by Penny Angeles-Tan | Nov 19, 2024 | Business

The crypto market has been volatile following Donald Trump’s 2024 election victory. With Bitcoin hitting new all-time highs, will another crypto winter follow? Learn what a crypto winter is, why it happens, and strategies like dollar-cost averaging and diversification to survive and thrive during these challenging market conditions.

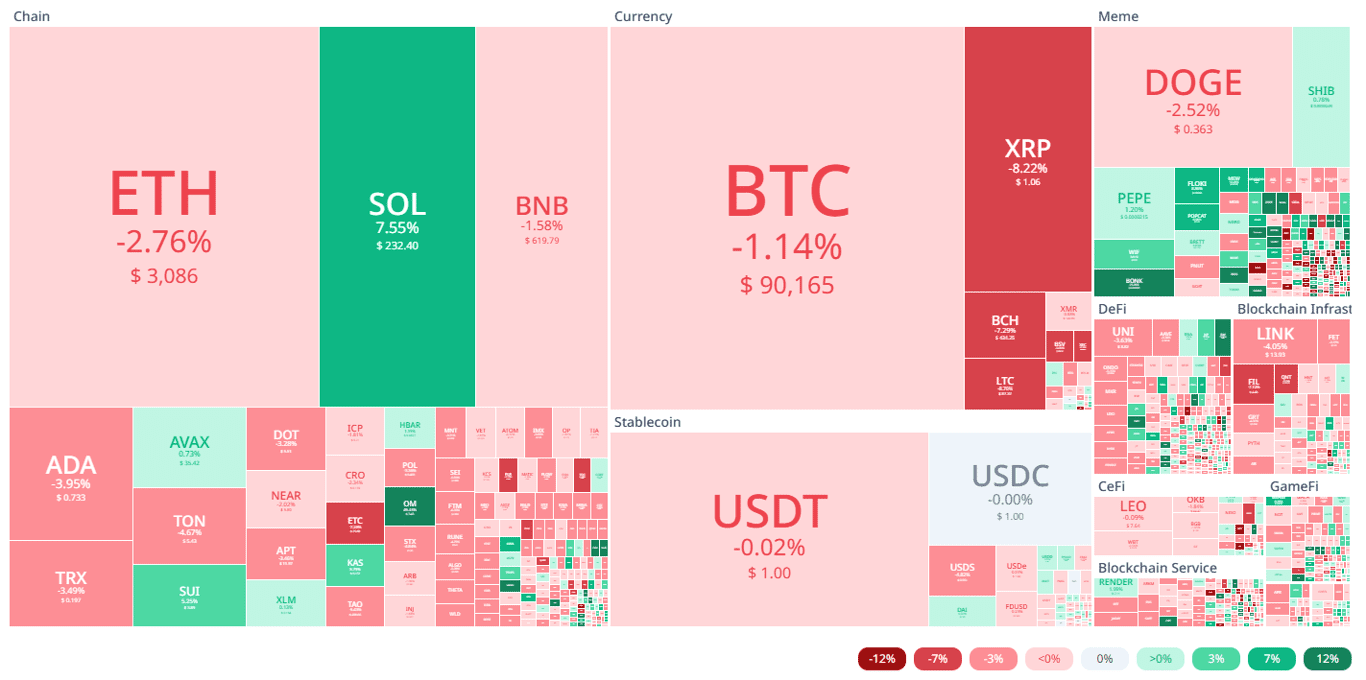

In the two weeks of November, the crypto ecosystem has been like a roller coaster. Starting from Donald Trump’s victory in the 2024 US Election, the crypto ecosystem has suddenly strengthened.

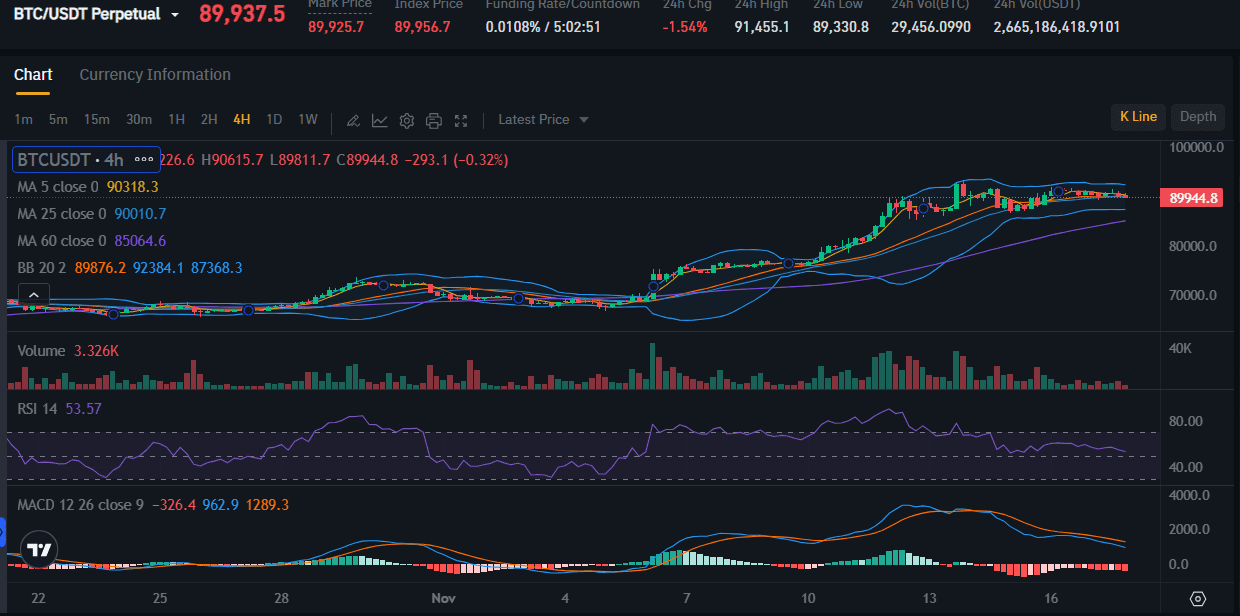

Bitcoin’s price has even always reached a new ATH every day, starting from $87,000 to over $90,000. However, in the last few days, the majority of crypto tokens have suddenly turned red. BTC is still at a price of over $90,000, but its condition continues to decline.

