by | Jun 18, 2025 | Business

As comfort food continues to evolve with local preferences, Karaoke Manekineko Malaysia has added a bold new dish to its expanding snack menu—MANECKEY Spicy Ramen. The launch signals a growing alignment between entertainment spaces and food offerings tailored for urban youth.

In response to the rising demand for flavour-forward comfort food among

younger consumers, Karaoke

Manekineko Malaysia has

introduced a fiery new dish: MANECKEY Spicy Ramen. Served hot and

infused with rich, savoury broth and a signature spicy blend, the dish is

positioned as a satisfying companion to karaoke sessions.

The

dish is offered in two variations: the MANECKEY Spicy Ramen, designed

for those who enjoy a traditional kick, and the Spicy Carbonara Ramen,

which balances heat with creamy richness. Both options are halal-certified

and were curated to appeal to regular guests seeking a quick yet hearty meal

between performances.

The ramen’s launch reflects a growing shift in karaoke venues that are

increasingly catering to all-in-one leisure experiences—combining music, casual

dining, and social gathering under one roof. For Karaoke Manekineko, this move aligns with evolving customer behaviour, especially among

urban youth and working adults who view karaoke lounges as more than just music

spaces, but lifestyle destinations.

While not a seasonal feature, the MANECKEY Spicy Ramen is expected to be

spotlighted in upcoming campaigns and may appear in limited-edition set menus

or event packages. However, the item is now part of the regular menu across

all Karaoke Manekineko Malaysia outlets, and early feedback from staff and customers suggests it could become a

popular staple.

From a food trend perspective, the inclusion of spicy ramen highlights a

broader regional preference for customisable heat levels and comforting

textures—a trend that continues to influence food service design across

lifestyle entertainment venues.

by | Jun 17, 2025 | Business

Solana (SOL) is back in the spotlight as $320M in mysterious whale transfers, rising ETF approval odds, and surging institutional interest stir both fear and excitement. Could this altcoin be the next breakout star of 2025?

As the broader cryptocurrency market endures a wave of volatility, Solana (SOL) has become a central figure in both investor anxiety and optimism.

From sudden multi-million-dollar whale transfers to soaring ETF speculation and surging institutional interest, Solana’s recent activity paints a complex but compelling picture of a blockchain network at the crossroads of speculation and adoption.

$320 Million in SOL Moved in Mysterious Whale Transfers

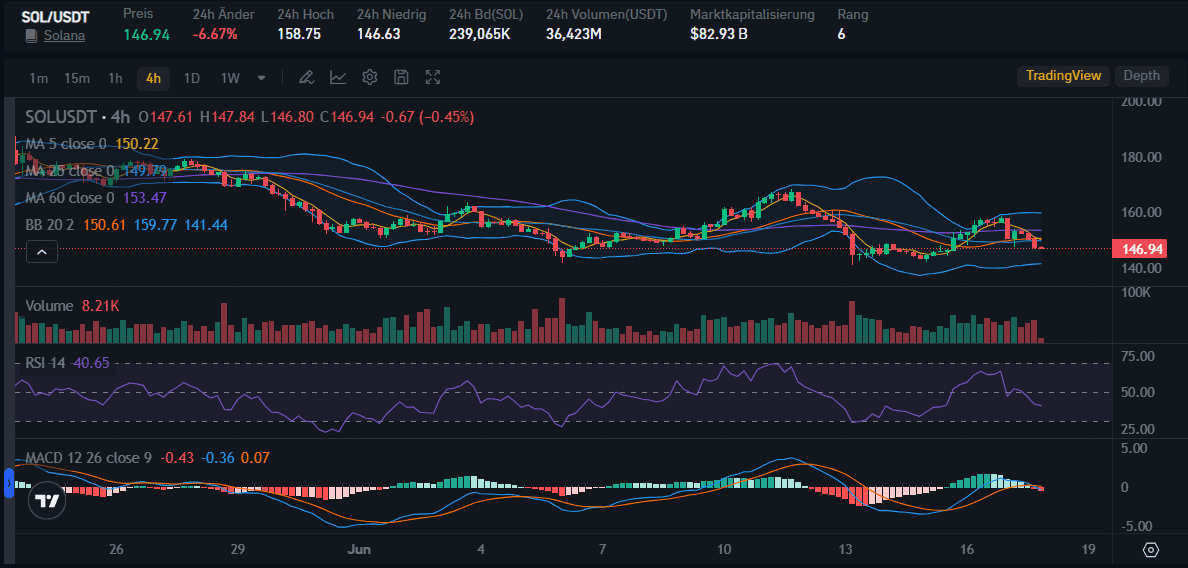

On June 12, the crypto market took a bearish turn, with top assets like Bitcoin and Ethereum plunging sharply.

In the midst of this downturn, on-chain analytics firm Whale Alert flagged a staggering 2,023,142 SOL, worth over $320 million, being transferred within a two-hour window. The transactions were split into two tranches:

- The first transaction moved 1,063,142 SOL (~$169 million).

- The second, more intriguing transfer sent 960,000 SOL (~$154 million) to a newly created wallet just one hour before the transaction.

The anonymous nature and scale of these movements raised alarms and speculation. Could these be whales offloading assets ahead of a broader correction, or internal reshuffling in preparation for institutional custody?

While no one has claimed responsibility, many analysts suggest these could be bearish whales bracing for deeper losses.

Meanwhile, SOL’s price dropped by 6.67%, hitting $146.97, underscoring growing uncertainty and fear in the market.

Futures Market Sees Institutional Inflows

Supporting the rebound is growing confidence from institutional players. According to derivatives data:

- Open interest in Solana futures soared 12% in 24 hours, reaching $7.54 billion, just 12% shy of its all-time high.

-

This signals renewed institutional appetite, even amid elevated liquidation risks.

Solana’s Ecosystem Strengthens

Beyond price and speculation, Solana’s fundamentals are showing remarkable improvement:

- Total Value Locked (TVL) has risen to 56.8 million SOL (~$9.1 billion)—the highest since June 2022.

