by Penny Angeles-Tan | Nov 29, 2024 | Business

Justin Sun invests $30M in Donald Trump’s crypto project, World Liberty Financial (WLFI), becoming its largest backer. Explore how this partnership shapes innovation, blockchain, and Trump’s crypto ambitions.

Justin Sun, the founder of the Tron blockchain and a controversial figure in the cryptocurrency space, has become the largest investor in World Liberty Financial (WLFI), a crypto project launched by President-elect Donald Trump.

Sun’s investment of $30 million was confirmed via a post on X, where he expressed his enthusiasm for contributing to innovation and “making America great again.” The investment came through Sun’s crypto exchange HTX, which acquired 2 billion WLFI tokens priced at $0.015 each.

Sun’s investment has brought the project’s total token sales to $52 million, still significantly short of its ambitious $300 million goal.

World Liberty Financial: A Glimpse into Trump’s Crypto Initiative

World Liberty Financial aims to be a decentralized financial platform offering services such as borrowing, lending, and investing in digital assets.

Trump has partnered with the venture through his LLC, DT Marks DEFI, which is entitled to 75% of net revenues once the project surpasses $30 million in sales—a threshold now reached thanks to Sun’s involvement.

Trump is listed as the project’s Chief Crypto Advocate, with his sons Eric, Barron, and Donald Trump Jr. serving as Web3 Ambassadors.

Despite its high-profile backing, the WLFI token’s launch in mid-October faced challenges, including limited sales to non-U.S. persons, U.S.-accredited investors, and nontransferable tokens.

These restrictions have likely hindered broader adoption, with blockchain data showing only about 20,400 unique wallet holders out of over 100,000 whitelisted potential investors.

Early Success and Future Prospects

World Liberty Financial co-founder Zak Folkman expressed optimism following Sun’s purchase, describing it as a testament to the project’s early success.

While the project still has a long way to go to meet its $300 million fundraising target, the recent influx of funds could help drive momentum. Folkman hinted at more significant developments in the coming weeks, suggesting the project is poised for future growth.

The Implications of Trump’s Crypto Involvement

This venture underscores the evolving nature of Trump’s business dealings. Unlike his real estate ventures, World Liberty Financial allows for direct financial contributions, such as Sun’s $30 million purchase, with minimal costs or liabilities for Trump’s LLC.

During Trump’s first presidency, concerns over the “emoluments clause” and foreign governments’ spending at his Washington, D.C. hotel were frequently raised. This new crypto initiative sidesteps those debates by creating a digital financial ecosystem where investments like Sun’s directly benefit Trump’s enterprises.

Justin Sun’s Controversies and Regulatory Landscape

While Sun’s investment aligns with Trump’s campaign promises to make the U.S. a global crypto hub, it also brings scrutiny. Sun and his Tron network have faced regulatory challenges, including a March 2023 lawsuit by the SEC alleging fraud and unregistered securities sales. The SEC also accused Sun of manipulating trading activity to artificially inflate Tron’s price.

Sun denies these allegations, and the broader crypto industry is closely watching how Trump’s administration might reshape regulatory policies. Notably, SEC Chair Gary Gensler has announced his retirement on Inauguration Day, potentially opening the door for a more crypto-friendly approach.

The Future of WLFI and Its Role in the Crypto Landscape

World Liberty Financial aspires to become a major player in the decentralized finance (DeFi) space. However, its path forward depends on addressing the challenges that have limited early adoption, including token transferability and restrictions on U.S. retail investors.

With Trump’s advocacy and Sun’s high-profile investment, WLFI has the potential to attract more significant investments and partnerships. As the project evolves, its ability to meet its lofty goals will hinge on its capacity to deliver a compelling and inclusive financial platform.

Conclusion: A High-Stakes Partnership

Justin Sun’s $30 million investment marks a significant milestone for World Liberty Financial, providing the platform with both credibility and resources. For Trump, it highlights how his foray into crypto could reshape his business model while aligning with his broader vision of deregulation and innovation.