Will the crypto ecosystem experience another crypto winter like in 2022-2023? Let’s discuss it together in this article.

Understanding the Beast: What is a Crypto Winter?

The cryptocurrency market, known for its wild swings, has experienced periods of intense volatility, often called “crypto winters.” These extended periods of declining prices can be challenging and rewarding for investors.

While it’s impossible to predict a crypto winter’s exact timing and duration, understanding its dynamics and employing effective strategies can help you navigate these turbulent times.

A crypto winter is essentially a prolonged bear market in the cryptocurrency space. It’s characterized by a significant and sustained decline in the prices of most cryptocurrencies, often accompanied by reduced trading volumes and investor sentiment.

These downturns can be triggered by various factors, including economic downturns, regulatory uncertainty, or even a loss of confidence in the underlying technology.

Surviving the Freeze: Strategies for a Crypto Winter

While crypto winters can be daunting, they also present unique opportunities for those who are prepared. Here are some strategies to help you weather the storm:

1. Dollar-Cost Averaging (DCA)

One of the most effective strategies to mitigate the impact of market volatility is dollar-cost averaging. This involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of the price.

By consistently buying, you reduce the average cost of your investment and smooth out the impact of price fluctuations.

2. Diversification

Don’t put all your eggs in one basket. Diversifying your portfolio across multiple cryptocurrencies and blockchain projects can help spread risk. Consider investing in different sectors, such as DeFi, NFTs, and blockchain infrastructure, to reduce exposure to any single asset or technology.

3. Risk Management

Risk management is crucial during a crypto winter. Setting stop-loss orders can help limit potential losses by automatically selling your cryptocurrencies at a predetermined price.

Additionally, taking profits when prices rise can secure your gains and reduce your exposure to further downside.

4. Long-Term Perspective

The cryptocurrency market is still in its early stages, and long-term trends often outweigh short-term fluctuations. By maintaining a long-term perspective, you can weather the storms and focus on the underlying potential of the technology.

5. Explore Alternative Income Streams

Crypto winters can be an opportunity to explore alternative income streams within the crypto ecosystem. Staking, lending, and yield farming are some popular ways to generate passive income with your cryptocurrency holdings.

6. Community Engagement

Joining online communities and forums can help you stay informed, connect with other crypto enthusiasts, and gain valuable insights. Engaging with the community can also boost your morale and provide support during challenging times.

Conclusion: Navigating the Bear Market

While crypto winters can be a daunting experience, they are a natural part of the market cycle. By understanding the underlying factors, employing sound investment strategies, and maintaining a long-term perspective, you can navigate these periods with confidence.

Remember, the key to surviving and thriving in a crypto winter is to maintain a long-term perspective, diversify your portfolio, and adapt to changing market conditions.

If you want to know how the crypto ecosystem is doing every day, you can visit the Bitrue blog directly. There are many articles for you to read so that you are always updated with the developments in the crypto and blockchain world.

by Penny Angeles-Tan | Nov 18, 2024 | Business

Solana’s price surge, bullish technical indicators, and strong on-chain metrics suggest a potential breakout, with the cryptocurrency eyeing a new all-time high of $250. Explore Solana’s technical outlook, regulatory developments, and factors influencing its growth amidst market volatility.

Solana, the high-performance blockchain platform, has been making significant strides in the cryptocurrency market.

Its recent price surge, coupled with positive on-chain metrics and favorable regulatory developments, has positioned it for a potential breakout even though the crypto market is experiencing a lot of price declines today.

With the current performance, is it true that Solana will soon reach its new ATH at $250? Can Solana reach the resistance price to reach the new ATH? Check out the explanation below.

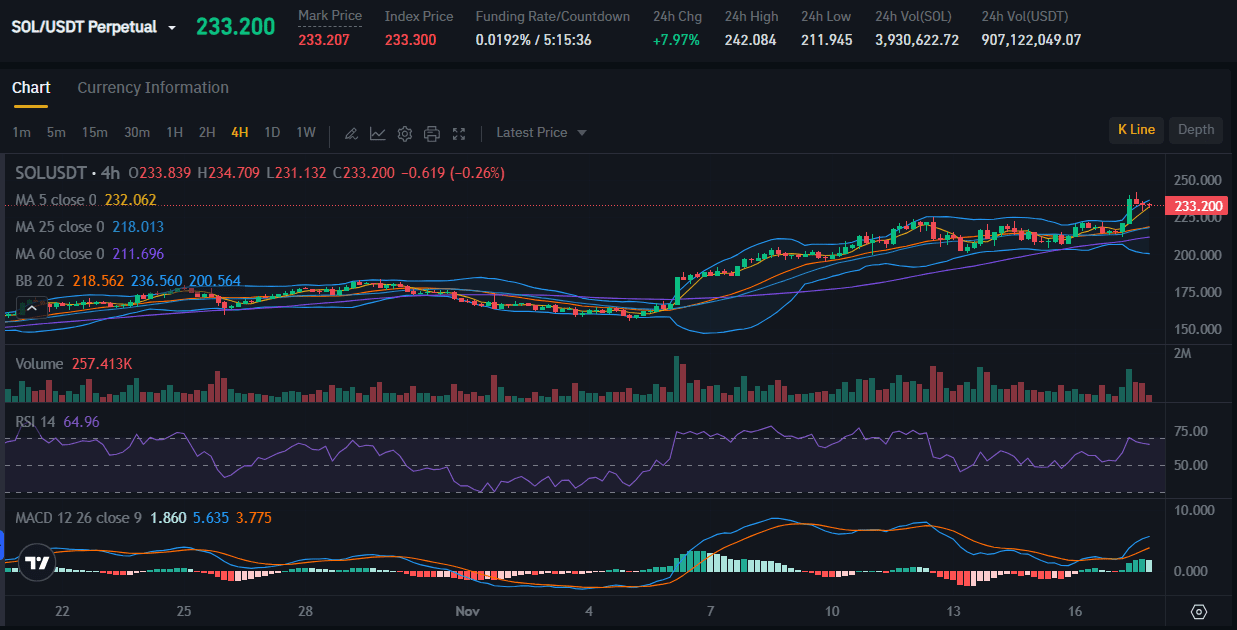

Solana’s Technical Analysis: A Bullish Outlook

At the time of writing this article on November 18, Solana’s price is currently at $233,200. This increase is supported by the RSI value which is at 64.96, which means that the buying trend is more dominant than the selling trend. Solana’s MACD line also shows a bullish signal.

