the art of scent and sensory exploration. Each curation at baroma is crafted with high-quality ingredients and features unique scent compositions or unconventional ingredients. This dedication not only enhances the shopping experience but also honours the rich tapestry of humanity, cultures, and histories.

“Our mission at baroma is to view life as a collection of moments to savour. We resonate with the adventurous spirit of those seeking happiness through exploration,” said Jack Leung, Founder of baroma. “Each product we offer serves as a gateway to new sensory escapes, guiding our customers towards moments of peace amidst urban chaos.”

baroma’s Mission and Philosophy

At baroma, the ethos centers around exploration and discovery, where every product is an invitation to awaken the senses and embrace the joy of exploration. Through thoughtful curation, baroma hopes to transform stress into tranquility, where customers can create their unique spaces to find solace and inspiration in their everyday lives. This philosophy is woven into every aspect of the brand, encouraging individuals to savour the simple yet profound moments that life offers.

Discovering Scented Treasures

What sets baroma apart in a fragrance market often dominated by Western narratives is its elegant commitment to enhancing accessibility for smaller, niche Eastern brands. By shining a spotlight on unique scents and unorthodox ingredients, baroma opens the door for customers to discover hidden treasures that enrich their lives. Each offering is not just a product; it is a story waiting to be told, inspired by human experiences, cultures, and histories. Customers can explore never-before-smelt fragrances, such as the Wild Garlic Eau de Parfum from AROMAG, and indulge in products that celebrate the beauty of humanity.

baroma collaborates closely with a network of industry experts to ensure the quality and experience of every product. This partnership ensures that each curation resonates with the adventurous spirit of those seeking happiness through exploration.

Latest Curation

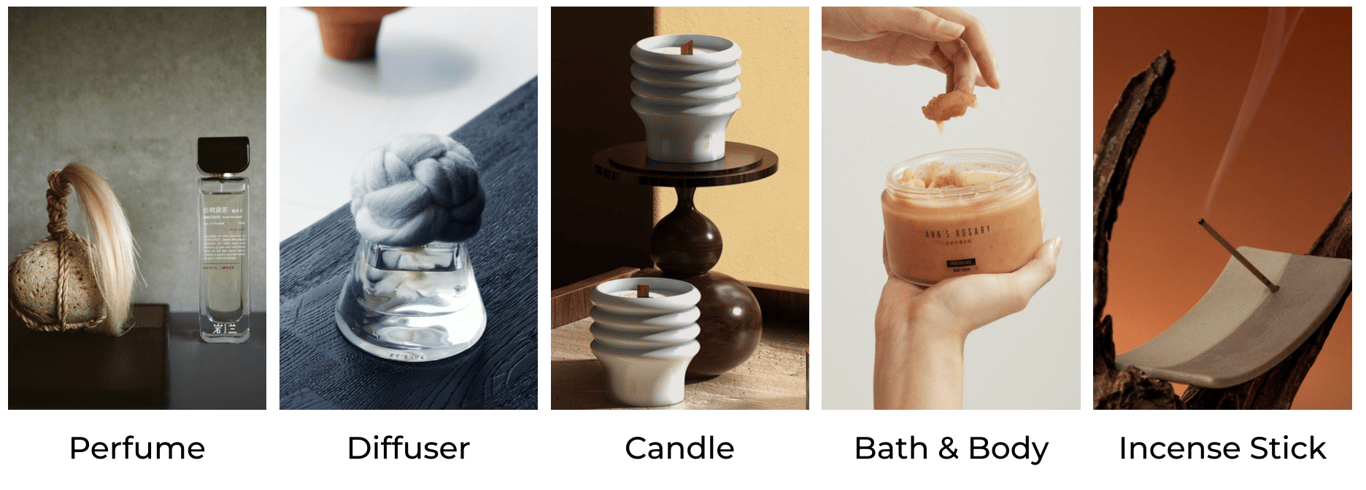

baroma’s current offerings seamlessly integrate into daily life, featuring a selection of perfumes, bath and body products, and space-transforming items such as diffusers, candles, and incense sticks.

Top-Shelf Hidden Gems:

AROMAG Wild Garlic Eau de Parfum: Capture the essence of vibrant spring mornings with the crisp aroma of wild garlic leaves, galbanum, tomato leaves, and celery leaves.

QICUNJIU YUNMENGZE Snuff Bottle: Inspired by Eastern mythology, this delicate lotus fragrance embodies the beautiful enigma of strength and gentleness.

ZHUFU Aged Pu-Er Tea Scented Candle: Evoking a serene midsummer night, this candle blends rich aromas of aged Pu-erh tea and dried orange peel, promoting relaxation and personal reflection through mindful tea rituals.

