by Penny Angeles-Tan | Dec 26, 2024 | Business

Explore Solana’s price outlook and potential for reaching $500 in 2025. This analysis delves into current market trends, on-chain fundamentals, macroeconomic factors, and technical analysis to assess SOL’s future trajectory.

The cryptocurrency market has seen significant activity around Solana (SOL), particularly as it attempts to stage a recovery during the holiday season. SOL’s performance, coupled with macroeconomic and on-chain fundamentals, paints a nuanced picture of its short-term and long-term potential.

Current Market Trends: Solana’s Modest Rebound

As of Christmas Day 2024, Solana’s price is making a modest recovery, trading just below the critical $200 mark. The asset has rebounded by 13% from its multi-week lows around $175, yet it remains significantly lower than its recent peak in the $260s.

However, despite the recent uptick, SOL is still trapped in a broader downtrend. Both the 21-day and 50-day moving averages (DMAs) suggest persistent bearish momentum, with analysts emphasizing that a meaningful break above $220 is necessary to confirm a trend reversal.

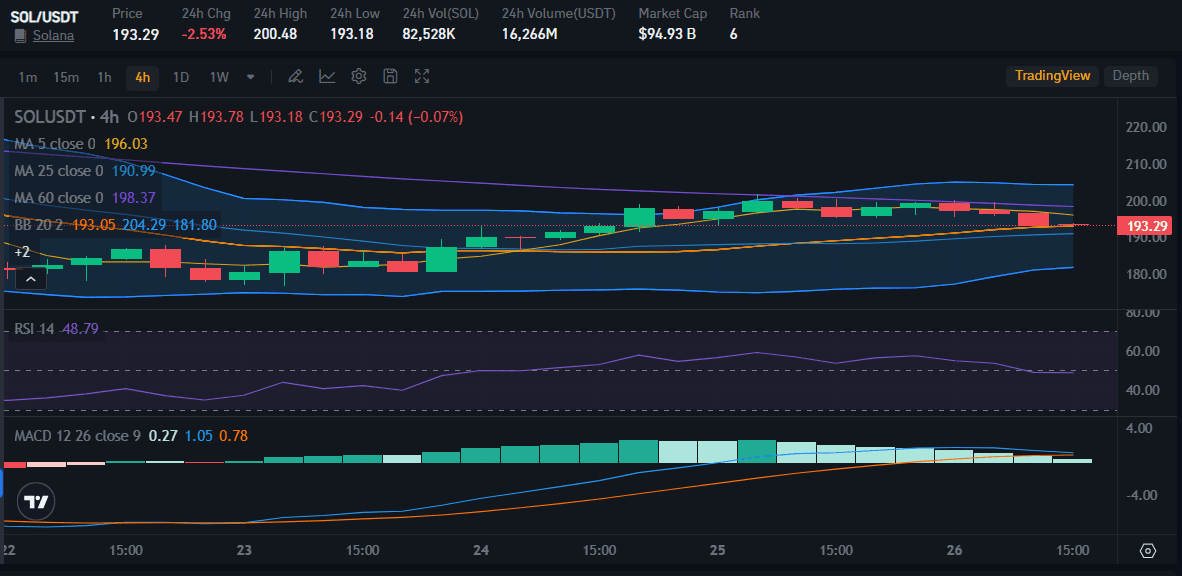

At the time of writing this article on December 26, 2024, Solana is trading at $193.29 with a decrease of -2.51%. The RSI value is below 50 which means the selling trend is higher than the buying trend.

Impact of Macroeconomic Factors

The Federal Reserve’s hawkish policy stance, signaling only two interest rate cuts in 2025, has dampened confidence in risk assets, including cryptocurrencies.

However, bullish indicators, such as the continued strength of the U.S. economy and the incoming pro-crypto Trump administration, provide a counterbalance.

This favorable regulatory and macroeconomic environment could usher in a “golden age” for the U.S. crypto industry, potentially driving renewed investor interest in assets like Solana.

Why Solana Could Retest $260 and Beyond

Solana, despite recent market volatility, exhibits strong on-chain fundamentals and presents a compelling case for a potential retest of $260 and beyond.

Robust network activity, indicated by rising trading volumes and transaction counts, coupled with a relatively low market capitalization compared to Ethereum, suggests significant room for growth.

While a direct comparison to Ethereum is unlikely, analysts predict a substantial price appreciation driven by Solana’s scalability advantages and increasing adoption within the DeFi and NFT sectors.

1. Strengthening On-Chain Fundamentals

Solana’s blockchain metrics remain robust, with trading volumes, transaction counts, and Total Value Locked (TVL) showing strong upward trends, according to DeFi Llama.

These indicators highlight increasing network usage, which could support future price gains.

Solana’s market cap of $94 billion, about 25% of Ethereum’s, suggests ample room for growth. While it is unlikely to surpass Ethereum this cycle, analysts predict a potential 4-5x increase from current levels, driven by Solana’s exceptional scalability and growing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

2. Short-Term Technical Analysis

Key Levels to Watch

– Support: $173.42 (61.8% Fibonacci level) has emerged as a critical base for SOL. If this level holds, it could signal the end of a corrective phase and the start of a bullish reversal.