As World Liberty Financial moves forward, its success—or failure—will offer insights into the broader convergence of politics, cryptocurrency, and global finance. The project has set its sights high, and the coming months will determine whether it can achieve its ambitious goals.

If you want to find more news about Donald Trump and his relationship with the crypto ecosystem, the Bitrue blog provides many articles for you to read. You can read articles on the Bitrue blog anytime and anywhere for free.

by Penny Angeles-Tan | Nov 29, 2024 | Business

Ethereum (ETH) surges past $3,545, breaking an 8-month downtrend. Explore bullish predictions, DeFi dominance, NFT trends, and key resistance levels driving its growth. Learn more now!

Ethereum (ETH), the world’s second-largest cryptocurrency, is experiencing a significant surge in price. After breaking out of an eight-month downtrend, ETH has climbed over 6% today, reaching $3,545. This rally follows a strong week with an 11.1% rise and a staggering 41% gain in the last 30 days.

Analysts Are Bullish on Ethereum’s Future

Analysts are optimistic about Ethereum’s future, predicting it could reach over $4,800 during this cycle. Several factors contribute to this bullish sentiment:

1. Technical Breakouts: ETH has broken free from a descending channel and descending triangle pattern, indicating potential for further price increases. Analysts have set targets as high as $4,700, bringing it close to its all-time high of $4,878.

2. Strong Momentum Indicators: Technical indicators like the Relative Strength Index (RSI) reaching 70 and Ethereum outperforming its moving averages suggest a robust upward trend.

3. Potential Golden Cross: A Golden Cross, where the short-term moving average crosses above the long-term one, is another bullish signal on the horizon.

Ethereum’s Dominance in DeFi

Ethereum remains a dominant force in the cryptocurrency space. It accounts for over half of the total value locked (TVL) in DeFi, solidifying its critical role in the ecosystem. Additionally, the success of ETH-based layer-two solutions further strengthens its position.

Possible Boost from Favorable Regulations

The possibility of pro-crypto legislation under the incoming Trump administration could also benefit Ethereum. If implemented, such policies could accelerate its growth and align its market price with its perceived intrinsic value.

Recent Price Action and Upcoming Resistance Levels

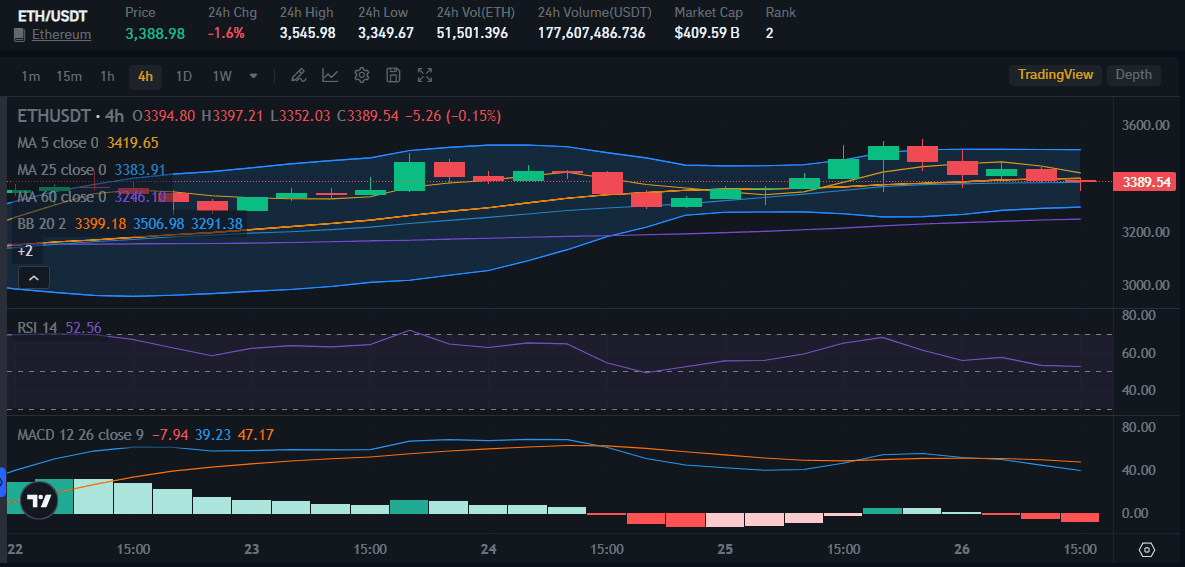

At the time of writing this article on November 26, Ethereum is priced at $3,388, which means it has decreased by 1.6% with its highest price being $3,545 in the last 24 hours.