-

Daily active addresses have jumped 38.5%, totaling 2.7 million.

-

Key decentralized applications (DApps) have seen 77% to 300% increases in unique wallet interactions.

These metrics indicate not just investor interest, but real user engagement, laying the foundation for long-term growth.

Solana ETF Approval Odds Hit 91%

Adding fuel to the bullish fire, prediction market Polymarket has placed 91% odds on the SEC approving a spot Solana ETF by 2025. Major asset managers, VanEck, Bitwise, and Grayscale, have already filed for such products.

Bloomberg ETF analyst Eric Balchunas even predicted Solana could lead an upcoming “Altcoin ETF Summer,” similar to what Ethereum and Bitcoin experienced during their ETF hype cycles.

Technical analysts further point out a bull flag pattern forming on the SOL/USD weekly chart, potentially targeting a move toward $335—if momentum holds and SOL reclaims the $190 support level.

DeFi Development Corp’s $1 Billion Solana Bet Hits a Regulatory Speed Bump

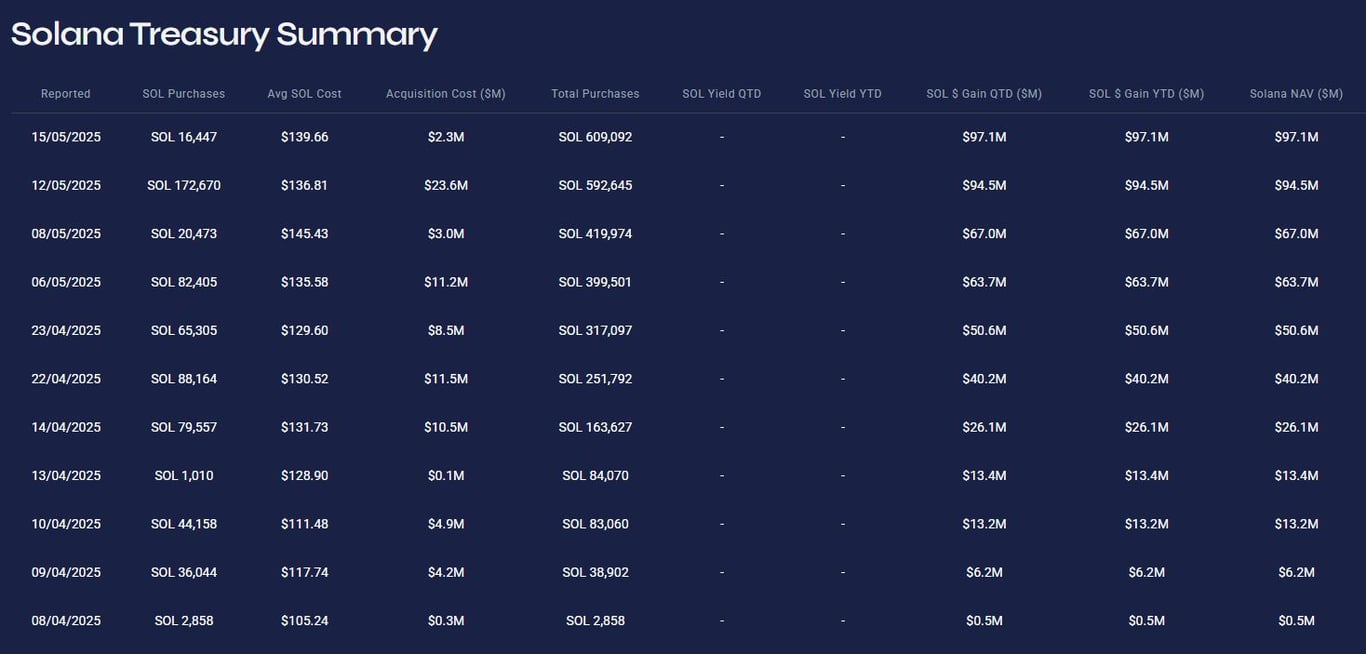

In a parallel storyline, DeFi Development Corp (DDC), a Nasdaq-listed firm and self-proclaimed “Solana Treasury Company”, has run into SEC resistance on its path to raise $1 billion for additional Solana purchases.

The company attempted to file a Form S-3 registration statement on April 25 to use proceeds for buying more SOL. However, the SEC rejected the filing due to missing internal control documentation.

As a result, DDC voluntarily withdrew the request but confirmed plans to resubmit via a resale registration statement in the near future.

Despite the setback, DDC’s commitment remains strong:

- It already holds over 609,190 SOL (~$97 million).

-

Recent purchases include 16,447 SOL at an average of $139.66.

-

The firm also adopted liquid staking, converting some of its SOL to dfdvSOL to enhance capital efficiency.

Now led by former Kraken executives, most notably Joseph Onorati, ex-Chief Strategy Officer of Kraken, DeFi Development Corp has transformed from a real estate tech company into a serious crypto player.

Conclusion: Solana Walks the Tightrope Between Fear and Opportunity

Solana is currently walking a tightrope between short-term volatility and long-term promise.

While large whale transactions and regulatory setbacks create anxiety, the concurrent rise in institutional investment, strong on-chain data, and ETF optimism point to a potentially explosive upside.

If the SEC greenlights a Solana ETF and market sentiment stabilizes, SOL could be poised to not only revisit its all-time highs but also claim a dominant role in the future of decentralized finance and blockchain infrastructure.