ANN’S ROSARY Wood Rose Sea Salt Body Scrub: Achieve tranquility with a soothing blend of citrus, saffron, and delicate Moroccan rose, enhanced by exfoliating Israeli Dead Sea salt for a refreshing experience.

BOUNDLESS Nighty Night Incense Stick: Infuse your space with the scents of the Himalayas using ancient spice recipes and natural ingredients. This portable incense invites you to slow down and embrace a new rhythm of living.

by | Mar 5, 2025 | Business

Officially known as the Municipality of Bustos, it’s the smallest town in Bulacan, covering just about 70 square kilometers and home to around 80,000 folks. Barely an hour away from NCR by taking NLEX and it’s also near Clark City so you can expect a lot of booming businesses for the coming days due to Bulacan’s proximity to two mega cities and airports.

Bustos has an interesting backstory that goes way back to the Spanish colonial days. Believe it or not, it used to be part of Baliuag. One of the first things you notice about Bustos is how laid-back life feels. Lush rice fields surround you, the air is fresh, and everything moves at a much slower pace than in the city. It’s the kind of place where people smile and wave as they pass each other, and it seems like everyone knows everyone else.

If you visit, you’ve got to experience the Minasa Festival. It’s inspired by its local cookie referred as Minasa. It took place last January, and it was an absolute blast! The whole town comes alive with vibrant street dancing, food stalls brimming with local delicacies, and cultural performances that showcase the town’s rich heritage. This year, they even had Rico Blanco, the Filipino rock icon, performing!

![[In photo: Rico Blanco stands before the iconic landmarks in Bustos Heritage Park (Image c/co Rico Blanco Facebook Page)]](https://imagedelivery.net/H6_s_Eb_ylTWnSEV3HlmYQ/3da54db6-105e-4eb1-fef4-beea67268a00/public)

Bustos has an emerging new concept of businesses coming from many young entrepreneurs who are bringing in an al-fresco with a modern take on its aesthetics. You have to check out these spots:

[Photos taken at the Arthur’s Inasal, https://www.facebook.com/macarthurinasal]

Arthur’s Inasal: Started by Arthur Gallarin, a former OFW and hotelier, this place serves up some seriously delicious chicken inasal. It’s super affordable, and they have other traditional dishes like sisig too. Think backyard vibes with amazing food. You should find Arthur’s Inasal when you look for “A Taste of Home-Grown Goodness”

[Photos taken at the Kain Lokal: https://www.facebook.com/kainlokalPH, https://www.instagram.com/kainlokalph/]

The Kain Lokal: This spot is all about fun! They have this super cool jeepney kitchen counter where you can watch your food being prepared. And the best part? They offer unlimited hot brewed coffee, pares soup, and garlic java rice! It’s “Where Food Meets Fun”. Check out their Facebook page and it has very engaging posts coming from its owner

Hungry Chef: If you’re looking for budget-friendly eats, this place is it! They have huge portions and flavorful dishes that are super popular with students. Budget-friendly family favorites. The ambiance is very comfortable, perhaps this is because it’s handled by a very familiar and comforting owner who has been in the place for many decades.

![[Photo taken at The Hungry Chef Sizzling House]](https://imagedelivery.net/H6_s_Eb_ylTWnSEV3HlmYQ/1a282db8-7e82-4542-5802-5866c3be8000/public)

[Chweck them out of Facebook – https://web.facebook.com/profile.php?id=61556938157507]

Bustos amid developments, indeed has a soul through its local artists. As you stroll through Bustos Heritage Park, you’ll encounter various sculptures made by Apo Balong that invite contemplation and appreciation. The park is designed to be an immersive experience where visitors can engage with nature and art, making it a perfect spot for families, tourists, and art enthusiasts alike.

![[Photo taken at the Bustos Municipal Office]](https://imagedelivery.net/H6_s_Eb_ylTWnSEV3HlmYQ/7da3b219-11f8-41e0-a662-e7bed751ff00/public)

Overall, Bustos has a refreshing vibe – the people and leaders we met made us realize that progress is achieved when there is determination and a dream that beams from everyone in the place. A solid goal that is reflected not just by the Bustosenyos but their young and dynamic leaders who pave the way for a brighter future. Leaders with fresh ideas, clear and doable ambitions, and a vibrant approach to the changing times.

![[Photo taken inside Zeny’s Pasalubong Center at Bustos Bulacan]](https://imagedelivery.net/H6_s_Eb_ylTWnSEV3HlmYQ/e72e65e4-7e35-40d4-2287-a845da067300/public)

![[Photo of Hon. Councilor Niña Perez taken at the Municipal Office of Bustos Bulacan]](https://imagedelivery.net/H6_s_Eb_ylTWnSEV3HlmYQ/017ed931-507e-4d3e-fab4-bd3da2baf600/public)

So, next time you’re planning a trip, consider adding Bustos, Bulacan to your list, indeed something more exciting is coming up there!