Despite the price decrease, Ethereum’s RSI value is above 50, which means there is still hope for a price increase in the near future because the ETH buying trend is still dominant compared to the selling trend.

Increased weekend buying pressure and potential rotation away from Bitcoin have pushed Ethereum prices up. Analysts suggest a 30% rally is possible if ETH maintains bullish pressure above the key $3,400 level.

A successful break above $3,400 could see prices surge towards $4,189 and potentially reach $4,862.

NFT Market Update

While NFT sales have dipped slightly from the previous week, the overall trend remains positive, with a total volume of $158 million.

Ethereum remains the top network for NFT sales, followed by Solana. Interestingly, Solana is witnessing a surge in the number of NFT buyers.

Analyst Predictions on Altcoins

Popular analyst Altcoin Sherpa believes Ethereum might be nearing a cycle bottom relative to Bitcoin (ETH/BTC). He expects altcoins, including XRP, to perform well after Bitcoin completes its current rally.

Overall, Ethereum’s outlook is positive. With strong technical indicators, a dominant position in DeFi, and potential tailwinds from regulations, ETH seems poised for further growth.

Key Factors Driving Ethereum’s Growth

As Ethereum continues its bullish momentum, its dominance in the crypto market remains undeniable. Its robust network, extensive developer community, and innovative applications have solidified its position as a leading blockchain platform.

1. Layer-2 Solutions: The emergence of layer-2 solutions like Arbitrum and Optimism has significantly improved Ethereum’s scalability and transaction speed, addressing one of its major limitations.

2. DeFi Ecosystem: Ethereum remains the backbone of the decentralized finance (DeFi) ecosystem, offering a wide range of financial services, from lending and borrowing to derivatives trading.

3. NFT Market: Ethereum has a significant presence in the NFT market, with many popular NFT collections being minted and traded on the platform.

4. Institutional Adoption: Increasing institutional interest in Ethereum, with major financial institutions and corporations exploring blockchain technology, has further bolstered its credibility.

Potential Challenges and Risks

While Ethereum’s future looks promising, it’s important to acknowledge potential challenges and risks:

1. Network Congestion: Despite layer-2 solutions, Ethereum’s network can still experience congestion during peak times, leading to increased transaction fees.

2. Competition from Other Blockchains: Emerging blockchains like Solana and Cardano are vying for market share, offering faster transaction speeds and lower fees.

3. Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies can impact the overall market sentiment and investment flows.

Conclusion

Ethereum’s strong fundamentals, coupled with its active developer community and growing ecosystem, make it a compelling investment opportunity. However, as with any investment, it’s essential to conduct thorough research and consider the potential risks involved.

You should always do thorough research before investing in the crypto ecosystem even if you are buying a leading token like Bitcoin, Ethereum, or Solana. Do your research using the features of the Bitrue website that you can access for free.

by Penny Angeles-Tan | Nov 27, 2024 | Business

Learn 7 essential strategies to navigate cryptocurrency market crashes. Stay calm, assess market factors, embrace volatility, and protect your investments in this unpredictable yet promising digital asset space.

Cryptocurrency markets are notorious for their volatility. Prices can surge to new highs only to plummet shortly after, leaving investors and traders grappling with uncertainty.

Recent developments, including the approval of a spot Bitcoin ETF and the approaching Bitcoin halving in 2024, have boosted market sentiment, with Bitcoin reaching a record high on March 5, 2024. Yet, the history of crypto tells us that dramatic crashes can follow significant rallies.