For investors, the message is clear: Watch Solana closely. It could be the most important altcoin story of 2025.

by | Jun 17, 2025 | Business

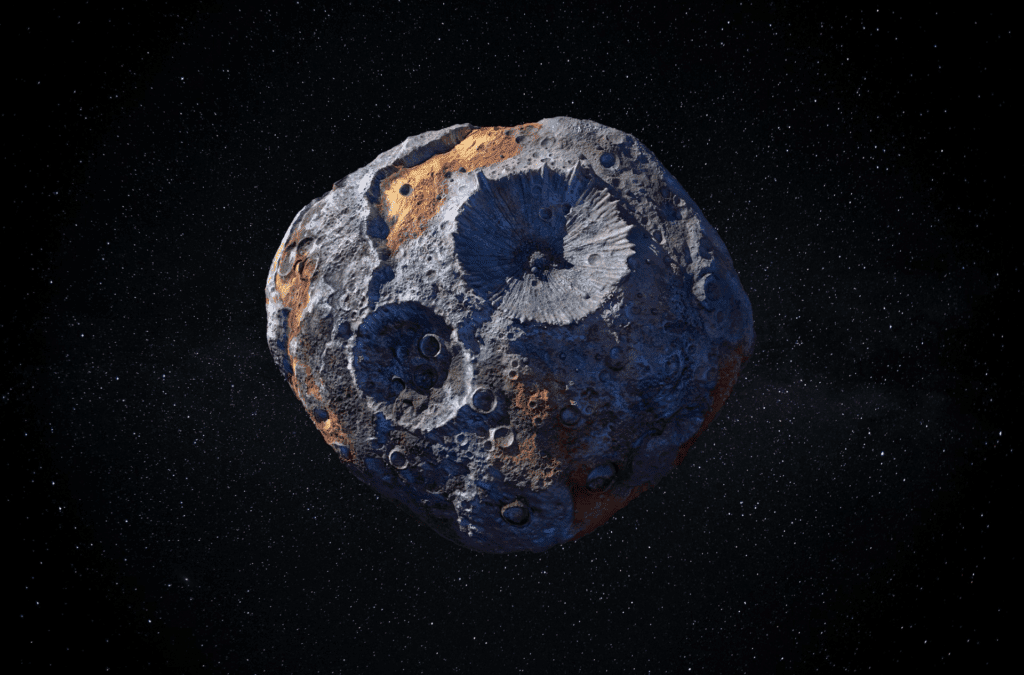

The space economy presents new investment opportunities as commercial space resource ventures grow, but investors must assess risks and regulatory challenges.

Most investors build their portfolios through traditional assets such as shares, property and bonds. However, a new investment horizon has emerged that extends beyond Earth’s atmosphere. The space economy represents a potential opportunity for forward-thinking investors willing to explore unconventional markets, but questions remain about how best to participate in this sector.

The space industry continues its rapid expansion, with estimates suggesting it could grow from approximately $US500 billion in 2022 to a multi-trillion dollar industry by 2040. While current growth focuses on communications, Earth observation and navigation, experts forecast significant expansion into cislunar (between the Earth and the moon) space.

“The long-term outlook for commercial space resources is promising, with space resource activity being essential for the commercial development of cislunar space, due to the ‘tyranny of the rocket equation’, where there is an exponential increase in cost as a function of distance from the Earth,” said UNSW Engineering PhD student Ben McKeown, who has led a number of co-authored research papers on the topic.

An increasing number of private sector companies targeting space resources, including Astroforge (a US-based aerospace firm that plans to mine asteroids to extract valuable minerals), Interlune (which has developed novel machinery and processes to detect and extract natural resources from space) and ispace (a Japanese firm that develops robotic spacecraft and technologies to discover, map and use natural lunar resources).

However, Mr McKeown said, the reality was that sustainable commercial space resource activity was still some way off.

“Important considerations for investors in space resource activities include current regulatory uncertainty, the lack of defined markets and the lack of geological resource definition. Over and above these factors, potential investors should consider the credibility and feasibility of a company’s technological capabilities and mission plans,” he said.

Mr McKeown, who is a research student at UNSW’s Australian Centre for Space Engineering Research and also serves as Chairman at Tinka Resources, a Canadian-based exploration and development company, highlighted the importance of evaluating tangible milestones, validating partnerships with entities such as NASA, and successful navigation of regulatory frameworks in helping investors identify opportunities with a higher likelihood of success and mitigate speculative risks.

Potential returns from investing in space resources

Mr McKeown’s most recent research paper, The space resources fund: A solution to the space resources benefit sharing dilemma?, examines various types of funding for commercialising space resources.

Co-authored by UNSW Business School Associate Professor Jeff Coulton and UNSW Engineering academics Professor Andrew Dempster and Professor Serkan Saydam, the paper analysed sovereign wealth funds, development funds, and private equity ventures to determine which characteristics might best serve the dual aims of industry development and benefit sharing.

Published in Space Policy, the research paper explained how a proposed Space Resources Fund would operate with a double bottom line mandate: generating monetary benefits from fund activities for global benefit sharing, while providing investment capital to facilitate the development of industry that supports the fund.

Financial modelling conducted by the researchers showed that if the fund achieved a 10% annual return over 50 years, it could grow to $186 billion from an initial $2 billion investment. At a 12% return, this figure increases to $439 billion over the same period.

This contrasted favourably with the potential income from royalties, which the authors found would generate significantly less value. Even with an 8% royalty rate on a hypothetical lunar ice mining industry growing at 6% annually over 50 years, the total value generated would be a fraction of the investment value created by the space resources fund approach.

Investment timeframes and considerations

A/Prof. Coulton said it was probable that progress in commercial space mining activities would take much longer than in many traditional resource sectors.

“Space mining ventures will operate on decade-long horizons before they would be likely to see significant returns, so investors should research whether a company has a robust plan as well as the organisational capabilities to last,” he said.

“The markets for in-space resource trade aren’t currently developed (we need both the demand for and supply of materials in space), and the technical feasibility tests are in their very early days.”

As such, A/Prof. Coulton said, investors should try to understand the technology, partnerships, and regulatory preparations.

“They’ll also need to investigate how businesses plan to deal with legal uncertainties: regulations around resource ownership and the right to mine celestial bodies are still evolving, so it will be crucial to invest in projects with a clear approach to navigating any shifts in that landscape,” he said.