Solana’s technical analysis paints a bullish picture. The cryptocurrency has successfully broken out of a symmetrical triangle pattern, indicating a strong upward trend. The $222 resistance level has now turned into support, providing a solid foundation for further growth.

However, the current price range between $234 and $242 represents a critical zone. A decisive break above $242 could propel SOL towards higher resistance levels, potentially reaching its all-time high. Conversely, a failure to hold this level could lead to a correction.

On-Chain Metrics: Signaling Strength

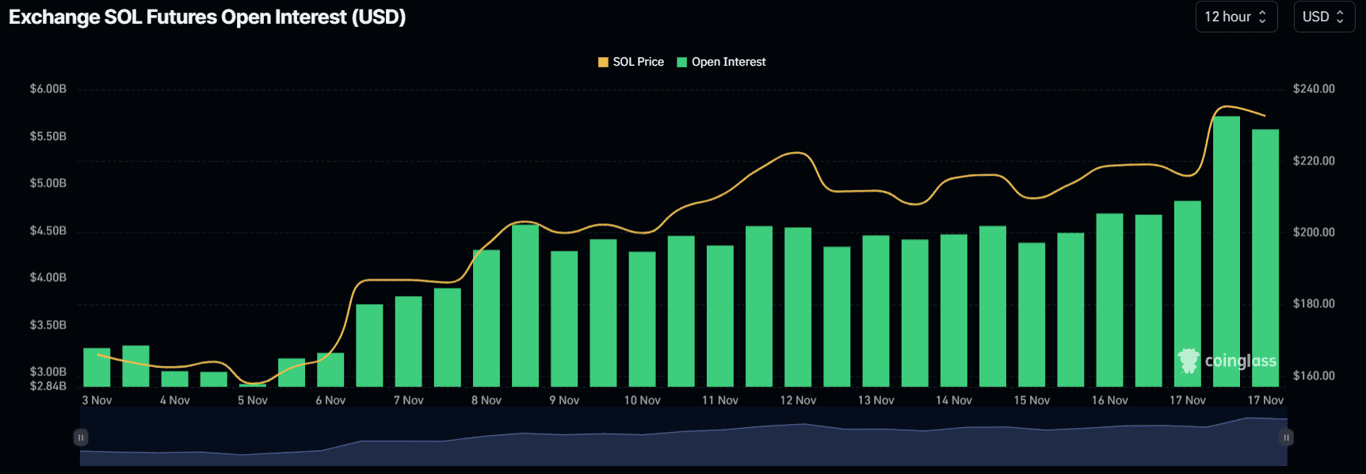

On-chain metrics further support Solana’s bullish outlook. A significant spike in open interest and dominance of long positions among traders indicate strong investor confidence.

Additionally, Solana’s impressive transaction volume, particularly during the US election week, highlights its growing adoption and network activity.

Regulatory Tailwinds and Institutional Interest

The potential for a Solana ETF listing in the US has generated significant excitement among investors. A favorable regulatory environment, especially under a crypto-friendly administration, could accelerate institutional adoption of Solana.

Market Sentiment and Bitcoin’s Influence

The broader cryptocurrency market, particularly Bitcoin, is also experiencing a bullish trend. Bitcoin’s recent price surge could further fuel the momentum of altcoins like Solana.

However, on the same day, the price of BTC decreased. From its highest price and latest ATH at $91,455, the price of BTC is now $89,937 with a decrease of 1.54%.

Conclusion

Solana’s combination of strong technical analysis, positive on-chain metrics, and favorable external factors positions it for a potential breakout. However, it’s crucial to remember that the cryptocurrency market is inherently volatile.

While the current outlook is bullish, it’s essential to exercise caution and conduct thorough research before making investment decisions. Stay updated on market trends, regulatory developments, and technical analysis to navigate the dynamic world of cryptocurrencies.

For those of you who are interested in investing in crypto, you can do in-depth research first so you know what strategy to apply. If your research is thorough, you can get maximum benefits from investing.

Bitrue has many features that can help you do research before buying a crypto coin. Starting from checking coin prices to converting from token price to USD, you can also do it easily on the Bitrue website.

by Penny Angeles-Tan | Nov 15, 2024 | Business

Is altcoin season on the horizon? With Bitcoin hitting new highs, key indicators suggest an altcoin boom may be approaching. Learn what to watch for and when the next altcoin surge could happen.

The cryptocurrency market is buzzing with excitement as Bitcoin reaches new heights. On November 14th, 2024, Bitcoin surged past its previous high of $73,000 in March 2024, reaching a staggering $90,250. This surge has many investors wondering: when will the next altcoin season arrive?

Some experts attribute Bitcoin’s recent success to the U.S. presidential election results. However, the bigger question for many is whether altcoins will experience a similar boom.

Understanding Altcoin Season

While Bitcoin season signifies a period of high demand and rising prices, altcoin season refers to a surge in interest and value for alternative cryptocurrencies, such as Solana (SOL) and Ethereum (ETH).

Multiple factors can indicate an altcoin season, including:

1. Increased Altcoin Dominance: This metric measures the combined market capitalization of all altcoins compared to Bitcoin. A dominance level exceeding 75% for altcoins over three months is often considered a sign of an altcoin season.

2. Rising Trading Volumes: Increased trading activity for altcoins suggests growing investor interest.

3. Coin Price Breakouts: Altcoins experiencing significant price increases can signify the beginning of a season.

4. Altcoin Season Index: Third-party tools track various factors to generate an altcoin season index.

Is Altcoin Season Here?

As of November 11th, 2024, the altcoin season index suggests we are not yet in an altcoin season with its altcoin rating at 37. However, several indicators suggest it could be on the horizon:

1. Total Market Cap Excluding BTC and ETH: This metric focuses on the overall market capitalization of altcoins, excluding Bitcoin and Ethereum’s influence. A recent breakout in this metric could indicate an altcoin surge.

2. Dogecoin’s Fibonacci Level: Dogecoin (DOGE) is often considered a barometer for the altcoin season. DOGE’s recent rise above its key 50% Fibonacci level can be interpreted as a positive sign.