– Immediate Resistance: $193.20 (50% Fibonacci level) serves as the first hurdle for upward momentum.

– Higher Resistance: $209.93 (38.2% Fibonacci) and $230.64 (23.6%) are subsequent levels to watch for a sustained breakout.

- Downside Target: Failure to hold the $173 support could push SOL toward the $152.65 level (78.6% Fibonacci).

3. Elliott Wave Analysis

Solana appears to be in the final stages of a corrective W-X-Y wave structure. A bullish reversal is plausible if the “C” wave concludes near the $173 support zone. A successful rebound could target $230 and potentially set the stage for higher highs.

Long-Term Price Outlook: Could Solana Reach $500?

Despite current struggles, many analysts remain optimistic about Solana’s future. As the crypto market transitions to a new cycle in 2025, several factors could propel SOL toward the ambitious $500 mark:

1. Pro-Crypto Regulatory Shift: The incoming U.S. administration is expected to create a favorable environment for blockchain innovation, benefitting major projects like Solana.

2. Ecosystem Expansion: Solana continues to attract new projects, enriching its ecosystem with advanced decentralized applications, tokenization initiatives, and cutting-edge solutions.

3. Bull Market Potential: Historical patterns suggest that Solana, like other major cryptocurrencies, has yet to enter the most explosive phase of its bull market, with significant upside remaining.

Risks and Challenges

1. Low Trading Volume: Recent declines in trading activity signal reduced investor confidence, potentially hindering price recovery.

2. Macroeconomic Uncertainty: Continued Fed hawkishness and other global economic factors could limit risk appetite for speculative assets.

Conclusion

Solana’s price action reflects a market in flux, caught between bearish trends and bullish fundamentals. While the short-term outlook suggests consolidation, the long-term narrative remains promising, driven by strong on-chain activity, ecosystem growth, and favorable macroeconomic shifts.

If Solana can break key resistance levels and sustain momentum, a retest of $260 appears likely, with the $500 target in 2025 firmly within reach.

by Penny Angeles-Tan | Dec 26, 2024 | Business

Discover Bitcoin’s remarkable 2024 journey, with a 131.5% YtD surge and key events like ETF approvals, halving, Trump’s pro-crypto win, and Fed rate cuts. Explore market trends, challenges, and future forecasts, including Tom Lee’s bold $250K prediction for 2025.

Bitcoin (BTC) experienced a rollercoaster year in 2024, marked by significant price fluctuations, groundbreaking events, and renewed optimism among investors. By December 25, Bitcoin closed at $98,429, representing a 131.5% year-to-date (YtD) increase compared to its closing price of $42,505 at the end of 2023.

Let’s delve into the factors driving Bitcoin’s performance and its potential trajectory.

Price Highlights and Market Capitalization

Bitcoin began 2024 on a challenging note, hitting its lowest price of $39,179 in mid-January. From this low, it soared 171.6% to reach its all-time high of $106,415 on December 17.

On December 18, Bitcoin’s market capitalization surged to $2.1 trillion, elevating it to the seventh-largest asset globally, surpassing major companies like Saudi Aramco, Meta Platforms, and Tesla.