Another key consideration in any early-stage investing would be the leadership and extent of proven expertise of the team. A/Prof. Coulton said a promising space resource startup should ideally have access to sufficient funding, strong engineering teams, and a track record of successfully managing large-scale, capital-intensive projects.

“The emerging investment opportunities will be very exciting, but investors will need patience and a willingness to embrace the uncertain nature of the projects and their outcomes,” he said.

The risks of space resources investing

While certain risks, such as subsurface or geological risk in the context of space resources may be comparable to those on Earth, Mr McKeown said, investing in space resources would carry unique risks when compared to terrestrial resource investments.

“Technology risks are substantial, given the complexity of operating safely and effectively in space. Regulatory uncertainty also poses challenges, as international space law and property rights on celestial bodies remain in early development,” he said.

Additionally, market risks such as unpredictable demand and pricing structure were significant at this point. Factoring all these risks into account, Mr McKeown asserted that investors should be prepared for the volatility and longer-term horizons associated with these innovative ventures.

A/Prof. Coulton echoed Mr McKeown’s observations and said investing in space resources would be considered riskier than that of many established Earth-based ventures. “This is due largely to the experimental nature of extraction and processing methods and the harsh conditions of outer space,” he said.

With Earth-based mining, A/Prof. Coulton said, there was long-standing proven technology as well as existing legal frameworks that helped mitigate some of the uncertainty. In space, even well-funded and organised missions would face surprises – from launch failures to hardware malfunctions to shifting international regulations – that might rapidly reshape the ownership of off-Earth resources.

Extended operational timelines can also mean waiting years or even decades to realise a commercial return, he added.

A long-term investment outlook

For those considering investment opportunities in the space resources sector, the research suggests a measured approach. Early stages of industry development will likely require significant capital with high-risk profiles, but offer potential for substantial returns.

The fund structure proposed by the UNSW research team could provide a middle path that satisfies both commercial interests and international obligations regarding benefit sharing. Rather than imposing potentially burdensome royalties on nascent space resources fund projects, the fund approach could generate greater long-term value while supporting industry development.

“I think that the long-term outlook for space resource investments is generally very positive, provided you recognise it IS a long-term consideration,” said A/Prof. Coulton. “As reusable rocket technology advances and launch costs fall (which we are currently seeing especially with SpaceX), we’re steadily approaching a point where space-based projects become more economically viable.”

This shift could prompt even more investment and innovation, with early successes boosting both investor confidence and therefore the capital available for further ventures. Government support was also likely to grow, said A/Prof. Coulton, who predicted nations would become more focused on securing strategic resources and maintaining a presence beyond Earth.

Mr McKeown also said the long-term investment outlook for space resources was promising, particularly as humanity expanded its footprint beyond Earth and an economy in cislunar space evolved.

“The space economy is projected to significantly expand in the coming decades, which could drive demand for water and construction materials in space, in addition to helium-3, demand for which could develop on Earth in markets such as quantum computing and fusion energy,” he said.

“Investors who enter this sector early, with a well-informed and patient strategy, may ultimately position themselves to benefit from what could become one of the defining industries of the next century.”

by | Jun 17, 2025 | Business

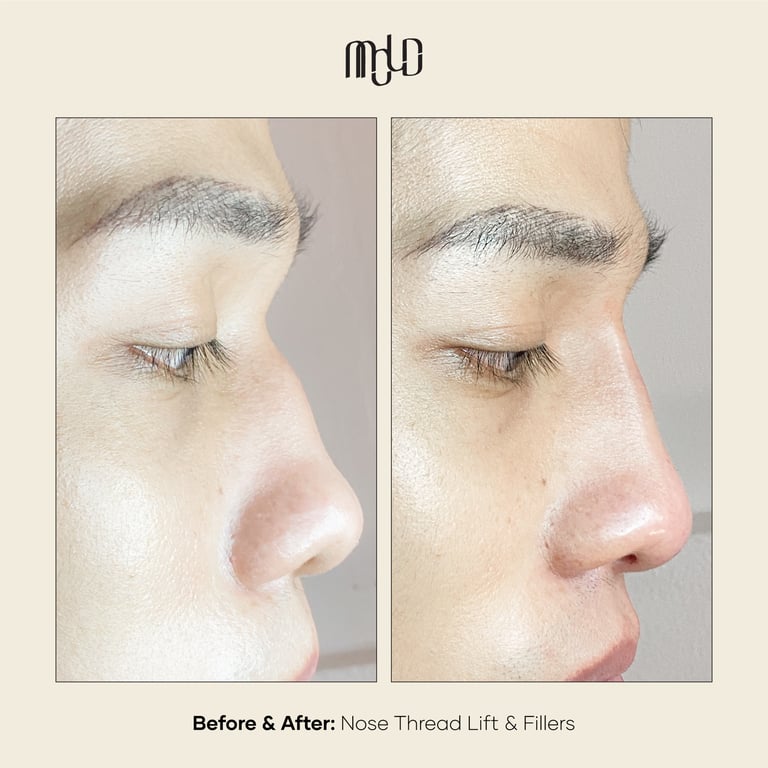

Discover MOLD Manila’s signature non-surgical nose thread lifts, jaw slimming, and facial contouring treatments. No scalpels—just sculpted beauty through minimally invasive aesthetic procedures.

Discover Non-Surgical Face Enhancements at MOLD Manila

We get it. You want to feel like the best version of yourself—refreshed, confident, and naturally glowing. Yet the idea of surgery can feel intimidating. Too permanent. Too much commitment for something that’s supposed to help you feel lighter, not more anxious.

You’re not alone. Many of our clients say the same thing: “I just want to improve this one area,” or “I want to feel more confident without changing who I am.”

That’s where MOLD Manila comes in.

We’re all about subtle yet stunning transformations—minimally invasive beauty treatments with real results. No incisions, no dramatic overhauls, no intimidating downtime—just the effortless glow-up you deserve.