3. U.S. Dollar Strength: A weak U.S. Dollar (USD) often coincides with a strong crypto market. The USD’s inability to break past its 50% Fibonacci level suggests continued strength for cryptocurrencies.

Cardano (ADA) and Dogecoin (DOGE): A Tale of Two Altcoins

Cardano (ADA) is a utility-focused altcoin experiencing steady growth. ADA price sits around $0.5797, with a healthy trading volume. While short-term sentiment may be cautious, long-term prospects for Cardano appear promising.

Dogecoin (DOGE), on the other hand, faces a potential decline. While still actively traded, investor focus seems to be shifting towards altcoins with real-world applications. Data suggests a high concentration of DOGE ownership among a small group, potentially impacting price stability.

The Future of Altcoins

With Bitcoin reaching record highs, expectations for a robust altcoin season are rising. Investors should monitor key indicators and conduct thorough research before making investment decisions in any cryptocurrency.

1. Regulatory Impact on Altcoins

Government regulations can significantly impact the cryptocurrency market. Favorable regulations can boost investor confidence and lead to increased market participation. Conversely, stringent regulations can stifle innovation and hinder market growth.

The U.S. Securities and Exchange Commission (SEC) plays a crucial role in shaping the regulatory environment for cryptocurrencies. The SEC’s stance on cryptocurrencies, particularly regarding security tokens, can influence the trajectory of altcoins.

2. Institutional Adoption of Altcoins

Institutional investors, such as hedge funds, pension funds, and endowments, have the potential to significantly impact the cryptocurrency market. As more institutions adopt cryptocurrencies, it could lead to increased market liquidity and price stability.

However, institutional adoption is often hindered by regulatory hurdles, security concerns, and a lack of understanding of the underlying technology. As the regulatory landscape evolves and institutional investors become more comfortable with cryptocurrencies, we may see increased interest in altcoins.

Conclusion

While the current market conditions seem favorable for an altcoin season, it’s essential to approach with caution. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Investors should conduct thorough research and consider the risks involved before making any investment decisions.

By staying informed about market trends, regulatory developments, and technological advancements, investors can make informed decisions and potentially capitalize on the opportunities presented by the altcoin market.

Stay updated with everything in the crypto ecosystem by continuing to visit the Bitrue website and reading articles on the Bitrue blog. Bitrue also has many features, such as checking crypto token prices in real-time, knowing how to convert crypto token prices to USD easily, and participating in various events with crypto token prizes so you can get maximum benefits.

by Penny Angeles-Tan | Nov 12, 2024 | Business

The seven tokens that will be discussed in this article are AIOZ, AMC, PIXFI, GME, EQ9, DEGEN, and ACT. Here is the analysis and discussion.