Disclaimer: The views, opinions, and insights expressed in this story/video are those of the individuals shown and do not necessarily reflect the position of TNC. Viewer/reader discretion is advised.

by | Mar 4, 2025 | Business

Discover how Trump’s new tariffs on Canada, Mexico, and China are shaking up financial and cryptocurrency markets. Explore Bitcoin’s price swings, stock market reactions, and global trade tensions impacting investor sentiment. Stay informed on the latest economic shifts and market volatility.

The crypto market and traditional financial markets experienced significant volatility following President Donald Trump’s announcement of new tariffs on Canada, Mexico, and China.

Stocks tied to cryptocurrencies initially surged before facing a sharp decline, while Bitcoin itself saw drastic price fluctuations. The broader economic landscape is also feeling the pressure as global trade tensions escalate.

Bitcoin’s Volatility Amidst New Trade Tariffs

In early trading, Bitcoin surged past $93,000 before settling around $86,200, after previously dipping to a three-month low below $80,000 on Friday.

However, as market uncertainty deepened, Bitcoin was last seen down 8.58% at $82,775.96. This volatility reflects investors’ concerns over economic policies affecting liquidity and risk appetite.

Shares of major crypto-related firms experienced similar fluctuations. MicroStrategy (MSTR), a major Bitcoin holder, initially gained more than 10% in morning trading before closing nearly 2% lower.

Coinbase Global (COIN) and Riot Platforms (RIOT), a Bitcoin mining company, surrendered earlier gains and closed down more than 4%.

Trump’s Tariffs and Their Immediate Impact

On March 4, 2025, the Trump administration implemented sweeping tariff increases:

- 25% tariffs on imports from Canada and Mexico

- 20% tariffs on imports from China

These trade restrictions were positioned as measures to counteract illicit drug activities and encourage domestic production. However, they have led to immediate disruptions in financial and cryptocurrency markets.

Within the first hour of the announcement:

- Bitcoin (BTC) fell 3.7% from $67,200 to $64,650, with a 15% surge in trading volume to $45 billion.

-

Ethereum (ETH) dropped 3.2%, from $3,850 to $3,725, with trading volume up 12% to $22 billion.

-

The Bitcoin to US Dollar (BTC/USD) pair saw an 18% increase in trading volume to $30 billion, signaling heightened volatility.

-

The Fear and Greed Index for cryptocurrencies fell from 55 to 48, indicating increased investor fear.

Global Stock Markets React to Trade Tensions

The stock market faced its sharpest losses of the year following the tariff announcement. On Tuesday:

- The S&P 500 fell 0.7% at opening, adding to Monday’s 1.8% decline—the worst drop of 2025 so far.

2. The Nasdaq Composite came close to a 10% decline from its all-time high, making February its worst-performing month since April 2024.

- European markets also tumbled, with declines in Britain’s FTSE 100, Germany’s DAX, and the Euro Stoxx 50.

China, Canada, and Mexico Respond with Countermeasures

In response, China, Canada, and Mexico have announced retaliatory tariffs, intensifying global trade tensions:

- China imposed a 15% tariff on U.S. chicken, wheat, corn, and cotton and a 10% tariff on soybeans, pork, beef, and other agricultural products.

-

Canada enacted 25% tariffs on $30 billion worth of U.S. goods and plans to expand them to $125 billion within three weeks.

-

Mexico has vowed to announce its own countermeasures on Sunday, as President Claudia Sheinbaum condemned the U.S. tariffs.

Economic Outlook and Investor Sentiment

These trade conflicts come at a precarious time for the U.S. economy:

- Consumer spending unexpectedly declined in January, suggesting reduced purchasing power.

-

Inflation remains stubbornly high, with rising prices further straining households.

-

The labor market is showing signs of stagnation, with jobless claims exceeding expectations and federal layoffs adding to economic concerns.

Conclusion: A Market in Flux

Trump’s aggressive tariff policies are reshaping global trade dynamics, injecting new volatility into both traditional and cryptocurrency markets. Bitcoin, often viewed as a hedge against financial instability, has seen rapid fluctuations as investors assess the long-term implications of heightened economic uncertainty.

With global markets on edge, traders and investors will closely monitor upcoming economic data, including the February jobs report, for further signs of economic resilience—or distress.