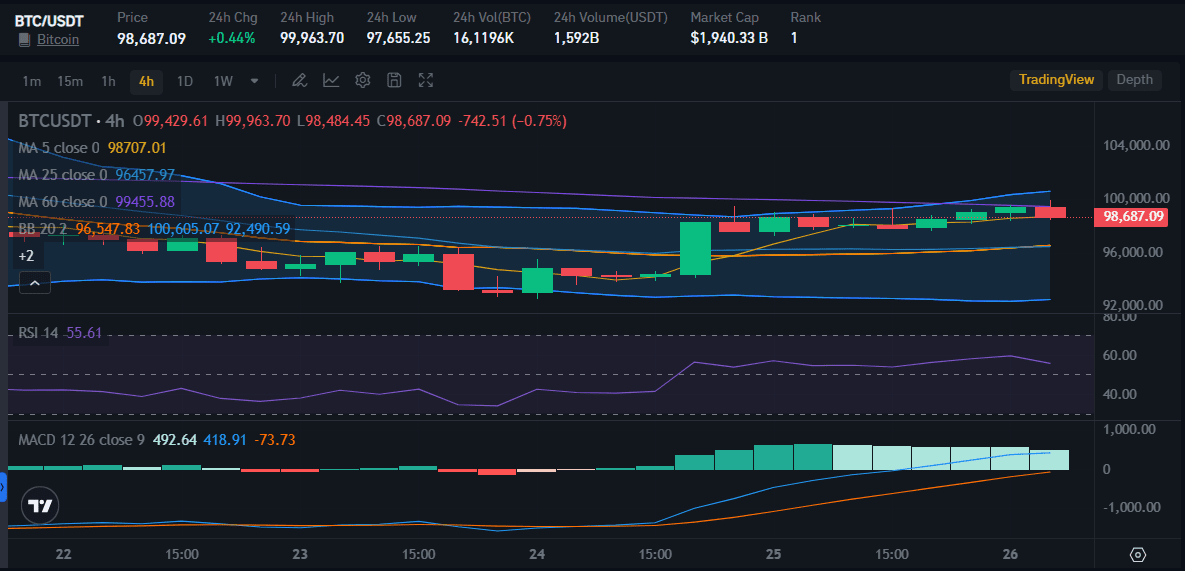

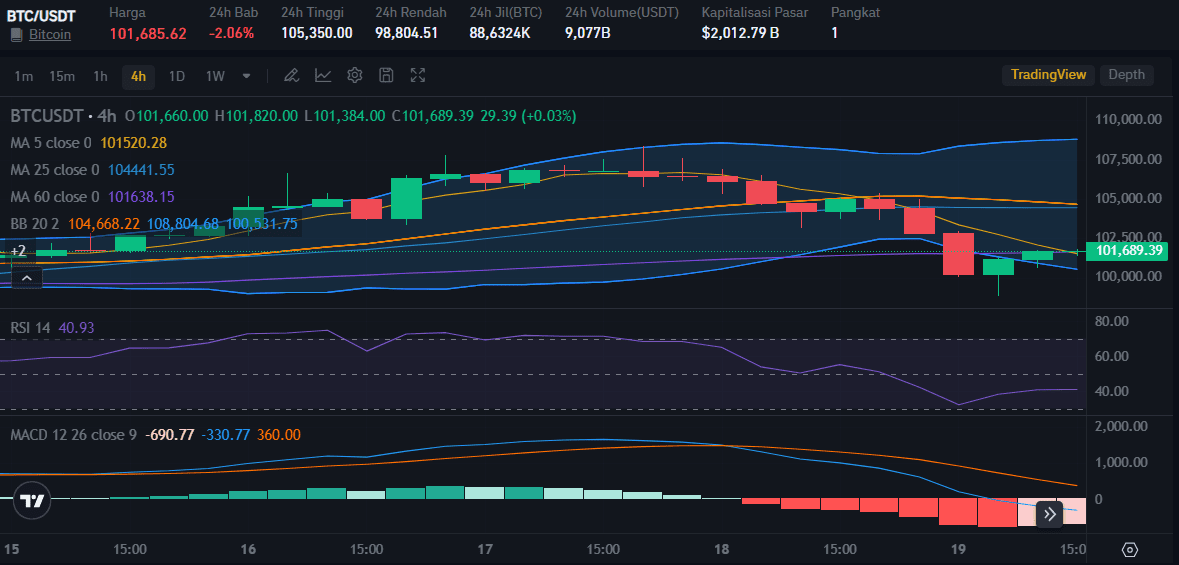

At the time of writing this article on December 26, BTC is at $98,687 with a gain of 0.44%. A price that is not too encouraging because BTC’s price is predicted to touch $100,000 again on Christmas Eve.

Four Key Events Driving Bitcoin’s Performance

Bitcoin has 4 major events happening during 2024 that will cause the token to surge in price today.

1. Approval of Bitcoin Spot ETFs in January

The U.S. Securities and Exchange Commission (SEC) approved 11 Bitcoin Spot Exchange-Traded Funds (ETFs), including offerings from BlackRock, Fidelity, and ARK Invest.

These ETFs allow traditional investors to gain exposure to Bitcoin without directly holding the asset. The approval attracted an inflow of $35.47 billion into Bitcoin Spot ETFs by December 24, pushing Bitcoin to $73,000 shortly after the announcement.

2. Bitcoin Halving in April

On April 20, Bitcoin underwent its fourth halving, reducing the mining reward from 6.25 BTC to 3.125 BTC. Historically, halvings have triggered long-term price increases due to reduced supply.

While Bitcoin’s price consolidated between $63,000 and $64,000 immediately post-halving, it aligned with historical patterns, which often see significant price growth within six months to a year after such events.

3. Trump’s Pro-Crypto Presidential Victory in November

Donald Trump’s re-election as U.S. President on November 6 was celebrated by the crypto community.

His pro-crypto stance, including promises to make the U.S. the “crypto capital of the world,” boosted Bitcoin’s price by 10%, reaching $75,984. Trump’s policies are expected to foster a more favorable regulatory environment for cryptocurrencies.

4. Federal Reserve’s Interest Rate Cuts

Throughout 2024, the Federal Reserve cut interest rates by 100 basis points, including reductions of 50 bps in September and 25 bps each in November and December.

Lower interest rates typically benefit risk assets like Bitcoin by encouraging capital flow away from bonds and into alternative investments.

Market Dynamics and Challenges

Just like other crypto tokens, BTC also experiences price movements that go up and down. Here’s how BTC’s price dynamics will be throughout 2024.

1. Derivatives and Margin Markets

Despite significant price volatility, Bitcoin’s derivatives market maintained a neutral-to-bullish stance. Futures contracts traded at a robust 12% premium, reflecting strong demand for leveraged long positions.