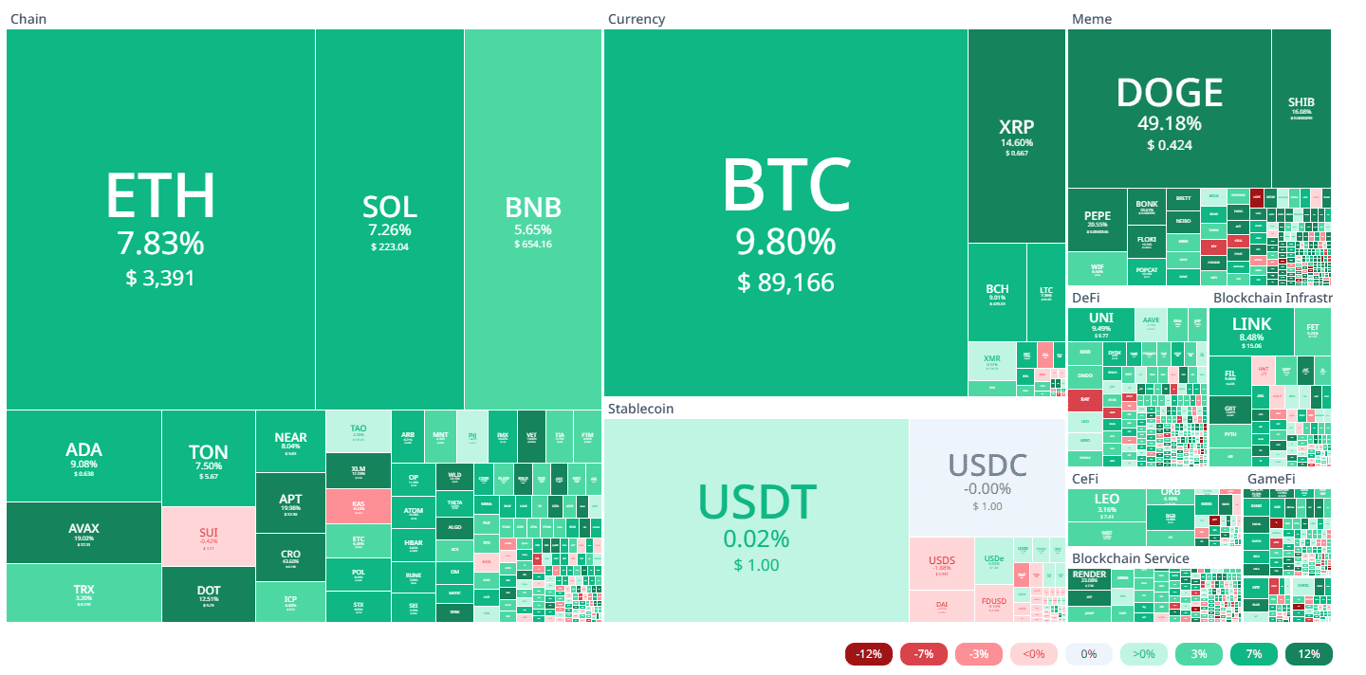

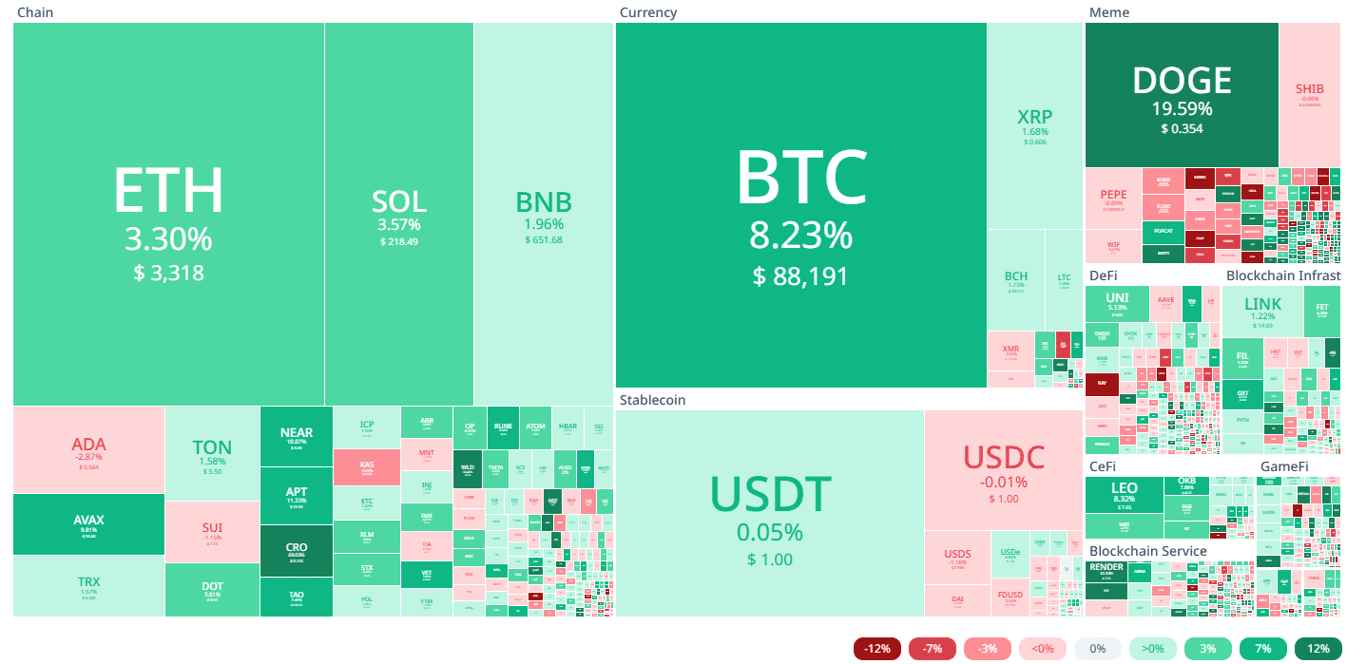

In today’s crypto heatmap on Cryptorank, the crypto ecosystem is greening up. In the joy of crypto investors who see major tokens such as BTC, ETH, SOL, XRP, to USDT experiencing significant increases, other alternative tokens are no less positive.

In this article, you will find out what are the 7 crypto tokens that have increased by more than 50%. It will be presented specifically for you how the price charts of the seven crypto tokens so that you can do their technical analysis.

7 Crypto Tokens with More Than 50% Increase

Today, BTC has again set a record with its new ATH. With a 9.80% increase, Bitcoin is currently trading at $89,166, up more than $8,000 from yesterday’s price of only $81,000.

Other major tokens such as Ethereum, Solana, XRP, and USDT have also experienced significant increases. The price of Ethereum today has even reached almost $4,000 with an increase of 7.83%. Solana is even at $223.04 with an increase of 7.26%.

In addition to the major tokens, other altcoins have also experienced a very significant increase of more than 430%. The token is Act I: The AI Prophecy which is currently on the rise.

The seven tokens that will be discussed in this article are AIOZ, AMC, PIXFI, GME, EQ9, DEGEN, and ACT. Here is the analysis and discussion.

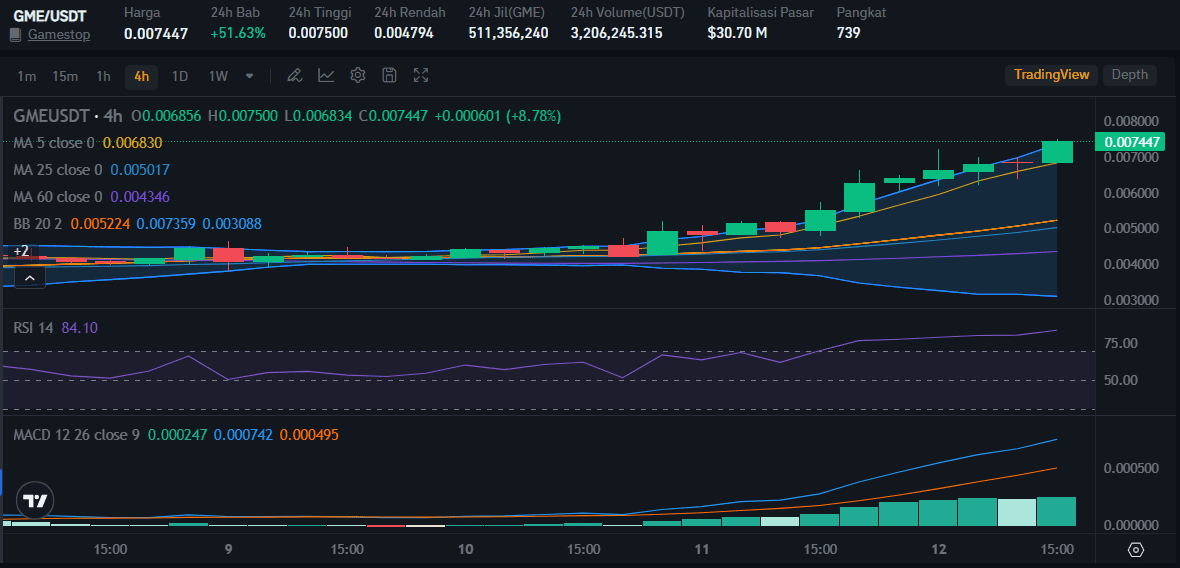

1. Gamestop (GME)

Percentage increase: 51,63%

Sector: Gaming, Memes, Solana Ecosystem

Market Capitalization: $52.12M

Total supply: 6.89B GME

The crypto token with the ticker GME went viral in 2021 due to its unexpected price spike. Roaring Kitty, an online broadcaster, was the cause of GameStop’s rally at that time.