Our clinic is where science meets subtlety. We use KFDA-approved threads, FDA-cleared fillers, and a personalized, artistic approach to elevate your natural features—not mask them.

Whether it’s a lifted nasal bridge, a more contoured chin, or a slimmer jawline, we help you mold your confidence—safely, gently, and beautifully.

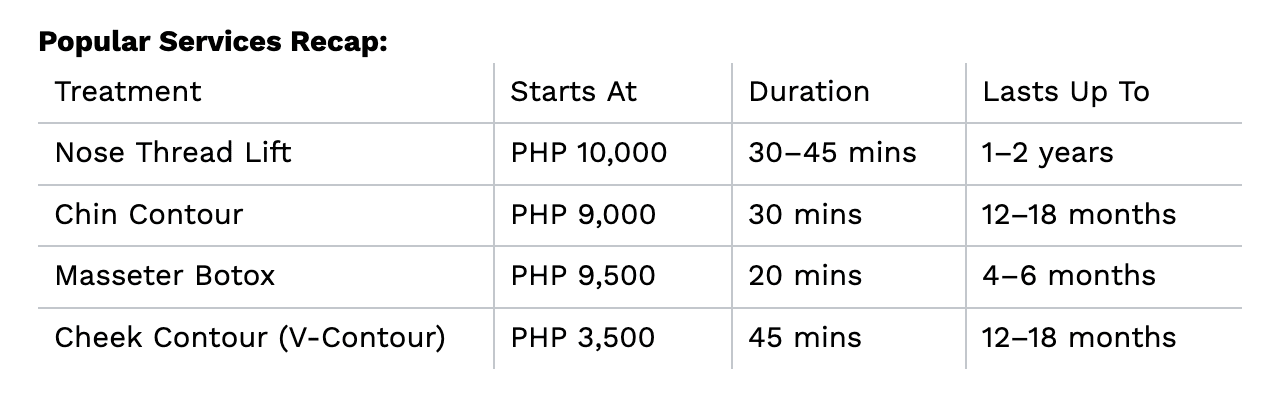

Understand the Benefits of Nose Thread Lifts

<img style="width: 100%;" src="https://slvrdlphn.com/wp-content/uploads/2025/06/public-155" alt="MOLD Manila's HIKO Nose Thread Lift – Non-surgical nose thread life” />

A best-seller at MOLD, the HIKO nose thread lift is a game changer for Filipino features. Using PDO threads, this treatment lifts the nasal bridge and refines the tip. Threads also promote collagen, so the lift improves over time.

Treatment Time: 30–45 minutes

Best for: Low bridges, undefined nasal tips, and those avoiding rhinoplasty

Starts at: PHP 1,500

Results last: Up to 2 years

Clients walk out with an enhanced yet natural look—no fillers, no incisions, and no regrets.

What to Expect During Chin Augmentation or Contouring

Chin contouring offers harmony to the lower face. We use dermal filler to improve projection and balance. Think: V-line profile, improved side profile, and photo-ready confidence.

Treatment Time: 30 minutes

Starts at: PHP 3,500

Best for: Short/recessed chins, facial asymmetry

Downtime: None

Learn About Jaw Slimming Through Masseter Botox

If your jawline feels too wide or boxy—or if you suffer from teeth grinding—masseter Botox is a dual-purpose solution. It gently weakens the bulky chewing muscle to create a softer, more feminine or contoured lower face.

Treatment Time: 15–20 minutes

Starts at: Php 350/unit

Results appear: Within 2–6 weeks

Lasts: 4–6 months

Bonus: Many clients also experience less jaw pain or TMJ symptoms.

Explore the Advantages of Cheek Contouring

Age and stress can cause the mid-face to hollow or sag. Our cheek contouring treatments restore volume, lift the face, and bring back definition to the cheekbones. Options include fillers or thread lifts, depending on your goals.

Starts at: PHP 3,500

Lasts: 12–18 months for threads; 6–9 months for filler

This is perfect for anyone who wants to glow without piling on makeup or filters.

Skin Rejuvenation Treatments That Support Your Look

It’s not enough to look perfectly contoured; your skin should glow from within. At MOLD, we combine targeted facials with regenerative therapies to bring back that fresh-faced luminosity:

PRP Therapy

Using your own plasma to boost collagen, reduce fine lines, and brighten skin tone.

LED Light Therapy

Soothes inflammation and acne while accelerating healing post-procedure.

Enzyme & Vitamin Facials

Custom facial treatments that nourish skin before or after contouring work.

These treatments pair well with any facial procedure and are often included in bundled sessions.

Why MOLD Clients Choose Minimally Invasive Procedures

We don’t do beauty by accident—we lead a movement in intentional transformation.

Our clients are:

• Young professionals prepping for their big break

• Brides and grooms aiming to glow at the altar

• Moms regaining self-care time

• Everyday people tired of heavy makeup and beauty pressure

We don’t sell perfection. We sculpt confidence.

And because our treatments are safe, fast, and subtle, there’s no awkward healing period or drastic change. Most people won’t know you had something done—they’ll just ask if you changed your skincare routine (wink).

People Also Ask

Q: Magkano ang nose thread lift sa MOLD Manila?

A: Nose thread lift starts at PHP 10,000. Packages vary based on thread type and desired outcome.

Q: Gaano katagal ang downtime?

A: Most clients experience light swelling or bruising for 1–3 days, but you can go back to work same day.

Q: Safe ba ito?

A: Absolutely. We use KFDA-approved threads and FDA-cleared fillers sourced from globally trusted brands.

Q: May maintenance ba?

A: Yes. Depending on treatment, we recommend a touch-up every 6–12 months.

Q: Pwede ba i-combine ang multiple procedures in one visit?

A: Yes! It’s common to pair nose threads with jaw slimming or skin treatments in one appointment.