Meanwhile, Bitcoin’s margin markets showed a 25x long-to-short ratio, indicating sustained bullish sentiment.

2. Whale Activity and Sell-Side Pressure

On-chain data revealed increased sell-side pressure from large investors during market downturns. The average Bitcoin transaction size peaked at $306,100 in December, the highest in two years, often signaling intensified sell-offs.

This behavior, combined with market uncertainty, poses short-term risks to Bitcoin’s price stability.

Bitcoin’s Future Prospects

So, what is the future of BTC? Here is an explanation that you can read.

1. Support and Resistance Levels

As of December 25, Bitcoin’s key support level stands at $90,500. Breaching this level could lead to further declines, with $88,000 as the next major support.

Conversely, breaking above the $99,426 resistance could signal a bullish recovery, potentially paving the way for a retest of the $108,353 high.

2. Tom Lee’s Prediction

Prominent analyst Tom Lee predicts Bitcoin could reach $250,000 by 2025, citing a friendlier regulatory landscape and increased adoption. He also highlights Bitcoin’s potential role as a Treasury reserve asset, which could significantly bolster its value.

Conclusion

Bitcoin’s performance in 2024 underscores its resilience and adaptability amid macroeconomic and geopolitical shifts. While challenges remain, such as heightened whale activity and economic uncertainty, the asset’s growing institutional adoption and favorable regulatory developments paint an optimistic picture for 2025 and beyond.

Investors and enthusiasts alike should keep a close watch on market trends, support levels, and policy shifts as Bitcoin continues its journey as a transformative global asset.

by Penny Angeles-Tan | Dec 26, 2024 | Business

Discover the future of Bitcoin mining as we approach the 21 million BTC cap. Learn about the transition to transaction fees, economic scarcity, and innovative strategies ensuring the sustainability and security of the Bitcoin network. Explore key insights and expert analysis for crypto enthusiasts and investors.

Bitcoin mining has evolved significantly since the cryptocurrency’s inception, driven by lucrative incentives and the decentralized ethos of its network. Initially, miners were rewarded with 50 BTC per block, enabling early adopters to accumulate substantial Bitcoin holdings relatively easily.