Now, GME is experiencing an increase that cannot be underestimated. With an increase of more than 51%, GME is currently trading at $0.007447 with its highest price in 24 hours being $0.007500. GME’s market capitalization has also increased by 65.86% currently.

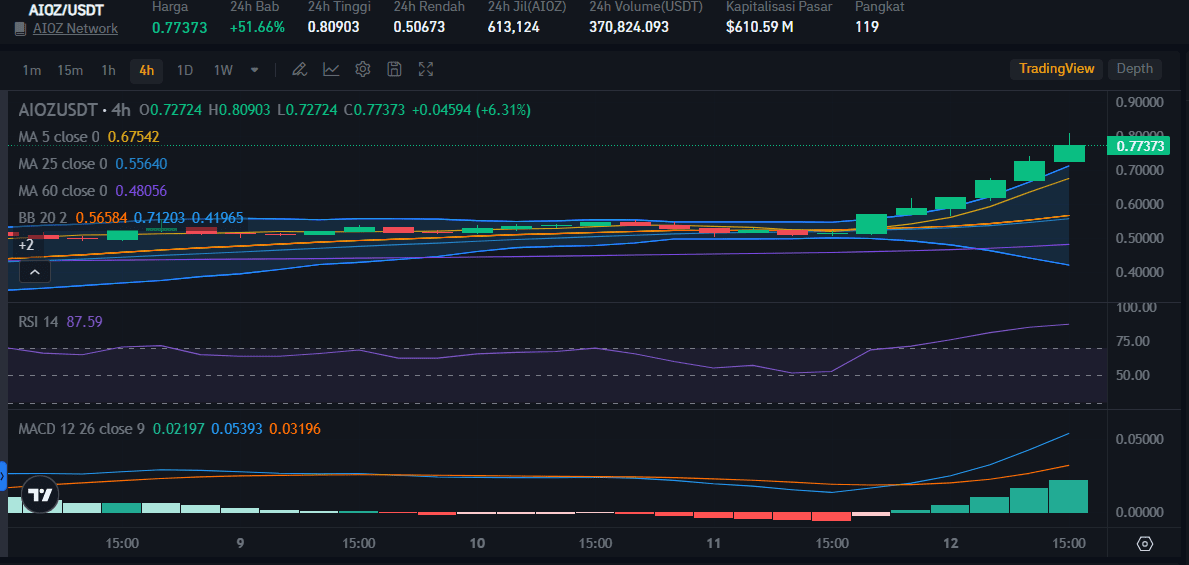

2. AIOZ Network (AIOZ)

Percentage increase: 51,66%

Sector: Media, Platform, AI & Big Data

Market Capitalization: $847.21M

Total supply: 1.14B AIOZ

AIOZ Network is currently focusing on building its AIOZ W3AI V3 with a focus on AI training with Decentralized Federated Learning to Spaces for building AI dApps.

AIOZ has more than 7 years of experience in its active development and will continue to update to broader development in the blockchain ecosystem, nodes, to infra.

Today, the AIOZ token has increased by 51.66% so that the current AIOZ price is $0.77373. The AIOZ RSI value is already in the overbought stage because it is at 87.59.

3. Dogecoin (DOGE)

Percentage increase: 53,15%

Sector: Mineable, PoW, Scrypt

Market Capitalization: $62.45B

Total supply: 146.76B DOGE

Dogecoin today is experiencing an increase of up to 53.15% so it is now for $ 0.42597. Previously, in 24 hours, DOGE was at its highest price of $ 0.43744.

This Shiba Inu-inspired memecoin has Dogecoin Core which is open-source and community-driven software. The development process is very open to the public so that everyone can see, discuss, and even develop the software.

4. Pixelverse (PIXFI)

Percentage increase: 64,02%

Sector: Gaming, Toncoin Ecosystem, Tap To Earn (T2E)

Market Capitalization: $7.98M

Total supply: 5B PIXFI

Pixelverse, which started from a successful Telegram game, has indeed received high support since its launch. With its PIXFI token, Pixelverse has succeeded in strengthening its presence in the crypto ecosystem.

In its mini-game on Telegram, Pixelverse has many interesting features, ranging from PvP Battles, Referral programs, Daily Combo, to Daily Rewards.

Now, the price of PIXFI has reached $0.007378 and is one of the crypto tokens from the Telegram game with a very high increase in this exciting week of crypto. With an increase of more than 64%, PIXFI is increasingly showing its ability to be bullish.

5. Degen (DEGEN)

Percentage increase: 77,55%

Sector: Memes, Base Ecosystem

Market Capitalization: $245.10M

Total supply: 36.97B DEGEN

DEGEN is currently trading at $0.01891 after experiencing a 77.55% increase. DEGEN’s RSI figure is very high at 86.56 which means there is already a red code because it is overbought. The MACD line is undoubtedly increasing by a fairly large distance which means that there is currently a bullish trend.

DEGEN was created in the realm of strong meme culture. Degen also has Degen Chain which is a pioneer of L3s in the Base network. There, users can build and use Degen apps.