Real Client Results

“I honestly thought I needed surgery to fix my nose bridge. Then I found MOLD. They gave me exactly what I wanted—without a scalpel.” — Ella, 25

“I booked a jaw slimming treatment for my prenup shoot. The results were subtle but powerful. Photos came out amazing!” — Joms, 30

“The vibe, the people, the process—it all felt safe, stylish, and well-executed. Best decision I’ve made for myself this year.” — Mae, 35

Explore Our Price Guide

You’ll never be surprised at checkout. Visit moldmanila.com for full pricing, promos, and consultation schedules. You can even send us a DM—we’re friendly like that.

Final Thoughts

You’re already stunning. Our mission? To sculpt that beauty into your boldest, most confident expression—effortlessly and pain-free.

Book your next consult at moldmanila.com or message us on Instagram @moldmanila.

Let’s sculpt what you already love.

Read full article at: https://moldmanila.com/post/discover-non-surgical-face-enhancements-at-mold-manila

by | Jun 17, 2025 | Business

Therium Capital Management quietly ceded control of its litigation portfolio to Fortress Investment Group on 11 June 2025, following layoffs and the formation of Therium Capital Advisors.

Fortress—now overseeing more than US $6.8 billion in legal assets—has introduced granular spend audits, weekly reporting and strict risk-return hurdles shaped by the UK Supreme Court’s PACCAR ruling.

Claimants, including those in the annulled US $14.92 billion Sulu arbitration, could face delays, early settlements or funding withdrawal, while investors brace for lengthened timelines and volatile secondary-market pricing.

Full article: https://knowsulu.ph/the-untold-sulu-story/inside-the-fortress-capital-control-and-the-quiet-collapse-of-therium

London, June 17 2025— Fortress Investment Group has quietly assumed operational control of Therium Capital Management’s global litigation-funding portfolio, completing a discreet transfer executed on 11 June 2025 after months of deep restructuring at Therium.

The hand-off, which covers more than forty active disputes spanning Europe, Asia and North America, is the largest realignment the asset class has seen since the United Kingdom’s PACCAR decision tightened recoverability rules for funders last year. Fortress, an alternative-assets manager overseeing roughly US $70 billion and already exposed to some US $6.8 billion in legal assets, will now set budgets, determine strategy and authorise capital calls for every matter previously under Therium’s watch.

Practitioners predict an immediate cultural shift. Therium historically offered flexible, claimant-friendly drawdowns and tolerated longer timelines; Fortress operates on quarterly performance metrics, demands weekly reporting and applies strict risk-adjusted return hurdles. Claimants whose cases have drifted, or whose damages models have weakened, may be pressed to accept earlier settlements, post additional security or face funding withdrawal if revised forecasts fail to satisfy those hurdles.

Insiders also anticipate tougher document scrutiny. Fortress is expected to require comprehensive counsel memoranda, granular budgets broken into six-month tranches and rolling scenario analyses before it releases each slice of capital. Lawyers who miss new benchmarks risk payment delays, while co-funders may be asked to surrender a larger share of upside to compensate for heightened volatility.

The controversial US $14.92 billion claim brought by the heirs of the Sultanate of Sulu against Malaysia remains funded but “under review.” Observers believe Fortress will keep the asset on the books until a Spanish court rules on pending annulment proceedings, yet several sources caution that further adverse findings could trigger an exit clause embedded in the transfer agreement.

Stakeholders therefore have a narrow window to renegotiate terms before Fortress completes its baseline portfolio review in early July. Delays will likely prove costly for all parties.

Analysts view the takeover as part of a broader consolidation trend in which large credit houses seek to ring-fence litigation risk during an era of rising capital costs. Should Fortress succeed in streamlining the inherited book, peers such as Burford Capital and Omni Bridgeway may pursue similar bolt-on acquisitions to defend margins and reassure investors.

For claimants and law firms the message is clear: documentation must be airtight, timelines realistic and economic models defensible, because the era of lightly monitored, open-ended funding has ended.

Image Source: Fortress Investment Group

by | Jun 17, 2025 | Business

At

Happycash, we recognize that data privacy is not only a legal obligation—it is

a core pillar of customer trust and long-term success. In line with this

belief, we have fully aligned our operations with the Data Privacy Act of

2012 and all regulations issued by the National Privacy Commission (NPC)

of the Philippines.

As a

registered Personal Information Controller (PIC) with the NPC, Happycash

adheres to the highest standards in the collection, processing, storage, and

protection of customer data. We treat our users’ personal information with the

utmost care—because safeguarding their privacy is central to how we do

business.

Fully

Committed to NPC Compliance

Happycash’s

data governance framework is designed to meet and exceed the requirements set

by the NPC. Our approach includes:

Data Minimization:

We collect only the data necessary to provide our services, avoiding

excessive or irrelevant information requests.User Consent and

Transparency: Our privacy policies clearly explain how data is used.

We ensure users are fully informed and give explicit consent before any

data processing.Security Measures:

We employ robust security measures, such as strong encryption, access

controls, and continuous monitoring to protect user information from

unauthorized access and breaches.Data Subject Rights:

We respect and uphold the rights of data subjects, including access,

correction, and erasure of personal data.Ongoing Staff Training:

All employees receive regular training on data privacy and NPC

regulations, embedding a privacy-first mindset across our organization.

Proactive

Engagement with the NPC

Happycash

not only complies with the law—we actively collaborate with the NPC to

strengthen our policies and ensure we’re ahead of evolving data protection

standards. We conduct regular privacy impact assessments, participate in NPC

consultations, and promptly address any inquiries from the Commission.

Putting

Privacy into Practice

Our

compliance efforts are not just policies on paper. We’ve built privacy into our

product design and business workflows. From app permissions to cloud

infrastructure, every layer of Happycash is structured to minimize data risks

and maximize user trust.