To successfully navigate this unpredictable market, investors must understand the factors driving volatility, assess their investment strategies, and prepare for potential downturns.

What Drives Cryptocurrency Volatility?

There are many factors why the crypto market has fluctuating prices. Some of them are as explained below.

1. Market Sentiment and Speculation

Cryptocurrency prices are heavily influenced by trader sentiment. With no intrinsic cash flow to support valuations, cryptos rely on market perception and speculation. This makes them vulnerable to swings between optimism and despair.

For instance, Bitcoin fell nearly 23% in four days in June 2023, while Ethereum plunged 31%. Such movements attract professional traders using advanced algorithms but can be nerve-wracking for individual investors.

2. Macroeconomic Factors

Rising inflation, higher interest rates, and liquidity tightening by central banks can impact riskier assets like crypto. For example, the Federal Reserve’s decision to reduce monetary stimulus in 2021 triggered a prolonged downturn in the crypto market.

3. Regulatory Actions

Governments and regulatory agencies, such as the SEC, play a significant role in shaping the crypto landscape. Decisions to ban crypto-related services or enforce stricter controls, as seen in China’s crackdowns in 2017 and 2021, have caused significant price drops.

4. Institutional Moves and Market Events

Large-scale institutional activities and derivatives expiries can introduce volatility. Recent outflows from Bitcoin ETFs, contrasting with inflows into others, reveal divided market sentiment.

Additionally, catastrophic events like the collapse of FTX in 2022 ripple through the market, affecting not only exchanges but also coins and companies connected to them.

Has Crypto Crashed Before?

Yes, the crypto market has seen multiple crashes:

1. December 2017: Bitcoin peaked near $20,000 before falling below $3,500 by the end of 2018.

2. November 2021: Bitcoin’s record high of $69,000 was followed by a 75% drop within a year.

Each crash underscores the importance of cautious investing and diversification.

What Should Investors Do During a Market Crash?

To keep your financial condition safe when investing in the crypto ecosystem, you can do these 7 things when the crypto market is experiencing a decline.

1. Stay Calm and Avoid Emotional Decisions

When prices plummet, panic selling can lead to substantial losses. Instead, revisit your reasons for investing. Are you in for the long-term opportunity, or are you looking for short-term gains? This clarity will help you make rational decisions.

2. Assess the Situation

Analyze the root causes of the crash. Is it a regulatory development, macroeconomic factor, or market rumor? Understanding the context allows you to respond strategically rather than react impulsively.

3. Embrace Volatility

Volatility is inherent to the crypto market and attracts traders seeking profit opportunities. While nerve-wracking, it can also be lucrative if approached with a clear strategy.

4. Reevaluate Your Portfolio

Decide whether to buy more during dips, hold, or exit the market. Ensure these choices align with your financial goals and risk tolerance.

5. Use Secure Storage

With exchange collapses being a recurring risk, consider transferring assets to a secure crypto wallet. Both online and offline options exist, offering varying degrees of security.

6. Invest What You Can Afford to Lose

Crypto is a high-risk asset class. A general rule is to limit crypto investments to no more than 10% of your overall portfolio.

7. Maintain an Emergency Fund

An emergency fund ensures that you’re not forced to liquidate investments during unfavorable market conditions.

Conclusion: Preparing for the Future

With events like the Bitcoin halving and continued institutional interest, the crypto market holds potential for long-term growth. However, its unpredictable nature calls for a balanced approach:

- Diversify your portfolio across traditional and alternative assets.

- Keep updated with market developments and regulatory changes.

- Stick to a disciplined investment strategy, focusing on long-term goals.

Cryptocurrency investment is not for the faint of heart, but with the right strategies, it can be a rewarding part of a diversified portfolio. By understanding the market’s dynamics and preparing for its inherent risks, investors can navigate the turbulence and seize opportunities in this evolving space.

by Penny Angeles-Tan | Nov 21, 2024 | Business

Explore what happens if Bitcoin hits $100K, from market reactions and profit-taking to a potential altcoin season. Understand the factors driving Bitcoin’s rise, including institutional support, political developments, and halving events, as the cryptocurrency nears this historic milestone.