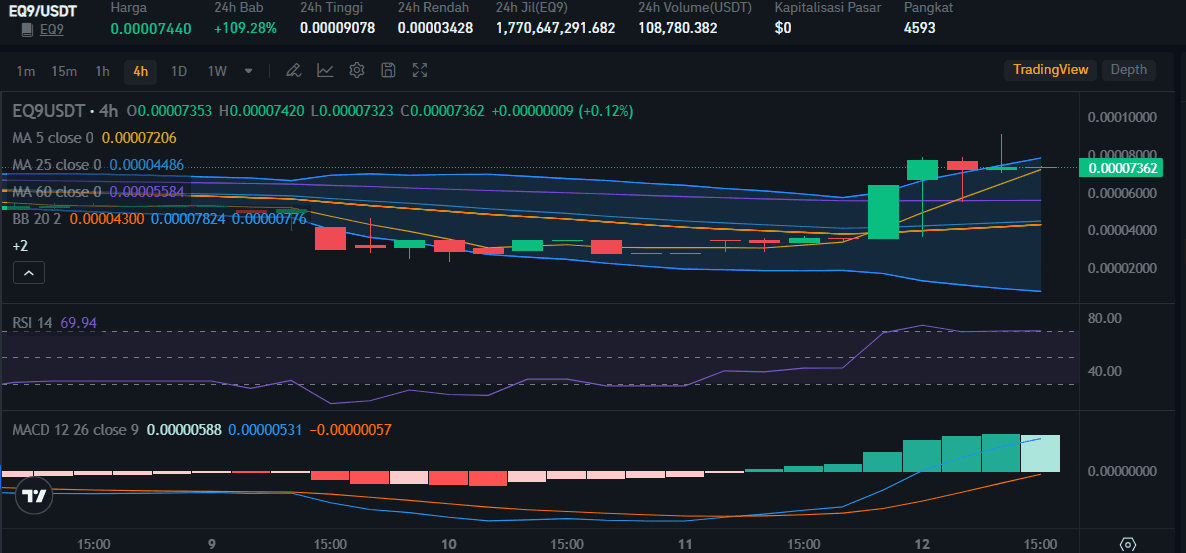

6. EQ9 (EQ9)

Percentage increase: 109,28%

Sector: dApps

Market Capitalization: $30.65K

Total supply: 1.80B EQ9

EQ9 created by a company called EQUALS9 ENTERPRISES & PARTNERSHIPS is a corporation from Brazil. This company focuses on controlling its various subsidiaries in various sectors. This company then created the EQ9 token as a bridge in the integration of their business ecosystem with blockchain.

When this article was written on November 12, EQ9 experienced a surprising increase because the percentage increase was more than 109%. Now, EQ9 is trading at $0.0007440 in 24 hours.

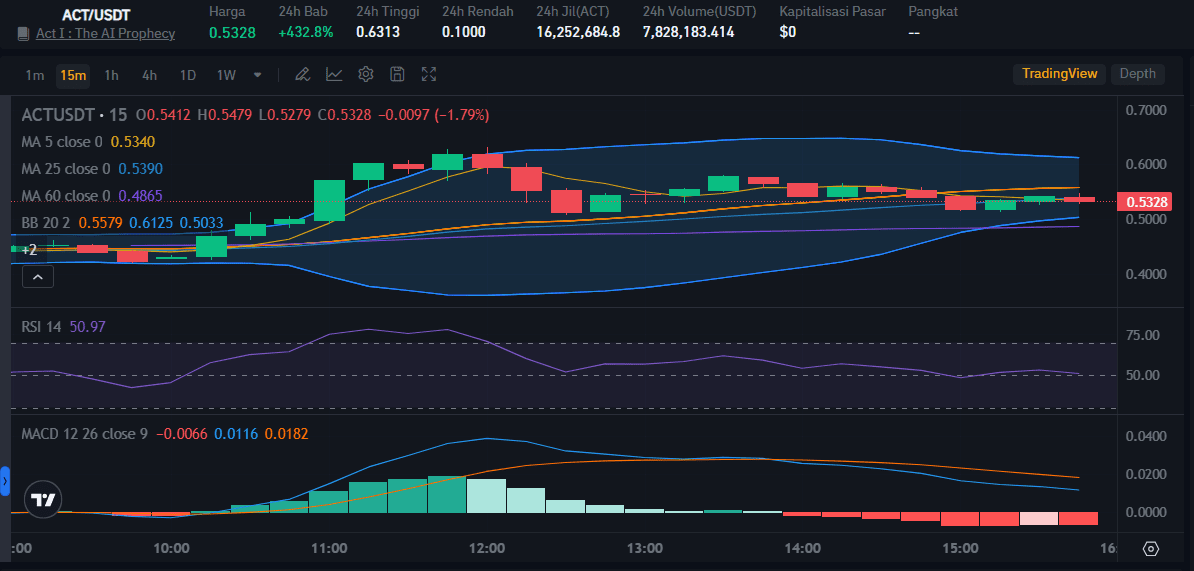

7. Act I: The AI Prophecy (ACT)

Percentage increase: 432,8%

Sector: Memes, Solana Ecosystem, AI Memes

Market Capitalization: $507.58M

Total supply: 948.25M ACT

Act I: The AI Prophecy (ACT) is currently experiencing hype due to its launch on various global crypto exchanges. ACT is a decentralized open-source project. Its goal is to create an interactive AI ecosystem. Users can freely interact with AI.

Because of this promising system, the ACT token has received high support. Currently, ACT has even experienced a very fantastic price increase of 432.8% so it is currently traded for $ 0.5328.

The ACT RSI value even tends to be normal with a more dominant buying trend than the selling trend. The MACD line looks down, but it does not eliminate the possibility that ACT will experience a greater bullish shortly.

Conclusion: DYOR

That’s an explanation of the 7 crypto tokens that have increased by more than 50% today. Always remember to do in-depth research before trading crypto. That way, you will know the risks of each token. Crypto prices are volatile, so strategize so you can get maximum profit in crypto investment.

Bitrue can help you in doing research. You can check prices, convert prices from token prices to USD, and check the latest information on every project in the crypto ecosystem.

by Penny Angeles-Tan | Nov 11, 2024 | Business

Bitcoin has shattered its previous all-time high, reaching over $87,000. With its bullish trend continuing, many are wondering if BTC will hit $100,000 this November. Read on to explore the factors driving Bitcoin’s price surge, its dominance in the crypto market, and what could push it past $100K in the coming months.

Bitcoin breaks its new ATH! Today, Bitcoin price hits over $87,000 with its highest price at $81,844. Will Bitcoin reach $100,000 faster than predicted in Q1 2025? Let’s read the explanation in this article until the end.