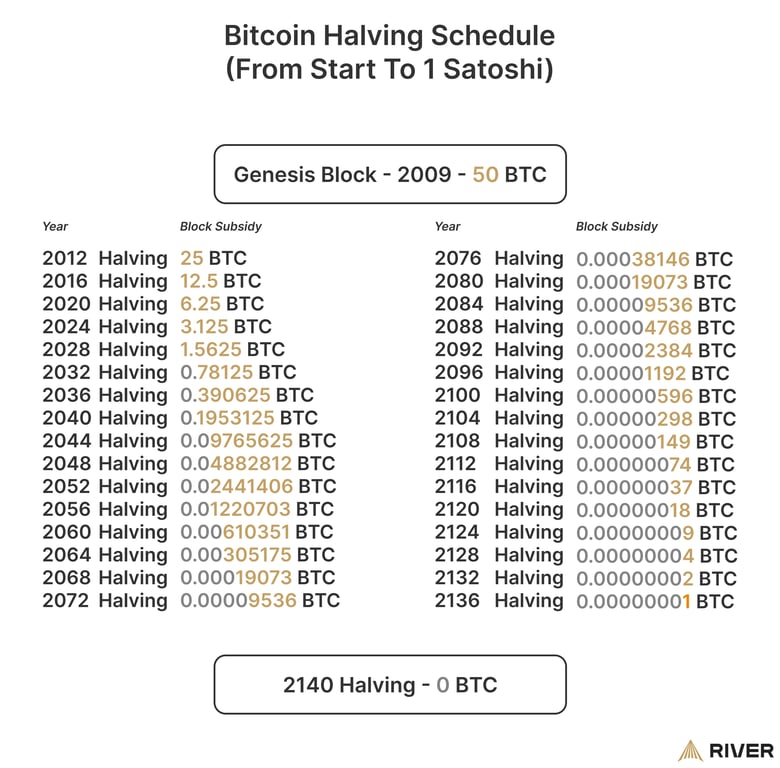

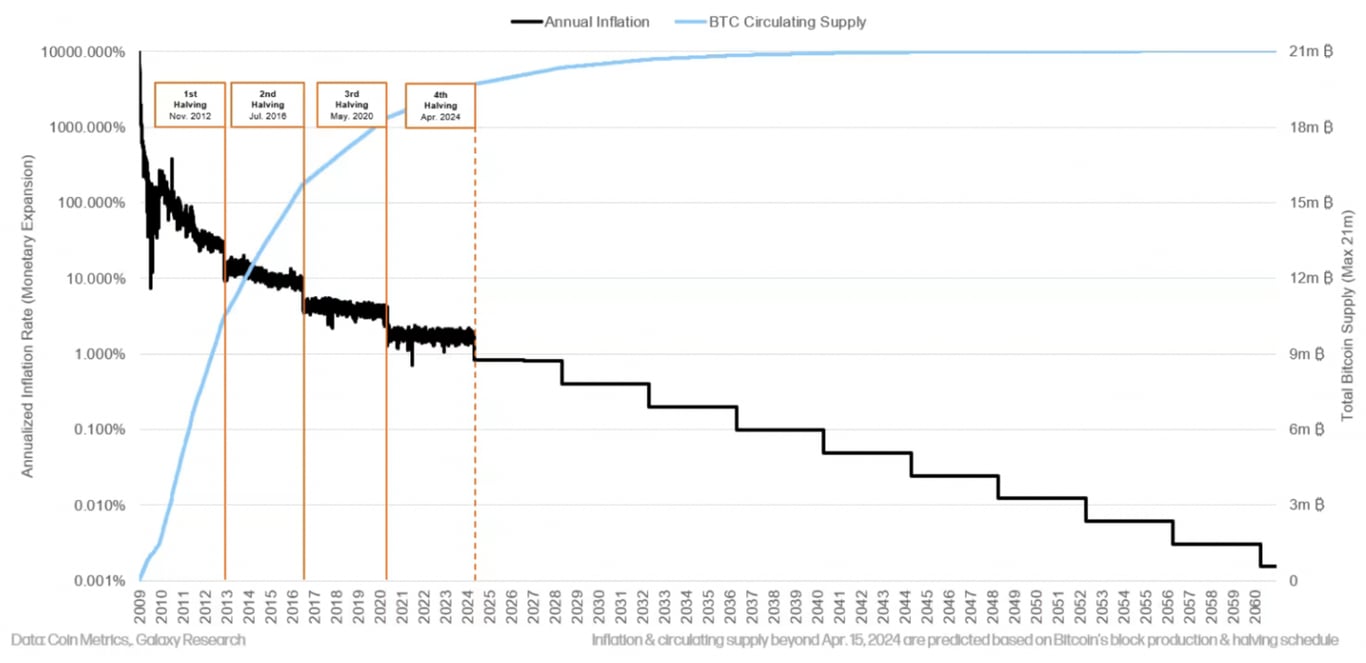

Today, the mining reward is 3.125 BTC per block following four halving events. With over 19.8 million Bitcoins already in circulation and only 1.5 million left to mine, the cryptocurrency will reach its cap of 21 million by approximately 2140.

Bitcoin’s Finite Supply and its Implications

The hard cap of 21 million Bitcoins is a cornerstone of Satoshi Nakamoto’s vision for a decentralized and scarce digital asset. This scarcity underpins Bitcoin’s value and demand, likened to digital gold. As the cap approaches, the network’s dynamics will shift:

1. Transition to Transaction Fees: Post-2140, miners will rely exclusively on transaction fees to validate and secure transactions. This shift is anticipated to sustain the network’s security and functionality.

2. Economic Scarcity: The finite supply enhances Bitcoin’s appeal as a store of value, potentially increasing its price as demand outpaces availability.

3. Adaptation of Mining Strategies: Miners are expected to adopt innovative solutions, such as utilizing heat generated during mining for secondary industries, ensuring continued profitability and sustainability.

Motivations for Bitcoin Mining

Bitcoin miners are driven by a mix of financial, ideological, and strategic motivations:

1. Financial Gains: Mining presents a lucrative opportunity through block rewards and transaction fees. Despite diminishing rewards, Bitcoin’s rising value and transaction activity continue to incentivize miners.

2. Decentralization: By participating in mining, individuals contribute to Bitcoin’s decentralized nature, which resists censorship and centralized control.

3. Long-Term Investment: Many miners view accumulating Bitcoin as a strategic investment, banking on future price appreciation.

4. Network Security: A high hash rate reflects robust network security and resilience, attracting further investment and participation.

Adapting to Challenges: The Resilience of Bitcoin Mining

Bitcoin’s mining ecosystem has demonstrated remarkable adaptability in the face of challenges. For instance, when China banned Bitcoin mining in 2021, miners quickly relocated operations, highlighting their resilience.

Similarly, the rising hash rate underscores Bitcoin’s ability to attract participation and maintain security, even amidst market fluctuations.

Key factors ensuring mining’s sustainability include:

1. Technological Advancements: Continuous improvements in mining equipment reduce operational costs and enhance efficiency.

2. Cheaper Energy Sources: Many miners leverage renewable and low-cost energy sources, such as hydroelectric power, to maximize profitability.

3. Difficulty Adjustments: Bitcoin’s algorithm dynamically adjusts mining difficulty, ensuring mining remains viable regardless of market conditions.

4. Price Appreciation: Historical trends show that halvings often drive Bitcoin’s price upward, offsetting the impact of reduced block rewards.

The Role of Transaction Fees

Transaction fees are poised to become the primary revenue source for miners as block rewards diminish. These fees have shown a potential to sustain mining operations, with instances like April 20, 2024, where transaction fees exceeded block rewards, accounting for 75% of miner revenue.