Looking

Ahead

As

digital finance grows in the Philippines, so does the responsibility to protect

user data. Happycash is proud to be a responsible steward of personal

information, and we will continue to invest in systems, people, and practices

that uphold the principles of transparency, accountability, and user

empowerment.

by | Jun 16, 2025 | Business

In

today’s fast-evolving digital lending landscape, transparency and

accountability are more critical than ever. At Happycash, we believe that

sustainable financial inclusion must be built on a foundation of trust and

regulatory compliance. That’s why we are proud to highlight our ongoing and

active collaboration with the Credit Information Corporation (CIC)—the

Philippines’ central credit registry. As both a submitting entity and an

accessing entity with the CIC, Happycash play a dual role in strengthening the

credit information ecosystem.

Since

our inception, Happycash has consistently reported loan data to CIC in

accordance with established guidelines. This partnership reflects our

commitment to building a responsible lending ecosystem that protects both

borrowers and lenders. By sharing accurate and timely credit data, we help

create a more robust financial infrastructure that empowers users while

reducing systemic risks. As an accessing entity, we also leverage the CIC

database to gain deeper insights into borrower creditworthiness, promoting

responsible lending decisions and risk mitigation.

Why

CIC Reporting Matters

As a

government-mandated credit registry, CIC plays a vital role in enabling fair

access to credit. When lenders like Happycash report to CIC:

Borrowers benefit from

having a verifiable credit history, helping them unlock better financial

opportunities in the future.Lenders gain deeper

insights into borrowers’ creditworthiness, promoting responsible

decision-making and risk mitigation.The entire ecosystem

benefits from reduced fraud, lower default rates, and enhanced financial

stability.

Our

Compliance Journey

Happycash

has taken proactive steps to integrate CIC reporting into our operations:

Regular and timely

submission of borrower credit data.Internal policies and staff

training aligned with CIC standards.Continuous engagement with

CIC for updates, clarifications, and audits to ensure full compliance.

We

view credit reporting not just as a regulatory requirement, but as a

responsibility to the people we serve. Our commitment extends beyond

compliance—we aim to be a model for ethical, data-driven lending in the fintech

sector.

Looking

Ahead

As

the Philippines continues to strengthen its credit information ecosystem,

Happycash remains committed to supporting CIC’s mission and aligning our

practices with the highest regulatory standards. We believe that transparency

is key to building long-term relationships with our users and earning the trust

of regulators, partners, and stakeholders.

by | Jun 16, 2025 | Business

In recognition of Father’s Day 2025, Karaoke Manekineko has introduced a limited-time promotion aimed at celebrating dads through accessible and fun family karaoke sessions. The special offer runs from 15 to 22 June across participating outlets.

In celebration of Father’s Day, Karaoke

Manekineko is offering

discounted happy hour rates exclusively for fathers from 15 to 22

June 2025. The initiative is part of the brand’s effort to encourage more

family bonding through music in a casual, welcoming environment.

The special promotion features heavily reduced prices during happy hours

for all fathers. Rates start as low as RM6++ for a 1-hour session on

weekdays, with extended sessions available at RM12++ for 2 hours and

RM15++ for 3 hours. Weekend prices begin at RM9++ per hour,

increasing to RM18++ for two hours and RM20++ for three hours.

This limited-time offer is valid during Happy Hour across the

promotional period and applies exclusively to fathers. All prices exclude

SST and service charges.

With this campaign, Karaoke Manekineko not only acknowledges the contributions of fathers but also reinforces

its ongoing mission to be a venue for family-friendly entertainment. The move

comes at a time when more consumers are seeking value-driven, inclusive

experiences that cater to multigenerational households.

For more information, guests are encouraged to contact their nearest

Manekineko outlet.

by | Jun 13, 2025 | Business

Despite employment reaching a record high in 2024, half of Australian workers (50%) are living paycheck to paycheck, according to ADP Research’s People at Work 2025 report. The study, which surveyed nearly 38,000 workers across 34 markets, uncovers stark regional disparities and generational divides in the global workforce’s financial resilience.

The findings reveal a complex financial picture, both locally and internationally: taking on extra work doesn’t necessarily close the pay gap, as nearly six in 10 (57%) workers surveyed globally are still struggling to make ends meet, even working multiple jobs.

In Australia, over half (52%) of workers with two jobs and nearly six in 10 (58%) of those with three or more jobs report holding multiple roles to cover necessary expenses.

Key Findings:

Global strain: Globally, more than half (54%) of single-job holders, 59% of workers with two jobs, and 61% of workers with three or more jobs are struggling to make ends meet.

Working multiple jobs to make ends meet: A significant portion of Australians are turning to multiple jobs to cope with financial demands.

Two jobs: 58% say they do it to afford extra costs, and 35% to build life savings and prepare for retirement.

Three or more jobs: 58% do it to build savings and prepare for retirement, and 46% to cover extra costs.

Regional Comparison: The country with the highest percentage of workers living paycheck to paycheck is Egypt (84%), followed by Saudi Arabia (79%) and the Philippines (78%). In contrast, South Korea reports the lowest proportion globally, at just 18%. Within the Asia-Pacific region, Australia ranks as the fourth lowest in terms of the share of employees living paycheck to paycheck, with 50% of workers facing this financial pressure. Only Japan (29%), Taiwan (30%), and China (31%) report lower proportions.

Why workers take multiple jobs

The survey reveals that most workers holding multiple jobs are doing it to cover their necessary expenses, to save for future spending, and to build savings for retirement. The number of workers working more than one job is the highest in the Middle East Africa (34%), Latin America (24%), and Asia Pacific (24%).

While people have different reasons for taking on extra work, holding two or more jobs can be a necessity in parts of the world where average wages are low relative to a country’s cost of living. Informal economies in Africa, Latin America and parts of Asia exacerbate challenges, with workers who piece together gig or part-time roles lacking stability or protection.

Navigating the high cost of living

“Pay is the foundation of financial wellbeing for most workers, yet our data shows that even record employment isn’t translating into financial security. Nearly two-thirds of people who hold three jobs still struggle to make ends meet. This presents an opportunity for employers to take a more holistic approach to compensation to help workers navigate the higher living costs of today’s global economy,” ADP chief economist Nela Richardson said.