As retaliatory measures unfold, the cryptocurrency market may continue to serve as a barometer of investor sentiment amid geopolitical and economic uncertainty.

by | Mar 4, 2025 | Business

XRP plunges 16% as Trump’s tariffs and mass liquidations rattle the crypto market. Discover key support levels, liquidation data, and the impact of Trump’s U.S. Crypto Strategic Reserve on XRP’s future. Will XRP rebound or face further declines?

The cryptocurrency market is experiencing a broad sell-off, with XRP mirroring the bearish sentiment. Over the past 24 hours, XRP has dropped 16% to trade at $2.32, effectively erasing all the gains made on March 2.

This decline comes amid wider market volatility triggered by geopolitical and economic factors, notably U.S. President Donald Trump’s newly implemented tariffs.

XRP Leads Crypto Market Bloodbath

XRP’s sharp decline is in line with a broader market sell-off as investors react to Trump’s tariffs on imports from Canada, Mexico, and China.

The cryptocurrency market has collectively lost 8% of its value, bringing the total global market capitalization down to $2.76 trillion.

Key Market Declines:

- Bitcoin (BTC) has fallen 10% over the last 24 hours, trading at $83,500, marking a 3% drop from pre-tariff levels.

- Ethereum (ETH) has tumbled 12%, now hovering just above $2,000.

- XRP, along with Solana (SOL) and Cardano (ADA), has suffered the steepest losses among the top 10 cryptocurrencies.

The risk-off sentiment among investors stems from fears of tighter economic conditions and the broader implications of Trump’s trade policies.

Over $50 Million in Long XRP Positions Liquidated

The sharp decline in XRP’s price has led to massive liquidations in the derivatives market. In the past 24 hours alone, nearly $58 million worth of XRP futures positions have been liquidated, with long liquidations accounting for $50 million.

This underscores the strong selling pressure currently dominating XRP’s price action.

Key Liquidation Data:

- $49.7 million in long positions wiped out, compared to $8 million in short liquidations.

-

A similar liquidation event occurred between February 24 and February 26, erasing $80 million in long positions and causing a 17% price drop.

-

XRP’s open interest (OI) has fallen 25% from $4.45 billion on March 3 to $3.34 billion, signaling waning trader participation.

The funding rate has turned negative, dropping from 0.0103% to 0.00032%, reflecting weakened bullish sentiment.

Key Technical Levels: Can XRP Hold Above $2.20?

With XRP’s price facing intense bearish pressure, key support and resistance levels could dictate the next move.

Key Levels to Watch:

1. Support: $2.20 remains a crucial psychological support level. A breakdown could see XRP test $1.76 (February 3 low) and potentially $1.55, where the 200-day simple moving average (SMA) resides.

2. Resistance: A decisive move above $2.48, where the 100-day SMA and the upper boundary of the descending channel meet, is necessary to reignite bullish momentum. If achieved, XRP could revisit $3.00.

Trump’s Strategic Crypto Reserve Sparks Brief XRP Rally

Despite the bearish market sentiment, XRP witnessed a brief surge near $3 following President Trump’s announcement of a U.S. Crypto Strategic Reserve.

The plan includes XRP, alongside Bitcoin, Ethereum, Solana, and Cardano, as part of a national stockpile of digital assets. The announcement drove a 34% spike in XRP’s price, adding $44 billion to its market capitalization.

Can XRP Reach $5 Under Trump’s Presidency?

The inclusion of XRP in the U.S. Crypto Strategic Reserve has fueled speculation about whether it could finally surpass the elusive $5 mark. Analysts highlight three critical factors influencing XRP’s price trajectory:

1. Further Details on the Crypto Reserve: A clear regulatory framework could increase institutional adoption.

2. SEC vs. Ripple Case: If the SEC drops its appeal, XRP could surge past its 2021 all-time high of $3.40. However, continued legal uncertainty may drag XRP down to $1.50.

3. Potential Approval of an XRP Spot ETF: Institutional inflows from an ETF could act as a major bullish catalyst.

Market Reactions: Industry Leaders Weigh In

The strategic crypto reserve proposal has sparked debate among industry leaders. Coinbase CEO Brian Armstrong has suggested that Bitcoin alone should be included, arguing it serves as the best store of value.

Meanwhile, Bitwise CEO Hunter Horsley and Gemini co-founder Tyler Winklevoss expressed skepticism about the inclusion of multiple cryptocurrencies.

Conclusion: A Volatile Road Ahead for XRP

XRP’s price action remains highly volatile, with macroeconomic factors, liquidation events, and regulatory developments influencing its trajectory.

The next key event to watch is Trump’s Crypto Summit on Friday, where more details about the strategic reserve could emerge. Until clearer policies are established, XRP traders should brace for continued market fluctuations.

You must be logged in to post a comment.