The increasing adoption of Layer 2 solutions, such as the Lightning Network, is expected to balance transaction costs and improve network efficiency, ensuring that Bitcoin remains accessible and secure.

Addressing Concerns About Deflation and Network Security

Bitcoin’s deflationary nature and fixed supply have sparked debates:

1. Economic Viability: Bitcoin’s divisibility into 100 million satoshis ensures usability even as its value rises. This design supports long-term investment and savings without stifling economic activity.

2. Network Security: Despite reduced block rewards, miners are expected to remain motivated by transaction fees, technological advancements, and Bitcoin’s price appreciation.

3. Global Adoption: Increasing acceptance by nation-states and integration into financial systems further solidify Bitcoin’s role as a global reserve asset.

Future Innovations and Diversification

Miners are exploring diversification strategies to sustain profitability:

1. Renewable Energy: Transitioning to sustainable energy sources reduces costs and addresses environmental concerns.

2. High-Performance Computing: Some miners are leveraging their infrastructure for AI and data processing, creating additional revenue streams.

3. Nation-State Involvement: Governmental adoption and initiatives, such as strategic reserves and cross-border trade, bolster Bitcoin’s legitimacy and utility.

Conclusion

Bitcoin’s ecosystem is well-positioned to thrive despite the eventual depletion of block rewards. The adaptability of miners, coupled with rising transaction fees, technological advancements, and broader adoption, ensures the network’s sustainability and resilience.

As cryptocurrency continues to evolve, it remains a testament to the ingenuity of decentralized technology and its potential to redefine global finance.

And please do your own research if you want to buy BTC. If you are a newbie in this crypto field, Bitrue will help you. You can use all of Bitrue’s features to get all the information you need before buying BTC. You also can check BTC price from BTC to USD so you can know how much budget you need to prepare for the investment you are going to make.

by Penny Angeles-Tan | Dec 19, 2024 | Business

Explore recent developments in Bitcoin, the Federal Reserve’s stance, and BTC price trends. Learn how macroeconomic policies, Bitcoin Rainbow Chart insights, and expert predictions could shape Bitcoin’s future, with forecasts of Bitcoin price by 2025.

Federal Reserve Chair Jerome Powell recently reaffirmed the institution’s legal stance on Bitcoin reserves. Speaking at a post-monetary decision conference, Powell stated that the U.S. central bank is legally barred from holding Bitcoin as a reserve asset.

Powell emphasized that current laws prevent the Federal Reserve from maintaining a Bitcoin reserve and that there is no interest in pursuing legal changes to allow for such holdings.

Powell’s remarks, coming after the year’s final Federal Open Market Committee (FOMC) meeting, reiterated the Fed’s consistent position on this issue.

Context Behind Powell’s Comments

These statements come as Bitcoin reached new all-time highs and amid significant global developments in cryptocurrency adoption. Notably, President Donald Trump’s administration has proposed creating a national Bitcoin Strategic Reserve, a policy supported by several legislators and industry leaders.

However, skeptics, such as Nic Carter from Castle Island Ventures, warn that such a move could undermine the U.S. dollar’s position as the global reserve currency. Meanwhile, countries like Russia appear poised to establish their own Bitcoin reserves, potentially escalating geopolitical competition in the cryptocurrency space.

Bitcoin Price Trends and Influences

Bitcoin’s price movements have been closely tied to macroeconomic policies, such as Federal Reserve interest rate decisions. Following the Fed’s recent 25 basis point rate cut, Bitcoin’s price dipped slightly, continuing a downward trend before stabilizing around $101,685.

Despite short-term volatility, Bitcoin has demonstrated significant growth, surpassing its previous all-time high and climbing to over $107,000 earlier in December.

This rally has been fueled by factors including the approval of Spot Bitcoin ETFs and growing skepticism about the U.S. dollar’s long-term stability.

The Role of the Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart, a popular tool in the crypto community, offers a visual representation of Bitcoin’s historical price movements. Using color-coded bands, the chart categorizes market sentiment from “Still Cheap!” to “Sell. Seriously, SELL!”

Here’s a summary of the Bitcoin price zones based on the Bitcoin Rainbow Chart above:

1. Fire Sale (Blue)

– Price: Extremely undervalued.

– Situation: Occurs during bear markets or sharp corrections.

– Ideal Action: Buy aggressively, as this phase reflects extreme pessimism or market overselling.

2. BUY! (Light Blue)

– Price: Low, but with slightly more market confidence than the Fire Sale zone.

– Situation: A favorable time for long-term accumulation.

– Ideal Action: Consider buying Bitcoin.

3. Accumulate (Green)

– Price: Still undervalued, but less so than previous zones.

– Situation: Seen as a good time to accumulate for long-term growth.

– Ideal Action: Build Bitcoin holdings for future potential gains.

4. Still Cheap (Dark Green)

– Price: Starting to rise but still relatively inexpensive.

– Situation: Often occurs during recovery phases after major corrections.

– Ideal Action: Buy or hold depending on your strategy.