As we approach the end of 2024, all eyes are on Bitcoin (BTC) as it nears the psychological and historic milestone of $100,000. Many analysts are speculating on whether Bitcoin will break this barrier by the close of the year, with some saying it’s a matter of “when,” not “if.”

While the digital currency is currently trading above $92,000, questions about the impact of such a surge, on both the market and its broader influence, remain.

In this article, we will explore what could happen if Bitcoin reaches $100K, including the likely market reactions, the potential for an altcoin season, and the catalysts that might drive Bitcoin’s price to unprecedented heights.

Bitcoin: The Road to $100K

Bitcoin’s surge toward $100,000 is not happening in a vacuum. It is the result of a confluence of factors that are propelling it higher. Institutional support has been a major driver, with financial giants like BlackRock investing heavily in Bitcoin and launching Bitcoin ETFs (Exchange Traded Funds) that have opened the door for traditional investors.

The approval of these ETFs has brought significant inflows into the crypto market, with Bitcoin ETFs alone attracting $2.6 billion post-2024 U.S. electioncal developments also play a crucial role.

The election of Donald Trump has led to increased optimism about a more crypto-friendly U.S. government, which could potentially propel Bitcoin prices even higher in the near future.

The idea of Bitcoin being integrated into national financial systems has generated optimism, with some predicting a Bitcoin reserve, similar to gold reserves, being established by governments worldwide .

Furtalving event earlier in 2024—where the reward for mining new Bitcoin blocks was cut in half—has led to a tighter supply of the digital asset. As history has shown, halving events tend to precede price increases as reduced supply meets ongoing demand .

Bitcoin Price Today

As we can see from the chart above, the price of Bitcoin is rising again today. If a few hours ago Bitcoin was still at $92,000, when this article was written on November 21, Bitcoin was traded at $94,753, very close to $100,000.

The prediction that Bitcoin will rise to $100,000 will not be just a fantasy at the end of the year. If Bitcoin continues to consistently increase by 1-2%, even at the end of November, the price of $100K can be achieved immediately and it is possible that it could reach more than $150K at the beginning of the year.

Both Bitcoin futures and trading, all prices have experienced similar increases. This increase in Bitcoin will be a trigger for other crypto tokens to soar.

What Happens When Bitcoin Hits $100K?

If Bitcoin does hit the $100K mark, several dynamics will unfold, shaping the future trajectory of the cryptocurrency market.

1. Market Reactions and Profit-Taking

Historically, when Bitcoin hits significant milestones, it attracts attention from both institutional and retail investors. This surge in interest often leads to a rush of profit-taking, with some investors choosing to sell and lock in their gains.

This could trigger a temporary selloff in the short term, followed by consolidation as the market digests the new price levels.

On the other hand, if Bitcoin can maintain its momentum above $100K, it could solidify its status as a mainstream asset, attracting even more capital into the crypto space. Bitcoin’s success could reignite broader interest in digital assets, which have somewhat lagged behind Bitcoin in recent years.

2. Renewed Interest in Altcoins

Bitcoin’s success in reaching $100K could spark renewed interest in altcoins. While Bitcoin has been the dominant force in the crypto market, altcoins have not mirrored its success to the same degree.

Ethereum (ETH), for example, has shown strong potential due to its foundational role in decentralized finance (DeFi) and the growing importance of smart contracts. But despite Bitcoin’s surge, Ethereum and other altcoins have lagged behind.

Historically, Bitcoin’s rallies have been followed by an “altcoin season“, where lesser-known cryptocurrencies experience exponential growth. In 2021, for example, when Bitcoin’s price surged, altcoins like Solana and Polygon saw dramatic increases. This phenomenon could repeat once Bitcoin breaks the $100K barrier, with altcoins potentially following suit.

Some of the more innovative and niche projects could see outsized growth as a result of Bitcoin’s success. For example, projects like XYZVerse (XYZ), an all-sport meme coin, could capitalize on the renewed market excitement by offering unique opportunities to investors. XYZVerse seeks to tap into the sports and meme coin intersection, leveraging the growing enthusiasm for both sectors .