“With the rising cost of living putting pressure on Australian households, many workers are finding it increasingly difficult to stretch their paychecks, even when holding down multiple jobs. For small and medium-sized businesses, offering across-the-board pay rises may not be realistic — but there are other meaningful ways to support employees,” Judy Barnett, Operations Director at ADP Australia said.

“Flexible work arrangements, subsidised transport, wellness programs, or financial planning support can go a long way in easing day-to-day pressures. These practical benefits help build trust, reduce turnover, and create more resilient workplaces at a time when employee wellbeing has never been more critical,” added Barnett.

by | Jun 13, 2025 | Business

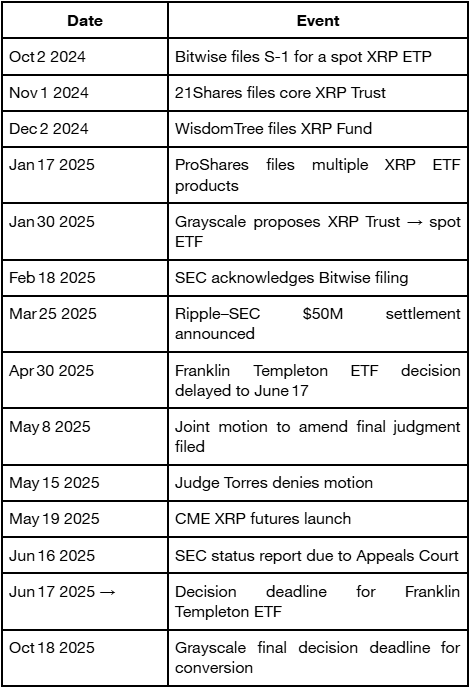

XRP ETF approval is closer than ever as Ripple nears a $50M SEC settlement. With June 17 looming and markets on edge, is XRP about to skyrocket—or crash? Here’s what you need to know.

As the SEC’s decision deadline for Franklin Templeton’s spot XRP ETF on June 17 rapidly approaches, speculation is escalating over the potential approval of XRP spot ETFs from major firms, including Grayscale, Franklin Templeton, and Bitwise.

Market participants are taking note of Ripple’s ongoing push to settle its long-running lawsuit with the SEC, a development that could remove a major obstacle to ETF approval, pending final judicial sign-off.

XRP ETF Odds: From Euphoria to Slight Pullback

On prediction platform Polymarket, the probability of an XRP ETF being greenlit by end-2025 soared to 98% in early June, before easing to around 88% in recent days. These numbers underscore both strong confidence and market sensitivity to regulatory cues.

SEC vs. Ripple: The Settlement Stalemate

Ripple’s legal battle with the SEC hinged on whether XRP constituted an unregistered security. Although the two parties reached a tentative $50 million settlement in March, Judge Torres rejected their joint motion in May due to procedural issues under Rule 60.

They have refiled and paused appeals, aiming for limited remand through the Second Circuit. A procedural status report is due to be submitted by the SEC by June 16, yet the settlement is still awaiting final judicial approval, meaning the case remains formally open.

Looking ahead, the June 17 deadline looms large for the Franklin Templeton ETF decision, and Grayscale’s chance of converting its XRP Trust to a spot ETF finalizes by October 18, 2025.

Price Dynamics & “Buy the Rumor” Effects

XRP has been highly reactive to both XRP ETF speculation and legal headlines:

- On June 12, XRP price declined roughly 5,21%, closing near $2.13, as the broader crypto market weakened.

- Technical indicators: a break above the 50-day EMA may lead to retesting $2.50 and eventually $3.55, while sliding below the 200-day EMA risks a drop to $1.93 .

Traders are treating the ETF buildup like the classic “buy the rumor, sell the news” scenario long seen with Bitcoin and Ethereum.

Projections range from bullish (up to $27) to cautious, with expectations of swift 20–40% corrections post-approval.

Market Volatility & Liquidation Shock

In the past 24 hours, XRP faced $7.95 million in liquidations, predominantly on long positions, triggered by a 182% futures imbalance and price dipping to around $2.11.

Though sharp, analysts view this as a short-duration turbulence within a broader upward trend, especially given ongoing institutional tailwinds.

Institutional Momentum: Futures, Stablecoins & Corporate Treasury Adoption

1. CME XRP Futures

On May 19, CME Group launched cash-settled XRP futures, standard (50,000 XRP) and micro (2,500 XRP) contracts, linked to the CME CF XRP‑Dollar Reference Rate.

These futures add institutional legitimacy, fulfilling a key SEC requirement for mature market structure.

2. Corporate & Real-World Adoption

Ripple’s network is seeing growing real-world use:

- Corporate allocations: Webus, VivoPower, and Wellgistics are committing over $450 million in XRP for treasury and payment purposes.

-

Tokenized assets: Guggenheim Treasury Services issued digital commercial paper on the XRP Ledger.

-

Stablecoin integration: On June 12, USDC came to XRPL, enabling auto-bridging through XRP, a move to bolster liquidity and stablecoin utility on Ripple’s network.

XRP Key Timeline at a Glance

What Comes Next?

1. June 16–17

2. Market and Technical Signals

Traders are watching the 50- and 200-day EMAs; momentum may surge or falter based on price action and ETF headlines.

3. Ongoing Institutional Growth

Futures activity, stablecoin integrations, and institutional treasury adoption all support XRP’s positioning—independent of a spot ETF outcome.

Conclusion

XRP stands at a pivotal juncture. With the SEC’s legal battle nearing resolution and regulated futures trading already in motion, the environment is primed for an ETF decision by late 2025. While odds on Polymarket exceed 80–90%, the outcome hinges on:

- Court confirmation of the $50 million settlement,

- SEC’s interpretation of ETF applications in this new legal context,

- And whether XRP’s market infrastructure satisfies regulatory demands for transparency and investor protection.

XRP’s future could point toward institutional mainstreaming, or a roller-coaster bear trap. All eyes now are on the June 16–17 window.

You must be logged in to post a comment.