5. HODL! (Yellow)

– Price: Rising steadily, and market optimism returns.

– Situation: No longer an ideal time for large purchases.

– Ideal Action: Hold onto your Bitcoin.

6. Is this a bubble? (Light Orange)

– Price: Approaching speculative levels.

– Situation: Market may be overheating.

– Ideal Action: Hold or prepare an exit strategy if you think the market is nearing its peak.

7. FOMO Intensifies (Orange)

– Price: Speculative behavior dominates as Fear of Missing Out (FOMO) drives prices.

– Situation: Gains can still be made, but risks increase significantly.

– Ideal Action: Consider taking profits or selling part of your holdings.

8. Sell. Seriously, SELL! (Red)

– Price: Extreme market euphoria, entering bubble territory.

– Situation: Prices are unsustainable, and corrections are likely.

– Ideal Action: Sell your Bitcoin, as the market peak may be near.

9. Maximum Bubble Territory (Dark Red)

– Price: Peak of speculative mania, extremely high prices.

– Situation: Often followed by sharp corrections.

– Ideal Action: Sell all remaining Bitcoin if you haven’t already.

This chart helps investors strategize based on Bitcoin’s market cycles and price trends.

Bitcoin Price Prediction 2025

Bitcoin price prediction 2025 by analysts could reach between $120,000 and $150,000 by mid-2025, driven by reduced leverage and increased institutional participation. Factors such as ETF approvals and the potential implementation of Trump’s Bitcoin reserve strategy are expected to fuel this growth.

However, risks remain, including the possibility of “stagflation”—a combination of high inflation and economic stagnation—as noted by analysts from The Kobeissi Letter.

If the Federal Reserve mismanages interest rate cuts amidst rising inflation, it could exacerbate market volatility.

Bitcoin: A Long-Term Projections

Michael Saylor, CEO of MicroStrategy, has forecasted that Bitcoin could grow at an average annual rate of 29% over the next 21 years, potentially reaching $13 million by 2045.

This ambitious projection aligns with models based on adoption rates and market cycles. For 2025, estimates suggest a peak price of $261,000, supported by the Rate of Adoption model and enhanced by the rising popularity of Bitcoin ETFs.

Conclusion: Key Takeaways for Investors

As the crypto market continues to evolve, understanding these dynamics will be crucial for navigating opportunities and risks in this rapidly changing landscape. Here some points that you have to pay attention for as investors in crypto market:

1. Regulatory Landscape: The Federal Reserve’s current position and the legal framework surrounding Bitcoin reserves remain unchanged. Investors should monitor developments in government policy and international competition.

2. Market Timing: Tools like the Bitcoin Rainbow Chart provide valuable insights into market phases, aiding in strategic investment decisions.

3. Economic Indicators: Macroeconomic factors, including inflation rates and Federal Reserve policies, will play a critical role in shaping Bitcoin’s trajectory.

4. Long-Term Potential: While short-term volatility is expected, historical patterns suggest strong long-term growth for Bitcoin, making it a valuable asset for patient investors.

by Penny Angeles-Tan | Dec 18, 2024 | Lifestyle

This holiday season, The Manila Hotel invites guests to enjoy a festive experience that combines cherished traditions with a modern touch. This year, the hotel offers a delightful array of holiday packages designed to spread joy and create lasting memories.

Café Ilang-Ilang’s Festive Buffet

Celebrate the season with an indulgent international buffet at Café Ilang-Ilang. Whether you’re dining on Christmas Eve, Christmas Day, New Year’s Eve, or New Year’s Day, you can enjoy a culinary experience that truly captures the festive spirit. Prices start at PHP 5,000 net per person for lunch or dinner buffets.

Chic Celebration at the Champagne Room

Experience the joy of the holidays with an exquisite culinary journey. Enjoy a special lunch and dinner set menu on December 24 and 25, 2025, for PHP 5,500 net per person. Choose from an enticing selection of main courses, including oven-roasted Gindara Fillet, Grilled U.S. Beef Tenderloin, or Sous Vide Turkey Breast in Truffle Cream.

On New Year’s Eve, indulge in a lavish dinner buffet priced at PHP 7,850 net per person. Then, on January 1, 2025, celebrate the New Year with a luxurious set menu available for PHP 6,000 net per person, featuring main course options such as Oven Roasted Sea Bass, Roast Lamb Rack in Herb Crumble, Grilled Angus Rib Eye, or Grilled Kurobuta Pork Cutlet.

Guests are invited to embark on a culinary journey through the rich flavors of traditional Chinese cuisine at Red Jade. This holiday offering features a sumptuous set menu, perfect for sharing with family and friends. The festive menus are available for lunch and dinner on December 24, 25, and 31, 2024, as well as January 1, 2025. Each menu is priced at PHP 3,888 net per person, with a minimum of four diners required per table.

Delicatessen Holiday Treats

The Delicatessen offers a delightful selection of festive treats, including wreath-shaped macarons, fruitcakes, stollen bread, pralines, and Santa Claus-themed chocolates. These goodies are perfect for gifting or personal indulgence, adding a touch of sweetness to the holiday season. They will be available until January 5, 2025.