3. Increased Retail and Institutioipation

As Bitcoin’s price rises and crosses new thresholds, retail investors are likely to re-enter the market. The $100K price point could reignite interest among casual investors who have been sitting on the sidelines.

Additionally, institutional investors, who are already getting involved in Bitcoin through ETFs and direct investments, may increase their exposure to the cryptocurrency as they see it reaching a new level of maturity and acceptance.

This influx of capital could further push Bitcoin’s price higher, creating a self-reinforcing loop of demand and growth. It also validates Bitcoin’s role as a store of value, much like gold, and could lead to it being seen as an essential asset class in institutional portfolios.

Will $100K Bitcoin Trigger Altcoin Season?

A key question surrounding Bitcoin’s price surge is whether it will trigger a full-fledged altcoin season. The answer to this depends on the overall market sentiment, as measured by indicators like the Fear and Greed Index.

Historically, extreme levels of greed in the market, as seen in 2019 and early 2024, have coincided with brief surges in Bitcoin’s price but didn’t lead to a prolonged altcoin rally.

However, if Bitcoin breaks through $100K and the market sentiment continues to show high levels of greed, it could lead to a more sustainable rally, similar to what happened during the late 2021 bull run.

Potential Risks and Challenges

While the outltcoin reaching $100K is generally positive, there are risks that could hinder its progress. A significant short-term correction could occur, especially with the large options expiry of $11.8 billion in December 2024, which could introduce volatility in the market.

Additionally, market speculation and leveraged trading may c fluctuations, even if the longer-term outlook for Bitcoin remains strong.

Another potential challenge is the risk of over-reliance on political or macroeconomic events, such as Trump’s victory. While political developments have spurred bullish sentiment, experts like Lorien Gamaroff caution against putting too much faith in any one figure, given their unpredictable nature .

Conclusion

The prospect of Bitcoin hitting $100,000 represents milestone in the evolution of cryptocurrency. If Bitcoin achieves this target, it could serve as a catalyst for renewed interest in the crypto space, triggering higher levels of institutional and retail participation.

The potential for an altcoin season would also grow, as investors seek to capitalize on the broader market rally that could follow Bitcoin’s surge.

The key question now is not whether Bitcoin will hit $100K, but when. While 2024 remains a likely candidate, early 2025 may be another realistic timeline.

Regardless of the exact timing, the fundamental drivers of Bitcoin’s price—institutional investment, political developments, and its increasingly established role as a store of value—suggest that the $100K target is well within reach.

However, short-term volatility and the potential for corrections are inevitable as Bitcoin’s meteoric rise continues. In any case, Bitcoin’s journey to $100K will likely leave a lasting impact on the broader crypto landscape, with far-reaching consequences for the financial world.

by Penny Angeles-Tan | Nov 19, 2024 | Business

Donald Trump’s media company, TMTG, is in advanced talks to acquire cryptocurrency platform Bakkt, signaling his deeper involvement in the crypto space. This acquisition could mark a pivotal moment for both Trump’s business ventures and the future of cryptocurrency regulation in the U.S. Read on to explore how Trump’s moves could impact the crypto ecosystem.

During the campaign, Donald Trump firmly made 11 promises for the crypto ecosystem to gain support for votes in the 2024 US Election. After declaring his victory, Donald Trump showed his seriousness. Donald Trump made a breakthrough by holding serious discussions to acquire Bakkt and meeting with the CEO of Coinbase.

Are Donald Trump’s steps a good sign for the sustainability of the crypto ecosystem? Or maybe it’s just Trump’s gimmick to get clear support for his inauguration later? Let’s see the explanation in this article.

TMTG’s Strategic Push into Cryptocurrency

Donald Trump’s media and technology company, Trump Media & Technology Group (TMTG), is reportedly in advanced negotiations to acquire Bakkt, a prominent cryptocurrency trading platform.

This move marks a significant expansion of Trump’s business interests into the burgeoning cryptocurrency sector and highlights his ongoing efforts to capitalize on digital assets.