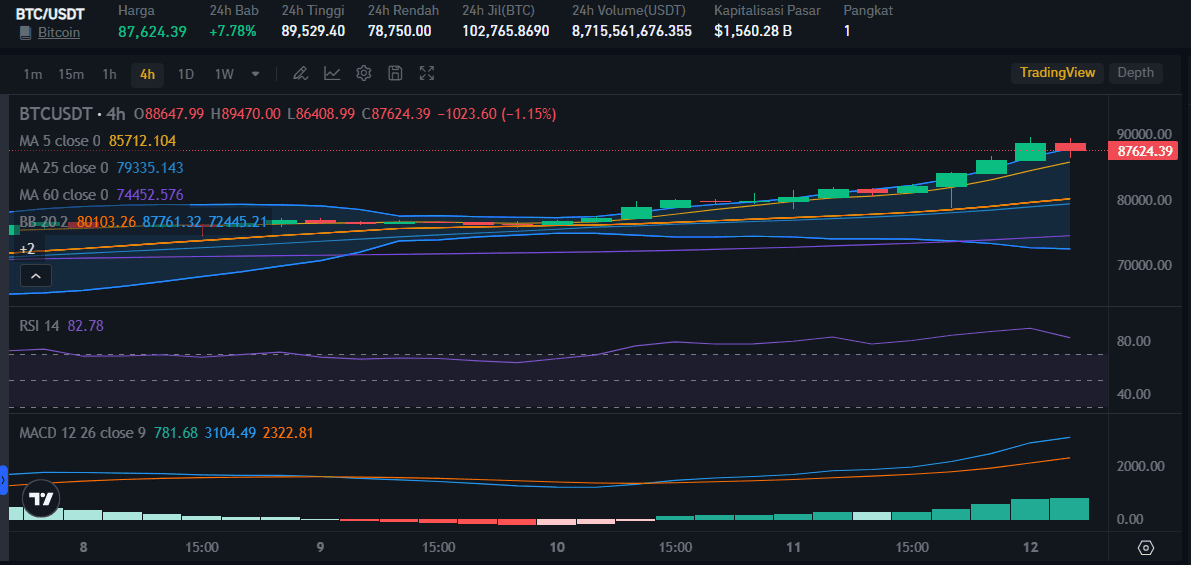

Bitcoin Price Today

On November 12, Bitcoin’s price was $87,624. This increase is fantastic because it has increased by approximately $3,000 from its lowest price of $78,750 in a matter of hours.

The Bitcoin price chart above shows that the BTC RSI value is very high, at 82,78, which could indicate overbought conditions.

The Bitcoin MACD line is far above the limit line which means that a bullish trend is occurring. If this line remains in this condition, Bitcoin will continue its bullish trend not only today and could break through its new ATH again.

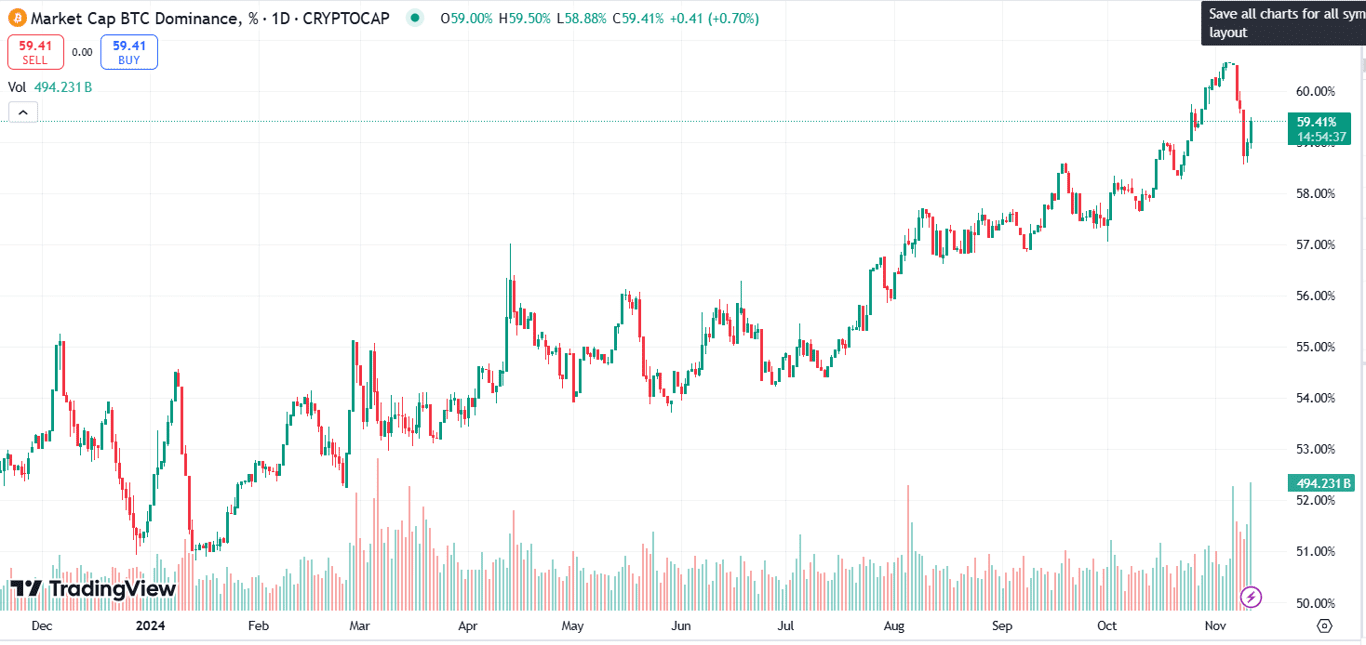

Bitcoin and Its Dominance in the Crypto Ecosystem

Today, the crypto ecosystem has varying price conditions for each token. It can be seen that the price of Bitcoin which rose by breaking a new record did not affect other tokens to also rise. BTC’s increase of almost 3% was indeed less than the increase in the price of DOGE which was almost 24%.

Bitcoin’s dominance in the crypto ecosystem today is 59.42%. A fairly high number because it is more than 50%. However, when compared to the conditions on November 7, BTC dominates at 60.55% which means there is a decrease today.

Conclusion: Reasons for Bitcoin Price Increase

The reason for this drastic increase in Bitcoin prices is predicted to be the reason for Donald Trump’s victory in the US Election this week. Right when Trump dominated voters in various regions of America, the crypto ecosystem even turned green with a price increase that cannot be underestimated in the majority of crypto tokens.

Bitcoin has been recorded to have increased by 35% in the past month and 94% in this year. When Donald Trump is officially inaugurated as the new president of America, the price of Bitcoin and other tokens could experience another promising spike. Especially when Donald Trump really carries out his promise to protect a more stable crypto ecosystem in America.

For those of you who want to buy Bitcoin tokens because you are interested in the price increase, don’t forget to do in-depth research. Bitrue can help you in researching BTC and other crypto tokens. Just visit the Bitrue website and you can check the Bitcoin price to easily do a BTC to USD price convert.

Bitrue also regularly presents articles about crypto that you can read at any time. That way, you will always be up to date on the crypto ecosystem.

You must be logged in to post a comment.