Festive Merrymaking at Tap Room and Lobby Lounge

Say goodbye to the old year and welcome the new one with a Tapas Buffet and Beer celebration! Guests can indulge in unlimited tapas paired with two glasses of local beers or non-alcoholic beverages for PHP 3,550 net per person. The tapas selection includes a variety of options such as assorted cold cuts, cocktail sausages, a cheese board, ceviche shooters, Italian mortadella sliders, Spanish croquetas with jamón, Swedish meatballs in mushroom sauce, and crema catalana, among others. Join us at the Tap Room on December 31, 2024, from 7:00 PM to 11:00 PM.

Special Festive Menu at Lobby Lounge

From December 1, 2024, to January 6, 2025, excluding New Year’s Eve, the Lobby Lounge will introduce a special festive menu. This menu features a variety of holiday-inspired à la carte dishes, including Turkey Fricassee in Mushroom Cream Sauce, Smoked Ham with Turkey Breast and Edam Cheese, Filipino-style Christmas Ham, and Gingerbread Blondie Cookies. Available daily from 11:00 AM to 11:00 PM, this menu offers something for everyone and serves as an ideal setting for gatherings with family, friends, or colleagues.

Raise a toast to the holidays with specialty drinks crafted to evoke the spirit of the season. Enjoy the following offerings:

- Lotus Biscoff Frappe: A creamy blend of spiced Lotus Biscoff and smooth frappe.

- White Chocolate Mocha: Perfect for those seeking something sweet and luxurious.

- Frozen Spiced Chai: A creamy, spiced brew with gentle vanilla notes.

- Christmas S’mores Cocktail: A delightful mix of chocolatey marshmallow flavors reminiscent of campfire memories.

These holiday beverages are available at the Tap Room, Lobby Lounge, and Pool Bar until January 31, 2025, priced at PHP320 each.

For a more intimate celebration, The Manila Hotel’s In-Room Dining service offers specially curated holiday menus available from December 20, 2024, to January 2, 2025, from 6:00 PM to 9:00 PM.

For PHP 2,650 net, guests can choose between two delicious options: one menu features all-time favorites like Roast Turkey and Pork Barbecue Ribs, while the other includes Filipino staples such as Chicken Inasal and Lechon Baboy. Each order serves two persons.

Experience the excitement of live entertainment, a stunning atmosphere, and festive decorations that create the perfect setting for an unforgettable New Year’s Eve celebration.

The Manila Hotel’s countdown party at the Grand Lobby promises an evening filled with vibrant performances by local artists and the cherished company of friends and family as guests welcome 2025 in style.

For inquiries and reservations, please call +632 8527 0011 or +632 5301 5500, local extensions 1261-1264, or email us at re************@************el.com. For more information, visit www.manila-hotel.com.ph.

The Manila Hotel steeped in a rich history since 1912, is located beside kilometer zero (0), where the City of Manila begins, and is within walking distance from the Philippines’ known landmarks: Rizal Park, Intramuros, and National Museums.

The Manila Hotel steeped in a rich history since 1912, is located beside kilometer zero (0), where the City of Manila begins, and is within walking distance from the Philippines’ known landmarks: Rizal Park, Intramuros, and National Museums.

Defined by its history, elegance, and world-class service, The Manila Hotel is the choice hotel for the most distinguished clientele. Since 1912, The Manila Hotel has continuously provided the best services and amenities for a truly memorable experience. It has more than 500 well-appointed rooms and 22 function rooms, including three (3) ballrooms.

Apart from these, the hotel offers five-star relaxation and wellness experiences with the Manila Hotel Spa, adult and children’s pools, and the Manila Hotel Health Club. The hotel is home to the Heritage Museum, a treasure trove of priceless memories that narrate its illustrious past. It also has an Art Gallery that offers a window into a contemporary world, captured through the objective point of view of different artists.

It has six (6) dining outlets, each offering a unique culinary adventure: Café Ilang-Ilang, which is a favorite spot for its extensive selection of International buffet delights; Champagne Room with its Old European style fine dining and also hailed as the most romantic room in Manila—it features European cuisine in a posh, fine-dining setting; Tap Room, an Old English pub-inspired outlet where one can enjoy an evening of live music; Lobby Lounge which is ideal for casual dining, aperitif, post-dinner nightcaps, or leisure meetings; Red Jade, a fine dining restaurant that serves authentic Chinese cuisine; and Delicatessen that offers the hotel’s signature pastries, bread, chocolates, and pralines.

The Manila Hotel steeped in a rich history since 1912, is located beside kilometer zero (0), where the City of Manila begins, and is within walking distance from the Philippines’ known landmarks: Rizal Park, Intramuros, and National Museums.

The Manila Hotel steeped in a rich history since 1912, is located beside kilometer zero (0), where the City of Manila begins, and is within walking distance from the Philippines’ known landmarks: Rizal Park, Intramuros, and National Museums.

You must be logged in to post a comment.