The reported acquisition has caused a surge in both companies’ stock prices, with shares of TMTG rising by over 16% and Bakkt’s stock soaring by an astounding 162%, triggering multiple trading halts due to volatility.

While the deal’s specifics remain unclear, sources suggest that it would be an all-share transaction, underscoring the value of TMTG’s stock despite its relatively modest earnings in the past year.

If finalized, this potential deal would serve as a key moment in Trump’s post-presidential ventures, positioning TMTG at the center of a fast-growing industry that aligns with Trump’s increasing involvement in cryptocurrency.

Trump’s interest in cryptocurrency is not new. Just weeks before the November 2024 presidential election, he announced the launch of a new crypto venture, World Liberty Financial (WLF), which would issue a token tied to the company’s activities.

The deal to acquire Bakkt would expand TMTG’s portfolio, giving the company a foothold in the cryptocurrency trading and services market, which could complement its existing plans to develop digital financial products.

A key figure in both Trump’s political network and Bakkt’s history is Kelly Loeffler, the former CEO of Bakkt and a former U.S. Senator for Georgia. Loeffler’s ties to Trump are significant. She co-chaired Trump’s inaugural committee in 2017 and has remained a close ally of the former president.

Trump’s Broader Crypto Strategy: Shaping Policy and Regulation

Trump’s push into cryptocurrency goes beyond business acquisitions. Reports suggest that his administration is planning to establish a “Bitcoin and crypto presidential advisory council” in the first 100 days of his presidency.

This council would aim to provide much-needed regulatory clarity for the cryptocurrency industry, which has long struggled with inconsistent rules and enforcement actions from agencies like the Securities and Exchange Commission (SEC).

Trump’s interest in cryptocurrency regulation is underscored by the involvement of key figures from the industry. Coinbase CEO Brian Armstrong is reportedly set to meet with Trump to discuss key appointments related to financial regulation and digital assets. This meeting aligns with Trump’s goal of appointing pro-crypto advocates to leadership positions within his administration.

Other figures reportedly under consideration for positions in Trump’s administration include Elon Musk, Vivek Ramaswamy, and Robert F. Kennedy Jr., all of whom have expressed favorable views on blockchain and cryptocurrencies.

Furthermore, Howard Lutnick, the CEO of Cantor Fitzgerald and a known advocate for Bitcoin, is rumored to be in the running for Treasury Secretary. These moves signal that Trump’s administration may take a more favorable stance on cryptocurrencies, potentially driving market growth.

Implications for the SEC and Future Crypto Regulation

One of the most significant areas of interest for the cryptocurrency industry is the leadership of the SEC, which has faced increasing criticism for its tough stance on digital asset regulation.

Trump has openly stated that he plans to replace Gary Gensler, the current SEC chair, on his first day in office. Gensler has faced backlash from crypto advocates due to his enforcement-focused approach, which many believe stifles innovation in the space.

Industry leaders like Armstrong and Ripple CEO Brad Garlinghouse have long called for clear, fair, and consistent guidelines for digital assets. Trump’s proposed advisory council and his discussions with crypto leaders suggest that the incoming administration is actively engaging with the industry to craft a more favorable regulatory environment.

Conclusion

The advanced talks between Trump Media & Technology Group and Bakkt represent more than just a corporate acquisition—they signal a strategic shift towards cryptocurrency and digital finance that could reshape Trump’s business empire and influence U.S. regulatory policy.

As Trump gears up for his return to the White House, the cryptocurrency industry is watching closely, anticipating a potential sea change in how digital assets are regulated and integrated into the broader financial ecosystem.

With key figures like Kelly Loeffler and Brian Armstrong involved, and with Trump’s administration likely to feature pro-crypto voices, the next few years could witness a transformative era for the cryptocurrency market, one that may be shaped by the policies of the 45th president of the United States.

Get the latest information about the crypto ecosystem to updates on the steps taken by Donald Trump only on the Bitrue website. Bitrue also provides various features that you can use to do research before buying your target crypto token.

You must be logged in to post a comment.